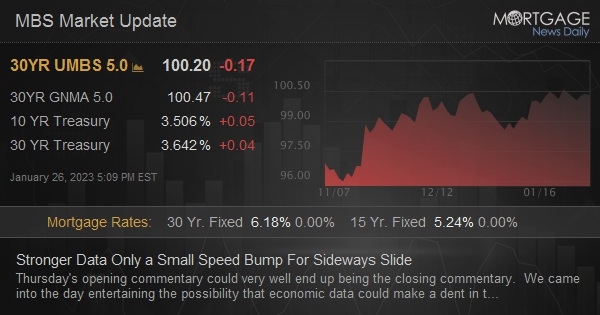

Thursday’s opening commentary could very well end up being the closing commentary. We came into the day entertaining the possibility that economic data could make a dent in this week’s sideways momentum. It looked like it might do just that for a few moments, but trading levels quickly corrected back to pre-data levels. Now we wait to see if anything else will nudge yields above this morning’s highs.

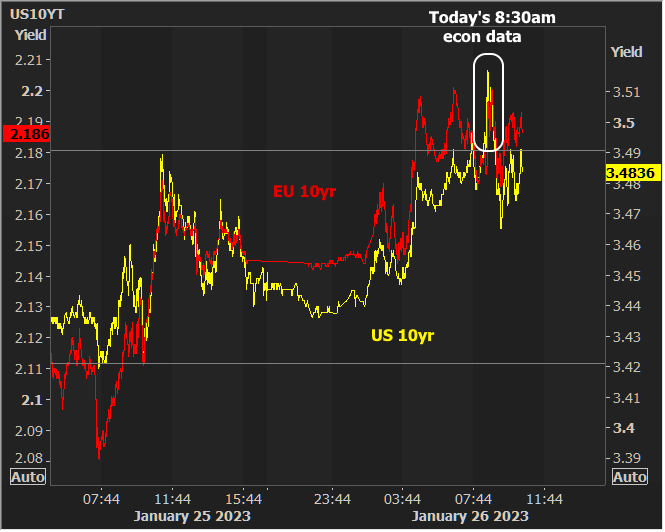

The following chart shows the recently relevant correlation with EU bonds as well as this morning’s data-driven breakout and return back under 3.50 (the line on the chart is actually at 3.49 as that ended up being more of a pivot point over the past 2 days, but within a single bp, it doesn’t really matter in the bigger picture). 3.49 or 3.50 would simply be an intermediate pivot point while 3.62 would be a bigger deal when it comes to ceilings we’d hope to avoid breaking.

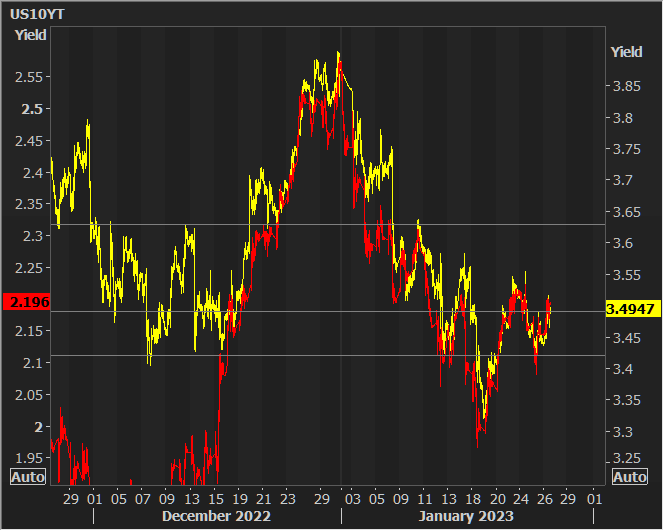

Here are the same two securities with the same scaling, zoomed out to show 3.62% as a pivot point for 10yr yields. Notice all of the ceiling bounces in early December, the floor bounce in late Dec and the ceiling bounce on January 10th on the way back down. Incidentally, this chart also reinforces the role of the EU bond sell-off in December as a factor that prevented a friendly range break-out in Treasuries.