Revolut is readying to expand into mortgages.

The fintech is looking to hire across a number of new roles to drive the development of mortgage products in Europe, but has not said when it plans to launch any new products.

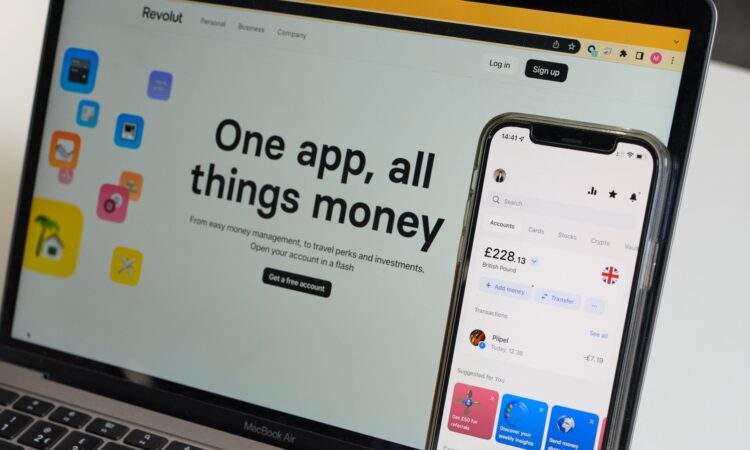

As it continues working towards becoming a financial super app, branching into mortgages would help the fintech round out its suite of products as it hopes to become its customers’ primary account.

“We’re focused on enhancing our offering to provide our customers with frictionless, accessible products and services,” Revolut Europe CEO Joe Heneghan said.

“As a next step in our journey we’re exploring the option of adding mortgages to our global financial super app, joining our suite of credit products available within the EEA, including loans, credit cards, and pay later.”

The new roles in the mortgage space add to more than 6,000 employees worldwide and include mortgage product managers, credit managers, software engineers and technical product managers.

In a previous interview with the Irish Independent, CEO Nik Storonsky said that Revolut mortgages could take a number of different forms.

One model could be financed by Revolut as a bank, he said.

Alternatively, it could be similar to a mortgage introduction.

After more than a year’s wait and reports that the Bank of England was planning to reject the fintech’s British bank licence back in May, news of the company’s progress has gone quiet.

“[U]ltimately what we want to build is a frictionless experience that is 100 per cent digital, so that within the app you apply for the mortgage, select the house that you want to buy and then be emailed at the same time,” Storonsky said.

“Everything would be instant and automated.”

Meanwhile, in a moment of déjà vu from last year, Revolut has been granted an extension on reporting its 2022 annual accounts until the end of the year.

Last year the report was published after a delay of nearly nine months, which has likely caused a knock-on effect for this year, though a smoother reporting process this time around definitely would not harm its chances of a bank licence.