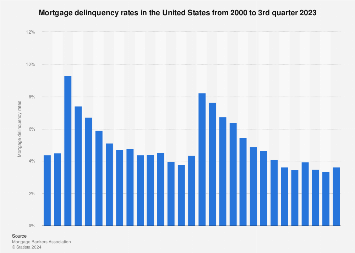

Under the effects of the coronavirus crisis, the mortgage delinquency rate in the United States spiked to 8.22 percent in the second quarter of 2020, just one percent down from its peak of 9.3 percent during the subprime mortgage crisis of 2007-2010. Following the drastic increase directly after the outbreak of the pandemic, delinquency rates started gradually declining and reached 3.62 percent in the third quarter of 2023.

‘Mortgage delinquency rate’

The mortgage delinquency rate is the share of the total number of mortgaged home loans in the U.S. where payment is overdue by 30 days or more. Many borrowers are eventually able to service their loan though, with foreclosure rates at below one percent since 2018. Total home mortgage debt in the U.S. stood at almost 12 trillion U.S. dollars in 2021.

‘Subprime mortgages’

‘Subprime’ loans, being targeted at high-risk borrowers and generally coupled with higher interest rates to compensate for the risk, have far higher delinquency rates than conventional loans. Defaulting on such loans was one of the triggers for the 2007-2010 financial crisis, with subprime delinquency rates reaching almost 26 percent around this time. These higher delinquency rates translate into higher foreclosure rates, which peaked at just under 15 percent of all subprime mortgages in 2011.