Mortgage rates are set to come down in the coming months, with brokers telling i they expect a “mini rate war,” with lenders competing for business by offering the best deals.

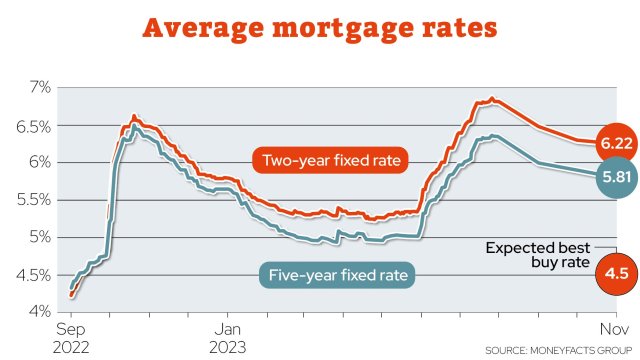

The cheapest two-year mortgage fix is now under 5 per cent for the first time since June, and some experts have predicted that we will soon see five-year fixes under 4.5 per cent.

And this heating up of competition between mortgage providers gives food for thought to borrowers who are deciding their next move.

Below, we’ve run through some of the guidance that brokers are giving to those who have to make a decision on their deal soon.

Fixed-rate mortgage in the coming months? Lock in a cheap deal now

If your fixed-rate mortgage is expiring in the next six months, brokers suggest that you should look to lock-in a cheap fixed-rate mortgage now, and that if rates get even cheaper, you can always switch to another deal.

Due to the fact that mortgage rates are far higher than they were two or five years ago, you will probably pay higher rates than you are currently paying, but you can mitigate against this by planning ahead.

“Begin the remortgaging process well before your fixed rate expires to ensure you have ample time to explore options and secure a better rate. You can secure a remortgage up to six months prior to your fixed rate ending” explains Nick Mendes, mortgage technical manager at John Charcol brokers.

And he says that this situation is a win-win.

“Securing a new rate early can be particularly useful as it means that if rates were to increase further you would have secured a lower rate already, and if they reduced in the six months before your fixed rate ends you would always have the option of switching to a new deal with the existing lender or can even starting the process again with a different lender” he says.

The second question is whether you opt for a two-year fix, or a longer fix, of possibly five years.

“A lot of people will opt for the cheapest two-year deal and then hope in two years there are cheaper deals available,” explains David Hollingworth of L&C Mortgages.

“Five-year fixes are even cheaper but of course you’re then locked in if rates go down. A lot of people will want that certainty and stability, so it’s about what you prefer to have” he added.

Mortgage expiring now? A ‘tracker’ is an option – though it’s a gamble

If your mortgage is expiring in the immediate future, or even has already expired, brokers warn that you need to ensure that you do not go on to a “standard variable rate” mortgage, which you move on to by default.

These are typically far more expensive than other deals, with the average tariff at 8.19 per cent, according to Moneyfacts.

You may want to lock in the cheapest fixed deal you can find, or an alternative is to switch to a “tracker” mortgage.

These track the Bank of England base rate, but crucially, many allow you to leave penalty free, so as long as you choose one that does this, you could sit on it until cheaper fixed deals become available.

Beware though, if the base rate rises, you will pay more, and there’s no guarantee that fixed deals will actually continue to fall, even though that’s what experts predict.

“With trackers, that is an option, but it’s more niche at the moment,” explains Mr Hollingworth.

“The cheapest trackers on the market are 0.14 percentage points above the base rate at 5.39 per cent, so those are more expensive than two-year fixes. If rate keep on dropping you can lock in a cheaper deal in the future, but nonetheless it leaves you open to base rate rising – can you deal with higher rates?”

“Trackers are an option for some that are prepared for that risk. There’s plenty of uncertainty, things look rosy but the picture can change. So a lot of people will be happy with fixed rates now – they’re far more palatable now than they were several months ago.”

Aaron Strutt of Trinity Financial adds that trackers may be an option for those that are unsure what they are going to do with their property in the future – perhaps if they are planning on selling – because of the lack of early repayment charges on many of these deals.

“They could be the right option for those that want the flexibility,” he says.