U.S. financial markets got a boost today with a lower-than-expected inflation reading, marking the lowest level since May 2020.

Headline inflation in the U.S. fell by 0.1% month-over-month in June after a flat reading in May and against expectations for a 0.1% monthly gain.

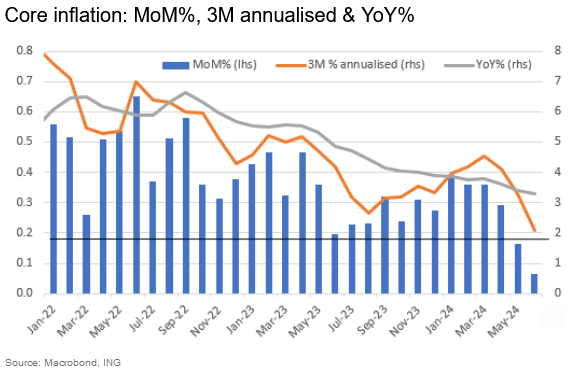

Core inflation, which excludes volatile food and energy prices, rose just 0.1%, a deceleration from May’s 0.16% gain.

On an annualized basis, both headline and core inflation readings also came in below expectations at 3% and 3.3%, respectively.

“The June consumer price inflation report is surprisingly soft and should go some way to boosting the confidence of individual FOMC members that inflation is on the path to the Federal Reserve’s 2% target,” wrote economists with ING.

They pointed out that aside from a rebound in auto insurance costs, all other components came in soft, including housing inflation, with shelter costs coming in at 0.2% month-over-month, down from the 0.4% rate it had been trending at.

Why Canadian mortgage borrowers should care

If you’re wondering why, as a Canadian homeowner, you should be interested in U.S. inflation trends, it’s because easing inflation in the U.S. can lead to lower interest rates, potentially benefiting mortgage rates in Canada.

“A very critical data point for Canadian mortgage Interest rates is U.S. inflation data,” notes rate expert Bruno Valko, VP of national sales for RMG.

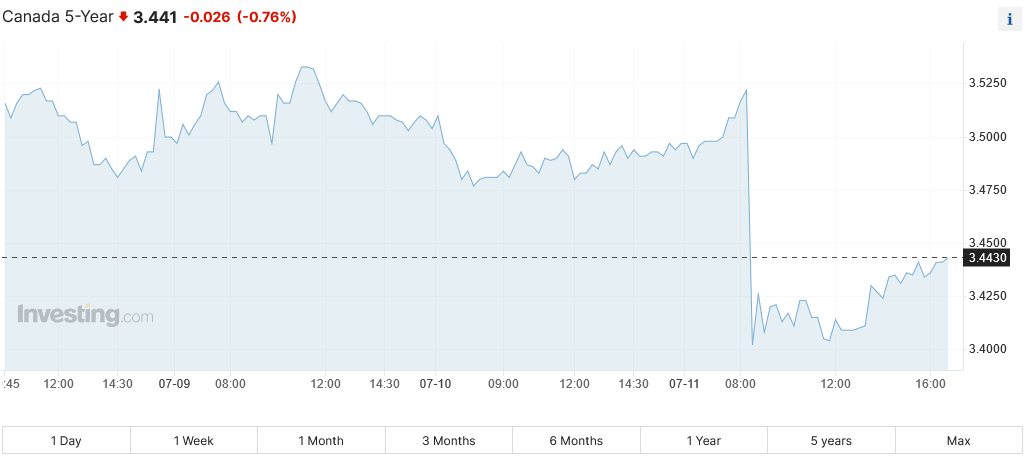

“This because it impacts the U.S. 10 year Treasury yield, which the 5-year Government of Canada (bond yield) follows closely,” he continued, pointing out the direct correlation between Canadian bond yields and fixed mortgage rates.

Canada’s 5-year bond yield dropped sharply today after the U.S. inflation release, continuing its latest downward trend and prompting some mortgage lenders to resume lowering their rates.

Valko adds that the Bank of Canada is also paying “very close” attention to what’s going on south of the border heading into its July 24 rate decision.

A September rate cut by the Fed is back in the cards

Today’s U.S. inflation report has increased the likelihood of a Federal Reserve rate cut in September, according to analysts.

“This better-than-expected inflation reading opens the door wide open for a September rate cut from the Fed,” wrote BMO’s Scott Anderson. “The report makes a very convincing case that consumer inflation has swiftly resumed its downward path after an unanticipated surge in the first quarter and is likely well on its way to a sustainable 2.0%.”

RBC economists Abbey Xu and Claire Fan add that today’s report builds on the weakening U.S. employment figures released last week that showed “persistent unwinding in tight labour market conditions.”

“From the Fed’s perspective, these are all data prints that they would like to see at this stage to confirm that interest rates are working to cool inflation pressures sustainably and to realize their dual mandate,” they wrote.

“After today’s CPI report, we think an interest rate cut at the Fed’s next meeting in July is still unlikely, but the odds are tilting towards a September cut.”

Visited 981 times, 226 visit(s) today

Abbey Xu Bruno Valko Claire Fan CPI inflation economic indicators economic news federal reserve fomc inflation Scott Anderson US inflation

Last modified: July 11, 2024