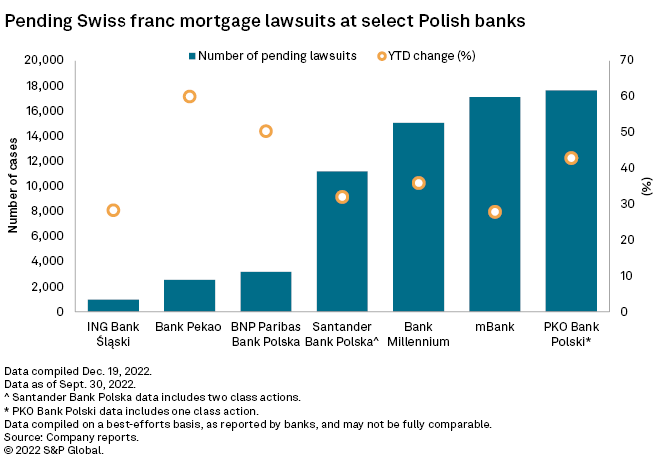

Polish banks are expected to put more money aside to cover risk related to Swiss franc mortgages in the coming quarters as they await a key legal decision by the EU’s top court.

The European Court of Justice will decide whether Polish banks can charge interest on Swiss franc mortgages that have been invalidated by local courts due to “abusive” clauses. The court’s advocate general will issue an opinion on Feb. 16, and the court will announce its decision later in the year, potentially putting pressure on banks whose capital and profits have already been hit in last few quarters by a mortgage repayment deferral scheme, contributions to a borrowers’ support fund and other regulatory burdens.

“We expect a high level of provisions in the coming quarters,” DM BOŚ analyst Michał Sobolewski told S&P Global Market Intelligence. With the European Court of Justice’s strong pro-consumer approach, the chance of banks being allowed to charge interest generated on mortgages before they were invalidated is very small, Sobolewski said.

Banks in early 2000s encouraged borrowers to get mortgages in Swiss francs to benefit from lower interest rates in Switzerland, but the value of the Swiss currency spiked and borrowers were left with higher repayments. In the ensuing legal disputes, Polish courts have overwhelmingly ruled against banks, and many lenders have offered to convert Swiss franc loans into zlotys.

Poland has already seen the “first victims of high provisions,” Sobolewski said. Foreign-currency mortgages were a significant reason for the collapse of Getin Noble Bank SA, which entered a orderly restructuring in late 2022, while large legal provisions for Swiss franc mortgages were one reason for a financial recovery program at Bank Millennium SA, a unit of Portugal’s Banco Comercial Português SA, the analyst said.

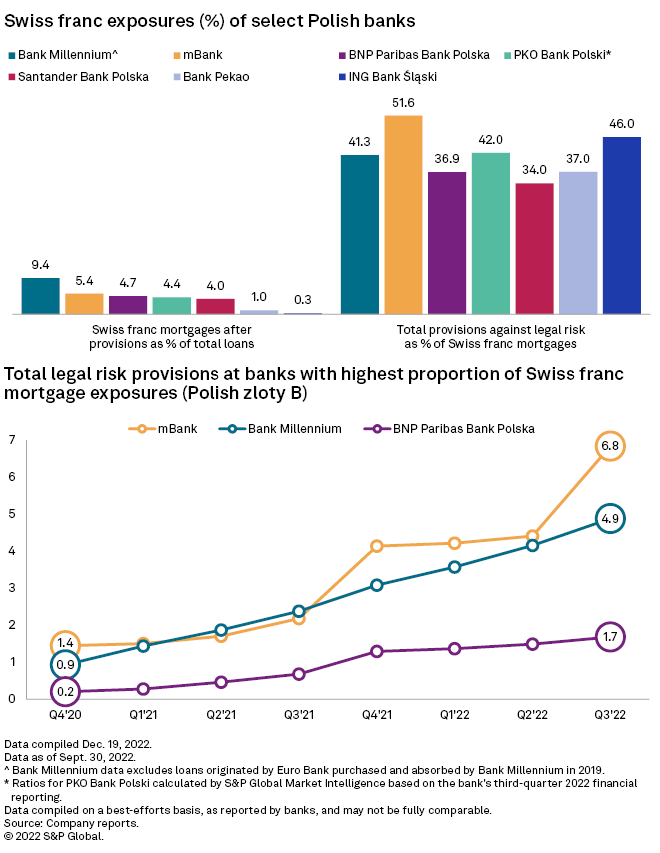

Bank Millennium has the highest percentage of Swiss franc mortgages in its portfolio among Poland’s largest banks at, 9.4%, followed by mBank SA with 5.4% and BNP Paribas Bank Polska SA with 4.7%, according to an analysis by Market Intelligence. MBank, owned by Germany’s Commerzbank AG, has the highest provision coverage of its Swiss franc portfolio, with 51.6%. Bank Millennium and BNP Paribas Bank Polska have coverage ratios of 41.3% and 36.9%, respectively.

The Polish Financial Supervision Authority warned in October 2022 that the European Court of Justice ruling could generate one-off costs of 100 billion zlotys for lenders, or roughly 50% of own funds held by local commercial banks. It could trigger bankruptcies and even lead to the collapse of Poland’s financial system, it said, adding that a negative ruling could undermine banks’ capital position.

Total legal risk provisions associated with Swiss franc mortgages at publicly traded banks totals 30 billion zlotys, according to Sobolewski. The central bank estimates that lenders will need between 27 billion zlotys and 50 billion zlotys in additional provisions to completely eliminate legal risks, depending on the structure of client settlements and litigation cases.

“We have incorporated in our models a 65% coverage ratio for all banks,” said Jovan Sikimic, senior equity research analyst at Raiffeisen Research, adding that the assessment might be too optimistic if the court rules against banks. The aggregate legal risk-related coverage ratio on Swiss franc mortgages for the seven banks analyzed by Market Intelligence is 41.3%.

Revised provisioning models

Some banks recently updated their provisioning models to account for the growing number of court cases and a high rate of unfavorable rulings. MBank reported a third-quarter 2022 net loss after booking a 2.3 billion zloty legal provision. Others, including Bank Pekao SA, PKO Bank Polski SA and Banco Santander SA unit Santander Bank Polska SA, also put more money aside.

“Santander and PKO may be among banks where we may see further upward adjustments,” Sikimic said.

MBank and BNP Paribas Bank Polska told Market Intelligence that their current provisioning levels reflect their projections of the costs of legal risk for their Swiss franc portfolios. Bank Pekao said this risk is fairly negligible for the lender and it will not affect its dividend payout abilities.

Bank Millennium, which needed a recovery plan after its capital ratios fell below regulatory requirements, previously said that it could face a pretax cost of roughly 5.6 billion zlotys if all its Swiss franc mortgage agreements currently under court proceedings were declared invalid without proper compensation for the use of capital. The amount equates to 86% of the bank’s total capital, Market Intelligence data suggests.

Bank executives said during a third-quarter 2022 earnings call that Millennium will continue its strategy regarding its Swiss franc portfolio, including efforts to negotiate with customers. The lender told Market Intelligence that it intends to improve capital ratios organically, without raising additional capital.

Other banks in the sample did not respond to requests for comments or declined to comment.

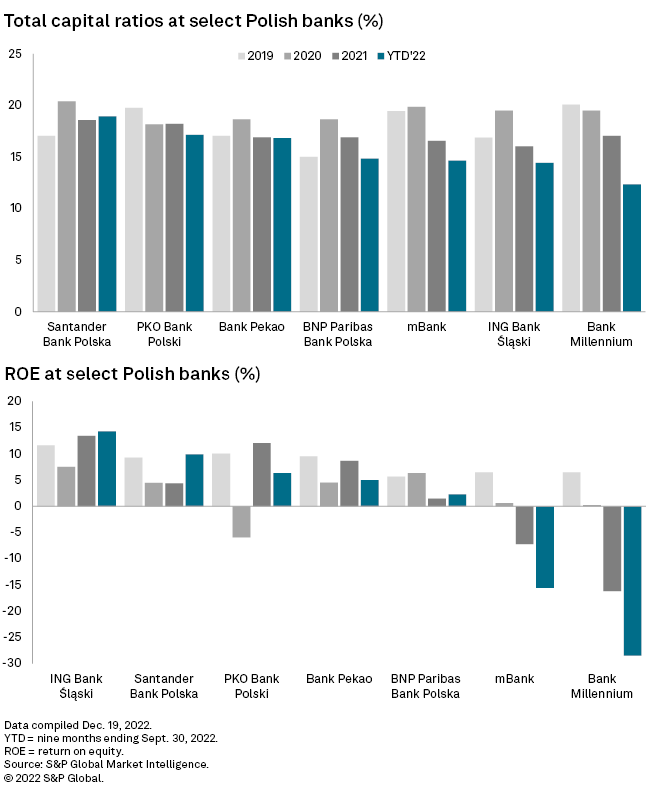

An unfavorable European Court of Justice verdict may lead to “a further squeeze of capital ratios in the sector but at this stage we would not, ceteris paribus, necessarily expect any other bank to undershoot the regulatory requirements,” Sikimic said.

Almost all banks in the sample saw their total capital ratios decline in the first nine months of 2022 amid Swiss franc provisions, credit holidays and other regulatory burdens. Millennium had the lowest ratio in the sample of 12.4%. Millennium and mBank also generated a negative return on equity in the nine months ended Sept. 30, 2022, and in 2021, with Swiss franc provisions affecting their performance. Moody’s recently extended a review for downgrade on the ratings of Millennium and placed on review for downgrade most of its ratings on mBank, citing profitability pressures, a weakened capital base and risks related to the banks’ significant franc mortgage exposures, among other things.

Emerging Wibor risks

Poland’s central bank, in its December 2022 financial stability report, pointed to potential risks stemming from attempts by some borrowers to challenge in courts their zloty-denominated mortgages based on the Warsaw interbank offered rate, or Wibor. The Wibor rate increased sharply after the central bank started its monetary policy tightening cycle in October 2021, increasing mortgage servicing costs for borrowers.

As the aggregate zloty portfolio of Poland’s banks is four times larger than the foreign-currency portfolio, the scale of problems in the sector would be significant for all players if mortgage holders succeeded in their court challenges, Sobolewski said. However, this is a very low-probability scenario, and banks are unlikely to set aside similar provisions for their zloty mortgage portfolios at this stage, the analyst said.

Poland is in the process of gradually replacing the Wibor rate with the Warsaw interest rate overnight, or Wiron, with the process to be completed at the end of 2024.

As of Jan. 4, US$1 was equivalent to 4.40 Polish zlotys.