What borrowers say about U.S. Bank mortgages

NerdWallet’s lender star ratings assess objective qualities, including rates, fees and loan offerings. To assess borrowers’ subjective experiences with lenders, NerdWallet has gathered customer satisfaction ratings from J.D. Power and Zillow.

-

U.S. Bank receives a score of 730 out of 1,000 in J.D. Power’s 2023 U.S. Mortgage Origination Satisfaction Study. The industry average for origination is 730. (Mortgage origination covers the initial application through closing day.)

-

U.S. Bank receives a score of 623 out of 1,000 in J.D. Power’s 2023 U.S. Mortgage Servicer Satisfaction Study. The industry average for servicing is 601. (A mortgage servicer handles loan payments.)

-

U.S. Bank receives a customer rating of 4.98 out of 5 on Zillow, as of the date of publication. The rating reflects more than 15,930 customer reviews.

U.S. Bank’s mortgage loan options

U.S. Bank offers fixed and adjustable-rate conventional mortgages, refinances, FHA loans, VA loans, and jumbo loans. In addition to these standard offerings, U.S. Bank stands out from other lenders for offering loans for investment properties with up to four units, as well as new construction and lot loans.

U.S. Bank conveniently lists its mortgage options in a comparative table that can help borrowers decide which kind of loan is right for them.

Borrowers looking to finance home improvements have their choice of loans. Secured options, like a home equity loan, HELOC and cash-out refinance, will likely offer the best rates. Unsecured options, like a home improvement personal loan or home improvement personal line of credit, can be more costly, but they don’t carry the same risk of foreclosure if the borrower can’t make their monthly payments.

U.S. Bank HELOC and home equity loan

The lender also offers both a home equity line of credit, or HELOC, and a home equity loan. These second mortgages are a way for homeowners to access existing home equity without refinancing or selling their home. Funds obtained with a second mortgage can be used for expenses such as home improvements, education costs or debt consolidation.

Borrowers need a credit score of at least 660 to qualify, among other requirements.

Borrowers can tap up to 80% of their home equity, which is typical among lenders. However, there are also plenty of lenders who allow for higher loan-to-value ratios for borrowers who need to access more equity. U.S. Bank is unusual for requiring a minimum balance of $15,000, as well as a maximum of $750,000 (or $1 million for California borrowers). Borrowers who want to borrow less than $15,000 should explore other lenders.

What it’s like to apply for a U.S. Bank mortgage

Borrowers can apply for a U.S. Bank mortgage entirely online.

U.S. Bank also has an app, which currently has a rating of 4.8 in the App Store. Customers can use this to manage their loan and make payments.

Borrowers who prefer phone support can request a call from a mortgage loan officer using an online form. You can also call U.S. Bank directly, though we made three attempts to contact a representative this way and were unsuccessful every time. The site does not have a live chat feature.

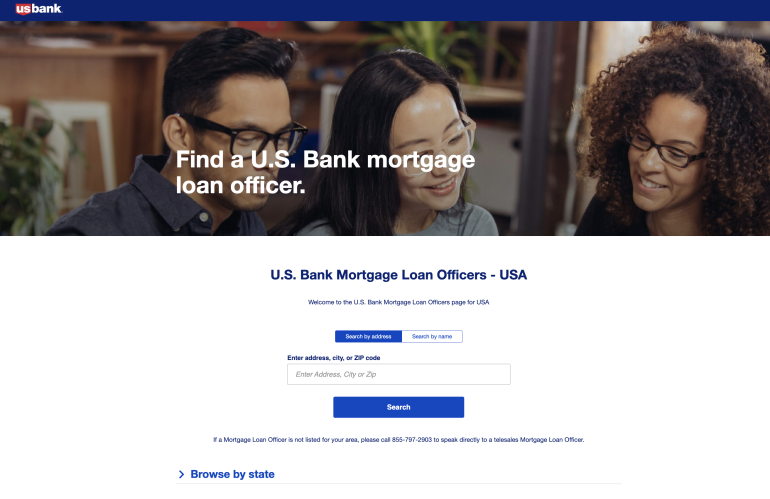

Borrowers who prefer an in-person experience can use the lender’s searchable database of mortgage loan officers, who are also listed by state.

U.S. Bank features content on its site that borrowers may find useful before filling out a loan application. This includes a monthly payment calculator, a detailed breakdown of the homebuying process from shopping to closing and information about building your credit score.

U.S. Bank’s mortgage rates and fees

-

U.S. Bank earns 3 of 5 stars for average origination fee.

-

U.S. Bank earns 3 of 5 stars for average mortgage interest rates.

NerdWallet analyzes federal data to compare mortgage lenders’ origination fees and offered mortgage rates. We measure annual averages across all loan types, as reported by the lenders. U.S. Bank has average origination fees and interest rates relative to other lenders.

Borrowers should consider the balance between lender fees and mortgage rates. While it’s not always the case, paying upfront fees can lower your mortgage interest rate. Some lenders will charge higher upfront fees to lower their advertised interest rate and make it more attractive. Some lenders just charge higher upfront fees.

U.S. Bank’s mortgage rate transparency

U.S. Bank provides sample mortgage rates for many of its products on its website, though these are not customizable. The lender also estimates APRs and monthly payments, along with the impact of purchasing points. Many of the sample rates assume a down payment of at least 25%, so borrowers with smaller down payments should expect that their actual rate will be higher.

Alternatives to a home loan from U.S. Bank

Here are some comparable lenders we review that borrowers can consider.

Rocket Mortgage could be a strong choice for borrowers interested in a home equity loan, while borrowers who want a national lender with local branches may be a fit for Bank of America.

Explore mortgages today and get started on your homeownership goals

Get personalized rates. Your lender matches are just a few questions away.

John Buzbee contributed to this review.