Scottish Mortgage Investment Trust (LSE:SMT) was once a darling of the FTSE 100. Baillie Gifford’s flagship growth stock fund used to dazzle investors thanks to huge historic increases in the Scottish Mortgage share price.

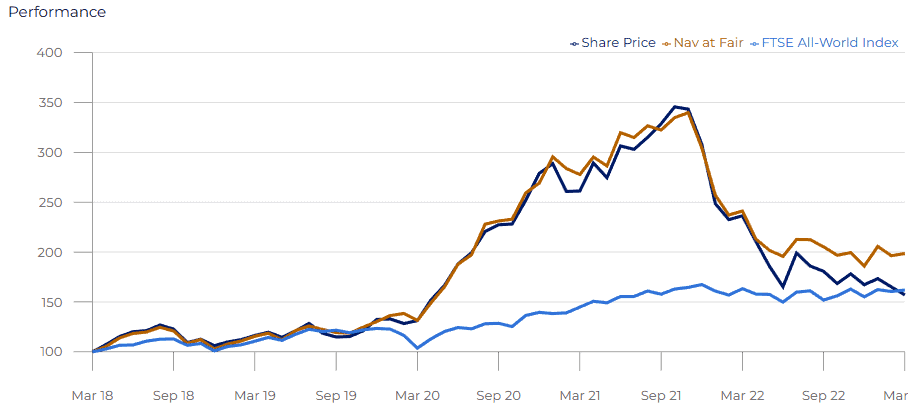

The astronomic returns shareholders became accustomed to were considerably higher than the FTSE All-World Index that the company uses as a benchmark. However, the sell-off over the past 18 months has been brutal. The investment trust now lags the index over five years.

As the stock languishes at a one-year low, is now the perfect time for me to buy? Here’s my take.

A bursting bubble?

At the peak of its pandemic heyday in November 2021, the Scottish Mortgage share price exceeded £15. The subsequent collapse has been catastrophic — today, the shares trade for £6.16 each.

The fund invests in a carefully selected portfolio of global growth stocks. It has considerable exposure to the US stock market. Ever since the Federal Reserve embarked on a mission to tame inflation with interest rate hikes, growth stocks have suffered, dragging Scottish Mortgage down in the process.

Curiously, however, the recent performance of trust’s top five holdings doesn’t sufficiently explain the 30% decline in the Scottish Mortgage share price.

|

Stock |

% of Scottish Mortgage’s portfolio |

One-year share price change |

|---|---|---|

|

Moderna |

8.6% |

-9% |

|

ASML |

8.0% |

+7% |

|

Tesla |

5.1% |

-45% |

|

MercadoLibre |

4.5% |

+20% |

|

Space Exploration Technologies |

3.5% |

N/A (unlisted stock) |

Indeed, the fund trades at a whopping 19.7% discount relative to its investments’ net asset value (NAV). On the face of it, there’s a convincing argument to be made that the trust is oversold.

But I think there’s another factor at play here. Just under 29% of the trust’s portfolio is concentrated in unlisted shares, which is close to its self-imposed 30% limit. Private companies are difficult to value and question marks have been raised about Scottish Mortgage’s valuation process.

To compound its problems, controversy surrounding an explosive boardroom row grabbed headlines recently. Soon after, chair Fiona McBain stepped down from her position. The investment trust relies on investor confidence in its management team and unedifying clashes of this nature certainly don’t help.

Reasons to be optimistic

It’s not all doom and gloom, however. Some of the trust’s key positions, such as South American ecommerce giant MercadoLibre, have performed very well in recent months. In addition, the trust’s top holding Moderna could benefit from future messenger RNA technology breakthroughs as it targets vaccines for cancer, heart disease, and other serious conditions by 2030.

Logically, there’s potential for Scottish Mortgage shares to benefit from increases in the valuation of its portfolio constituents. In that regard, I expect the recent decoupling between the fund’s share price and its NAV could be short-lived.

Should this materialise, today’s share price would represent a significant discount relative to the company’s true value.

Should I buy?

I own Scottish Mortgage shares and can’t deny that my patience is being tested as their performance continues to disappoint.

Nonetheless, I’ll continue to hold my existing position. That said, I’m not looking to increase my exposure any further at present. I wish I’d waited until today to take a significant stake in the company.

Let’s hope the trust’s fortunes change soon.

The post The Scottish Mortgage share price crashes to a 52-week low! Time to buy? appeared first on The Motley Fool UK.

More reading

Charlie Carman has positions in Scottish Mortgage Investment Trust. The Motley Fool UK has recommended ASML, MercadoLibre, and Tesla. Views expressed on the companies mentioned in this article are those of the writer and therefore may differ from the official recommendations we make in our subscription services such as Share Advisor, Hidden Winners and Pro. Here at The Motley Fool we believe that considering a diverse range of insights makes us better investors.

Motley Fool UK 2023