Published 12:00 am ET April 4, 2023

Getty Images

PayPal offers a handy way to send and receive money among family and friends. You can send money from your bank or PayPal balance, or use a credit card to fund your PayPal transactions.

A credit card might be a convenient source of funds for your next PayPal transaction. However, PayPal attaches fees when you use your credit card, which can add up quickly.

Should you use a credit card to send money on PayPal?

PayPal offers the option to send money using a credit card. The catch is a hefty transaction fee. While you can send money through the platform with $0 transaction fees to friends and family from your bank or PayPal balance, you’ll pay 2.9% per transaction when you use your credit card.

This transaction fee can add up quickly. For example, if you want to send $500 through PayPal using a credit card, the transaction would cost $14.50.

Everyone has to decide whether or not the fees are a dealbreaker for their unique situation. Perhaps, for instance, you have an important bill due, but don’t yet have the funds to pay for it.

But for many, the transaction fees tied to credit cards make sending the funds from your PayPal balance or bank account a more attractive option.

How to use a credit card to send money on PayPal

If you want to send money using a credit card on PayPal, here’s how to do it:

- Create a PayPal account. If you don’t already have a PayPal account, you’ll need to create one before sending money.

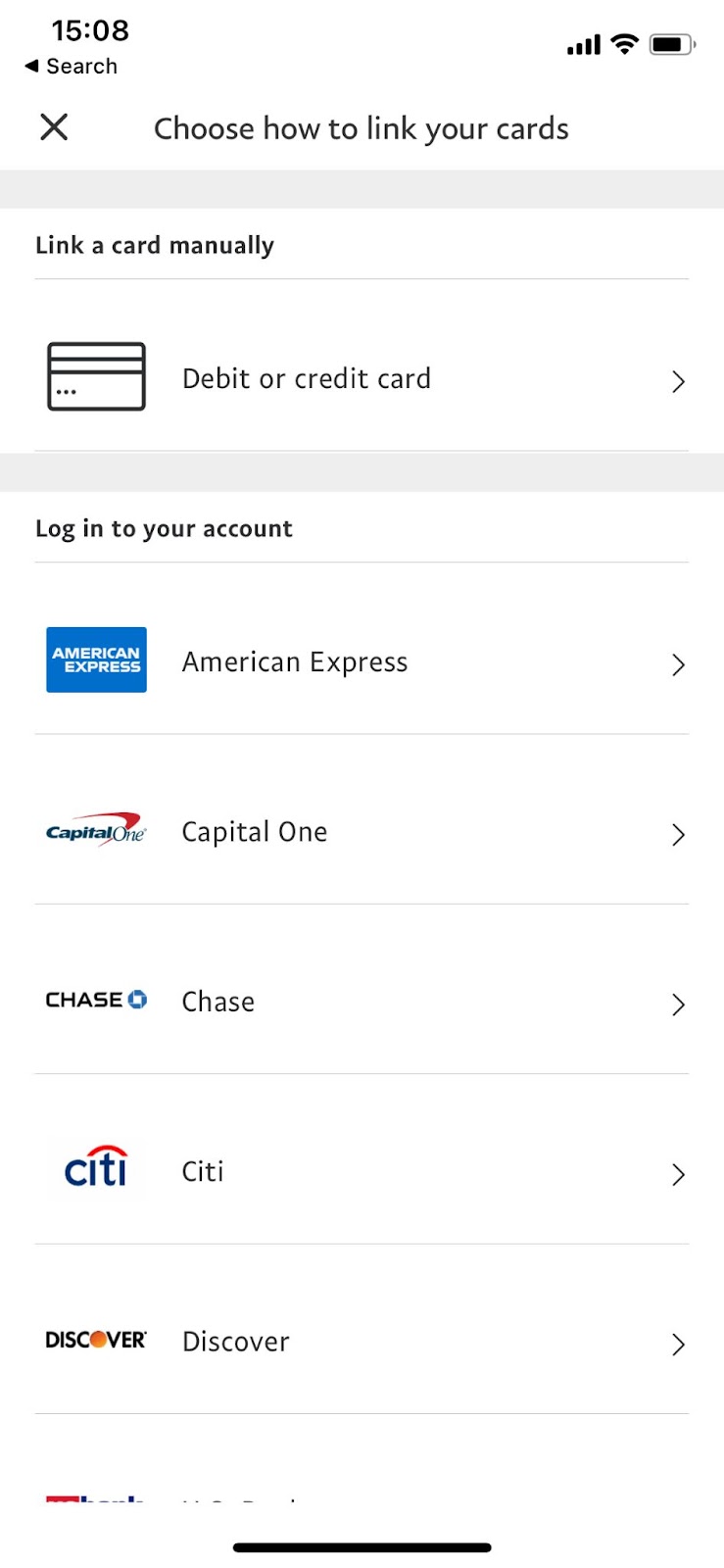

- Add the card to your wallet. You must manually enter the details of your credit card (PayPal also gives you an option to scan your card) or log in to your credit card account to add it to your wallet.

- Confirm the details. If you add a card by logging into your bank account, your bank will ask you to confirm details before sending it to PayPal. Details may include your name, address, and email. Before finalizing this addition to your wallet, you’ll need to confirm the details. Carefully review these details before agreeing to the terms and conditions and sending the information to PayPal.

- Pay with a credit card: When it’s time to send money, start by entering the amount you want to send and the recipient. You can select the credit card from your payment methods.

As you set up the transaction, keep the fees in mind. Before you press send, you should see a summary of the transaction, which includes the PayPal fee. If you determine that the PayPal fee is too steep, you don’t have to follow through with the transaction. Instead, consider a different payment method to keep your costs down.

When using a credit card for a PayPal transaction can make sense

The transaction fees tied to using a credit card to send money on PayPal can add up. But in some situations, you might still come out ahead:

- Credit card rewards. If you have a rewards credit card in your wallet, the rewards you earn might outweigh the PayPal fees. But the rewards must amount to greater than 2.9% of your transaction. Otherwise, you’ll still lose money to PayPal fees. For example, if your credit card offers 5% back on your Paypal spending, then you’ll beat the 2.9% fee.

- Welcome bonus spending. If you’ve recently opened a credit card with an attractive welcome bonus, you might have to hit a certain amount of spending. In some cases, sending money via PayPal to someone else might help you hit the required spend.

In either case, the goal is for your credit card rewards to outweigh the PayPal fees. Take the time to run the numbers before moving forward with a transaction. Otherwise, the rewards you earn might be overpowered by the fees.

Why you shouldn’t use a credit card on Paypal

As with all transaction options, there are also some reasons to avoid using a credit card with PayPal.

- PayPal fees. First and foremost, the fees tied to a credit card transaction on PayPal can add up. Before sending funds, confirm that you are comfortable with the total cost of the transaction.

- Credit card fees. Depending on the details of the transaction, your credit card issuer may be able to charge a cash advance fee when you send money via PayPal. Check the fine print of your credit card to determine whether or not you’ll face a cash advance fee. When combined with PayPal fees, a cash advance fee might be a dealbreaker for this type of transaction.

- Security. The more places you store your credit card information, the greater the likelihood that it’ll eventually be snatched. There’s no set rule, but take care that you aren’t putting your credit card on too many platforms.

The fees of a transaction will vary based on your credit card and the amount you are sending. Take a minute to double-check the costs before moving forward.

Frequently asked questions (FAQs)

When sending money on PayPal, you may earn credit card points. The details of your reward points will vary based on your credit card.

Some banks may consider sending money via PayPal as a cash advance. Check the terms and conditions of your credit card to determine if your card will charge you a cash advance fee.

Yes. When you send money to others with a credit card on PayPal, you’ll incur a 2.9% transaction fee. But you have the option to have the receiver pay this fee.

PayPal has security measures in place to keep your credit card information safe during a transaction. However, tens of thousands of PayPal accounts were recently hacked and there are no guarantees against data breaches in the future.

Blueprint is an independent publisher and comparison service, not an investment advisor. The information provided is for educational purposes only and we encourage you to seek personalized advice from qualified professionals regarding specific financial decisions. Past performance is not indicative of future results.

Blueprint has an advertiser disclosure policy. The opinions, analyses, reviews or recommendations expressed in this article are those of the Blueprint editorial staff alone. Blueprint adheres to strict editorial integrity standards. The information is accurate as of the publish date, but always check the provider’s website for the most current information.