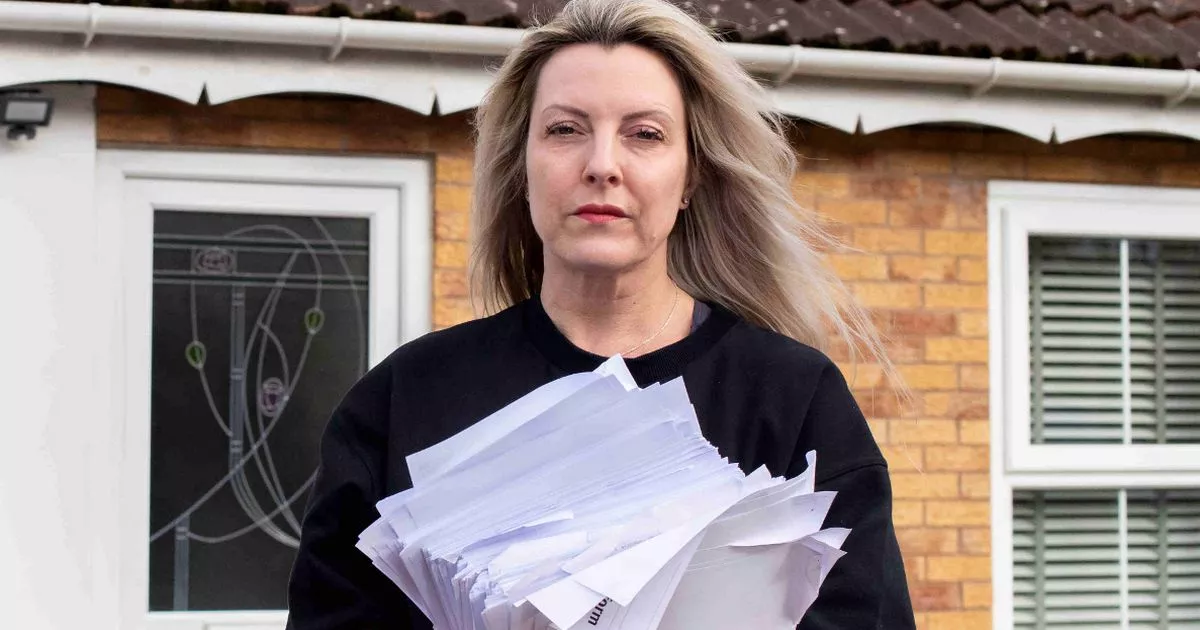

Rebecca Wendel says her monthly mortgage payments are now £2,150 and with a rate of 9.79%, up from £1,049 in August 2022 when she was paying 6.75%

A single mother-of-four has had to pay more than £91,000 extra on her mortgage after she became trapped on high rates.

Rebecca Wendel, a self-employed hairdresser, aged 46, from Leeds, is a mortgage prisoner who is now paying 9.79% interest. Mortgage prisoners took out loans before the financial crisis – when lending rules weren’t as tight – with lenders that went on to fail such as Northern Rock.

Many of the loans were later sold to firms that are not mortgage lenders and are not able to offer them cheaper products. Mortgage prisoners are also often rejected when they apply for cheaper mortgages elsewhere because they now don’t meet strict borrowing criteria introduced in 2014.

Ms Wendel says her monthly payments are now £2,150, up from £1,049 in August 2022 when she was paying 6.75%. In comparison, the average two-year fixed mortgage rate today is 5.78%, while the average five-year fix is 5.34%, according to Moneyfacts.

There are more than 200,000 mortgage prisoners in the UK and Martin Lewis estimates the Government has made more than £2.4billon from selling these loans. Law firm Harcus Parker, which represents more than 10,000 mortgage prisoners, has secured a trial at the High Court against TSB to determine whether the bank financially exploited its Whistletree mortgage prisoner customers.

The law firm, which is running a no win, no fee group litigation claim, believes that if the trial is successful, it could set a precedent for all mortgage prisoners. Ms Wendel is not a TSB customer but will be watching the outcome carefully to see what it could potentially mean for other mortgage prisoners.

Ms Wendel said: “It makes me feel angry that I’ve paid so much extra money and makes me all the more adamant that this needs to be sorted out. If I can get the money back it would go straight off my mortgage, and enable me to access a normal mortgage. I’d be about £1,000 better off each month, and that’s life changing for somebody like me.

“The money would also enable me to stay where I am. At the moment I’m still 50/50 about putting the house up for sale. Part of me feels that’s giving up. But equally, I can’t afford to keep doing what I’m doing. My kids haven’t had a childhood – they haven’t been able to do things with their mother that they would normally do.”

Last year Ms Wendel was told that she was not eligible for a mortgage that would see her pay 4% as she “couldn’t afford it” and instead was told to stay on her more expensive scheme.

Ms Wendel and her now ex-husband took out a mortgage of £284,000 with Northern Rock in 2007. She still owes the full amount 17 years later. She says they were previously on a repayment mortgage in 2007, but were talked by a broker into switching to an interest-only deal on a temporary basis to help pay for an extension.

But nine months into their deal, Northern Rock collapsed and their loan was sold to Heliodor Mortgages. Since then, Ms Wendel has been unable to switch to a more favourable mortgage deal.

Damon Parker, senior partner at Harcus Parker, said: “Tens of thousands of mortgage prisoners are still stuck on these high interest rates through no fault of their own. Ms Wendel’s case is typical of the financial pressure and misery caused to tens of thousands of mortgage prisoners.

“It is our contention that these people have been terribly financially exploited and deserve recompense. We are very hopeful that the trial in July, this year, will finally determine that these people are victims of an appalling financial injustice and should be allowed to recover the excess money that they have paid. Our group litigation represents both current and former mortgage prisoners.”

A TSB spokesperson said: “Whistletree customers are not mortgage prisoners. Since we took over the management of these mortgages, over two-thirds of Whistletree customers have either moved to a new mortgage or closed their mortgage with Whistletree. We remind customers they can switch at least annually, and this is displayed prominently on the Whistletree website.”

Harcus Parker told The Mirror it has spoken to Whistletree mortgage customers who haven’t been able to switch due to failing affordability checks with new lenders.