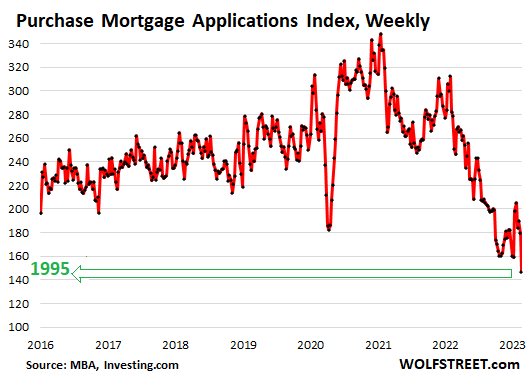

Spring Selling Season Starts Ominously: Mortgage Applications to Purchase a Home Plunge to Lowest since 1995

Prospects of 7% Mortgages Return. Surge in activity in January from very low levels has fizzled.

By Wolf Richter for WOLF STREET.

Here we go again. After jumping nearly 30% in January on lower mortgage rates and the beginning of the spring selling season, applications for mortgages to purchase a home plunged to the lowest level since 1995.

Compared to a year ago, purchase mortgage applications plunged by 41%. Compared to two years ago, they plunged by 44%. This is from the Mortgage Bankers Association today.

Mortgage applications to purchase a home are a forward-looking indicator of where home sales volume will be. January had given the housing industry a lot of hope because mortgage rates had dropped on intense Fed-pivot mongering. While activity was still down massively from a year ago, it looked like it all had bottomed out, with mortgage applications to purchase a home bottoming out in early January and then jumping by nearly 30% over the next few weeks. Turns out, that was a false bottom. An ominous beginning of the spring selling season:

After the usually dreary holiday season, when activity stalls, comes the spring selling season that kicks off in January and February in terms of foot traffic and other early measures of buyers’ interest, including mortgage applications to purchase a home.

Improvements in January gave rise to hopes that the spring selling season might actually somehow materialize on hopes that mortgage rates would soon be below 6%, and soon below 5% and heading back to 3%.

But now the whole January thing got blown out of the water by resurging inflation – not that it ever died down but it had backed off some – with inflation in services spiking to a four-decade high, triggering fears that the Fed might actually not pivot asap after all, but might instead push rates to the levels it had loudly projected at its December meeting, or perhaps even further, and keep them there for a lot longer.

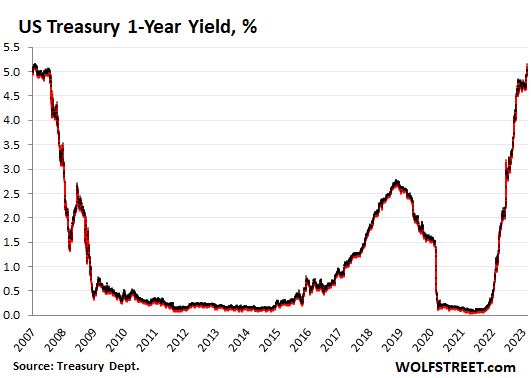

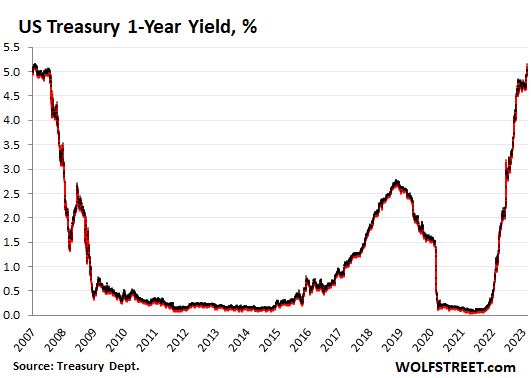

And so Treasury yields surged. The 10-year yield is once again near 4%. The six-month and the one-year yields are now solidly above 5% for the first time after 15 years, as the era of interest-rate repression and money-printing ended.

And the average 30-year fixed mortgage rate has jumped back to 6.88%, after having briefly dipped to 5.99% by February 2, according to the daily measure by Mortgage News Daily. The weekly measure by the Mortgage Bankers Association, released today, jumped to 6.62%.

Homebuilders, in their Q4 earnings calls, reported out of one side of their mouth that sales orders after cancellations (net signed contracts) had collapsed by 40% to 60% across the board year-over-year – these are their future revenues. But current revenues are still based on working off what’s left of their backlog, so OK.

Toll Brothers today chimed in and said out of one side of its mouth that its “net signed contracts” collapsed by 51% year-over-year – its future revenues. And out of the other side of its mouth, it added to the talk of other homebuilders.

Out of the other side of their mouth, they all talked about improving buyers’ interest, and improving buyers’ confidence, and improving contract signings, based on their January activity, which was up from rock-bottom lows, in part because the spring selling season had kicked off after the holidays, in part because mortgages rate had dropped, and also on the hope that the big price cuts some of them implemented would gin up sales orders.

But that was so January. With the 7% mortgage now looming over the spring selling season, the plunge in purchase mortgage applications is giving an early indication of where sales during this so fervently hoped-for season might be headed.

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the beer and iced-tea mug to find out how:

Would you like to be notified via email when WOLF STREET publishes a new article? Sign up here.

![]()