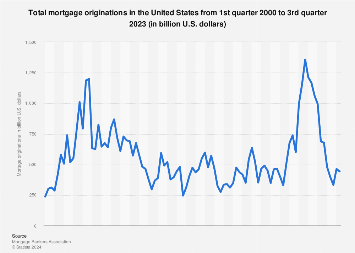

Mortgage originations in the United States plummeted in 2021 and 2022, after soaring to an all-time high in the previous two years. By the third quarter of 2023, the value of new mortgage originations amounted to 444 billion U.S. dollars, about a third of the value recorded during the market peak in the fourth quarter of 2020. These fluctuations were mostly because of the development of mortgage interest rates and mortgage lending for home refinance: While interest rates were at a record low in 2020, many homebuyers used the opportunity to refinance their loan. After rates increased, refinancing declined dramatically.

How have home sales developed?

Over the past decade, the annual number of homes sold in the U.S. ranged between 4.7 million and 6.9 million, with the number of sales of existing homes far outweighing that of newly built homes sold. Housing transactions have generally declined since 2021 because of the less favorable credit conditions and worsening housing affordability.

Cash purchases on the rise

Although buying in cash is largely uncommon in the U.S., the number of houses bought with cash has increased since 2009. For those who can afford it, a cash purchase provides a number of benefits. Most importantly, cash buyers save from mortgage payments. Additionally, the closing time on these transactions time faster, which gives a competitive advantage in markets with a lot of competition.