Poland recorded the European Union’s second-highest annual growth in house prices in the latest figures from Eurostat. They also show that the country saw Europe’s highest quarterly price growth after the introduction of a mortgage subsidy scheme for first-time buyers last summer stimulated demand

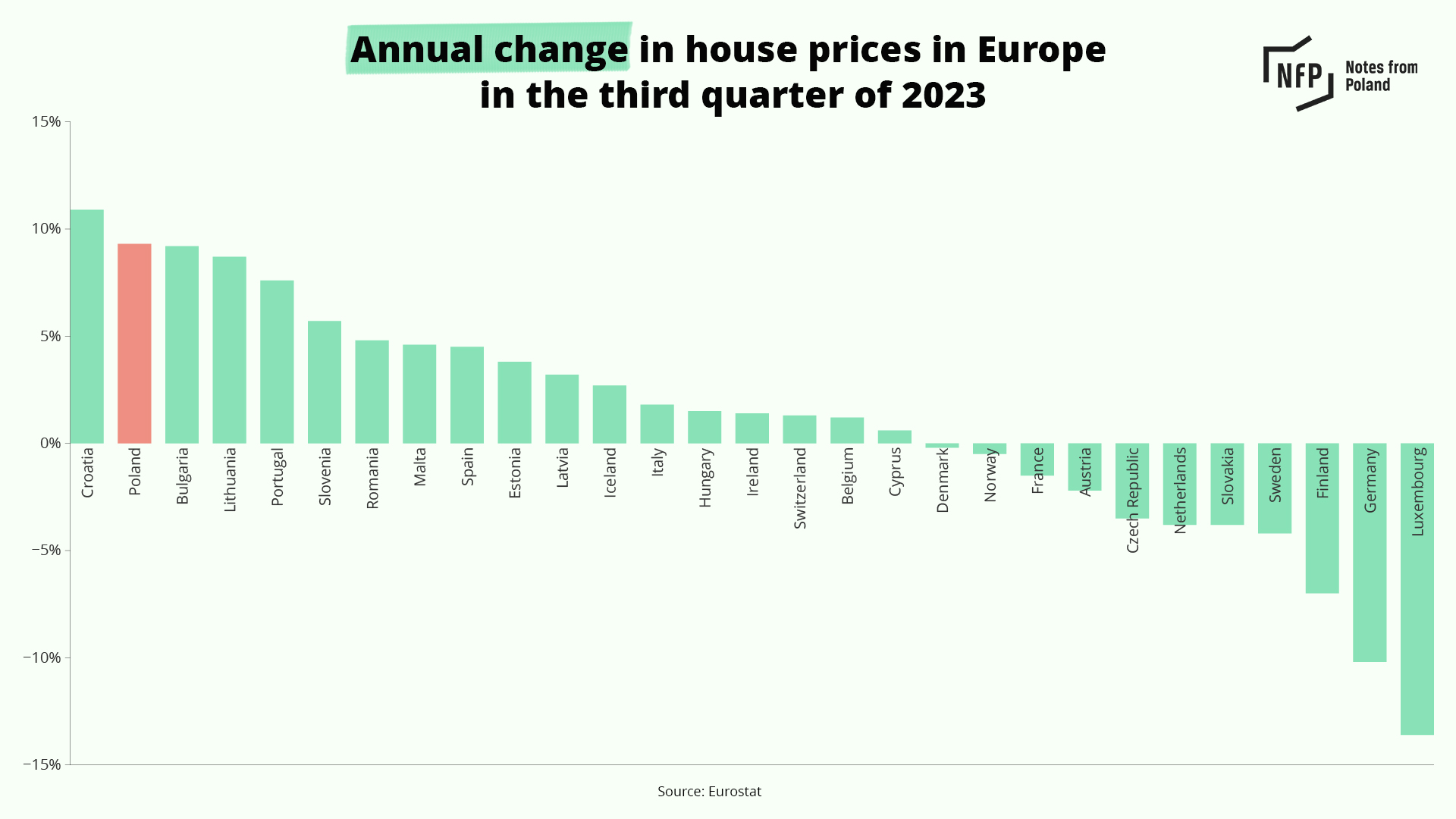

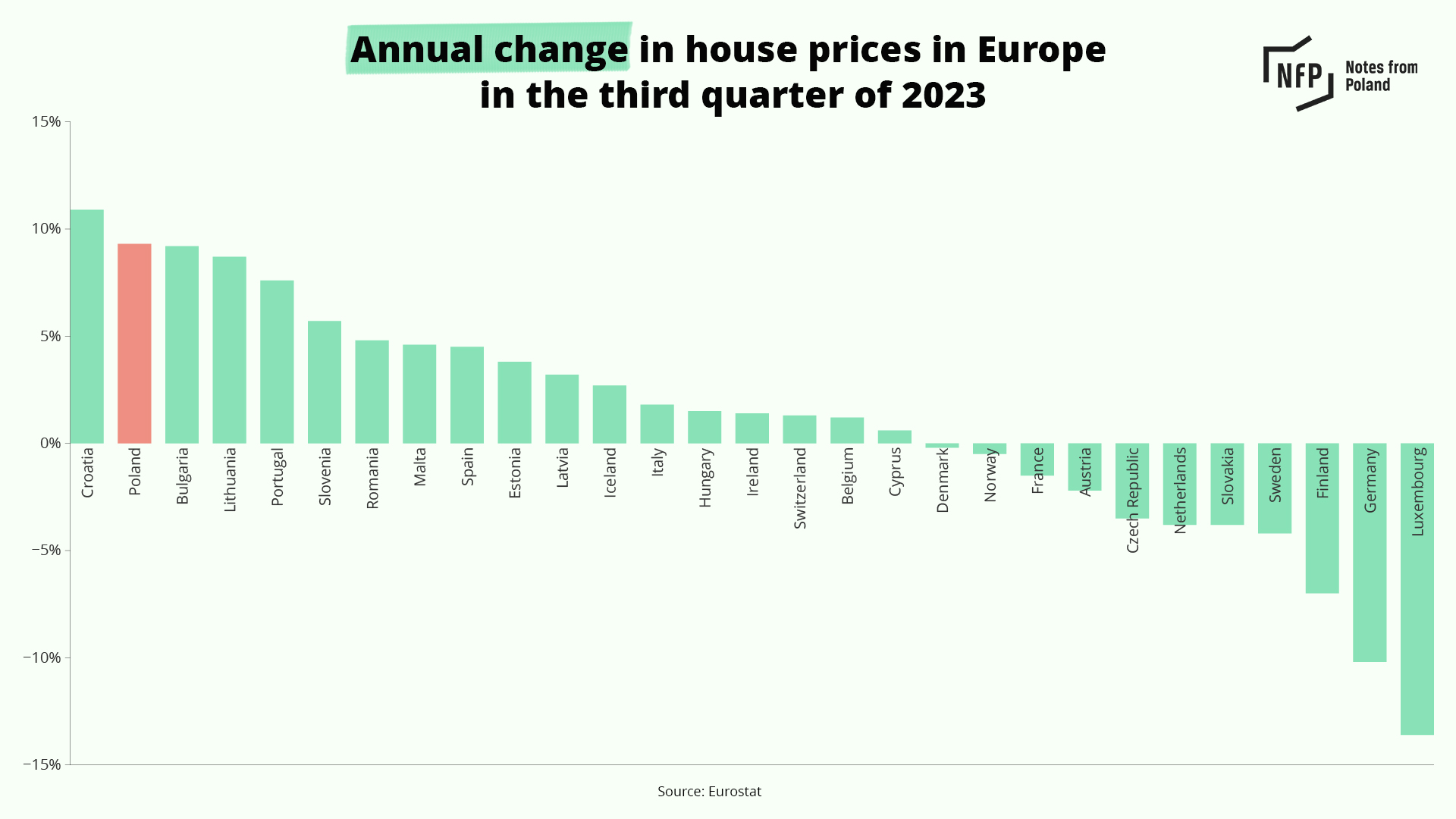

The data, from the third quarter of 2023, show that prices in Poland were 9.3% higher than the same period a year earlier. Only Croatia (10.9%) saw faster growth among the EU’s 27 member states plus Norway and Switzerland.

Across all 29 of those countries, average price rises were 1.1%. Eleven countries saw prices fall, with Germany (-10.2%) and Luxembourg (-13.6%) seeing the biggest annual drops.

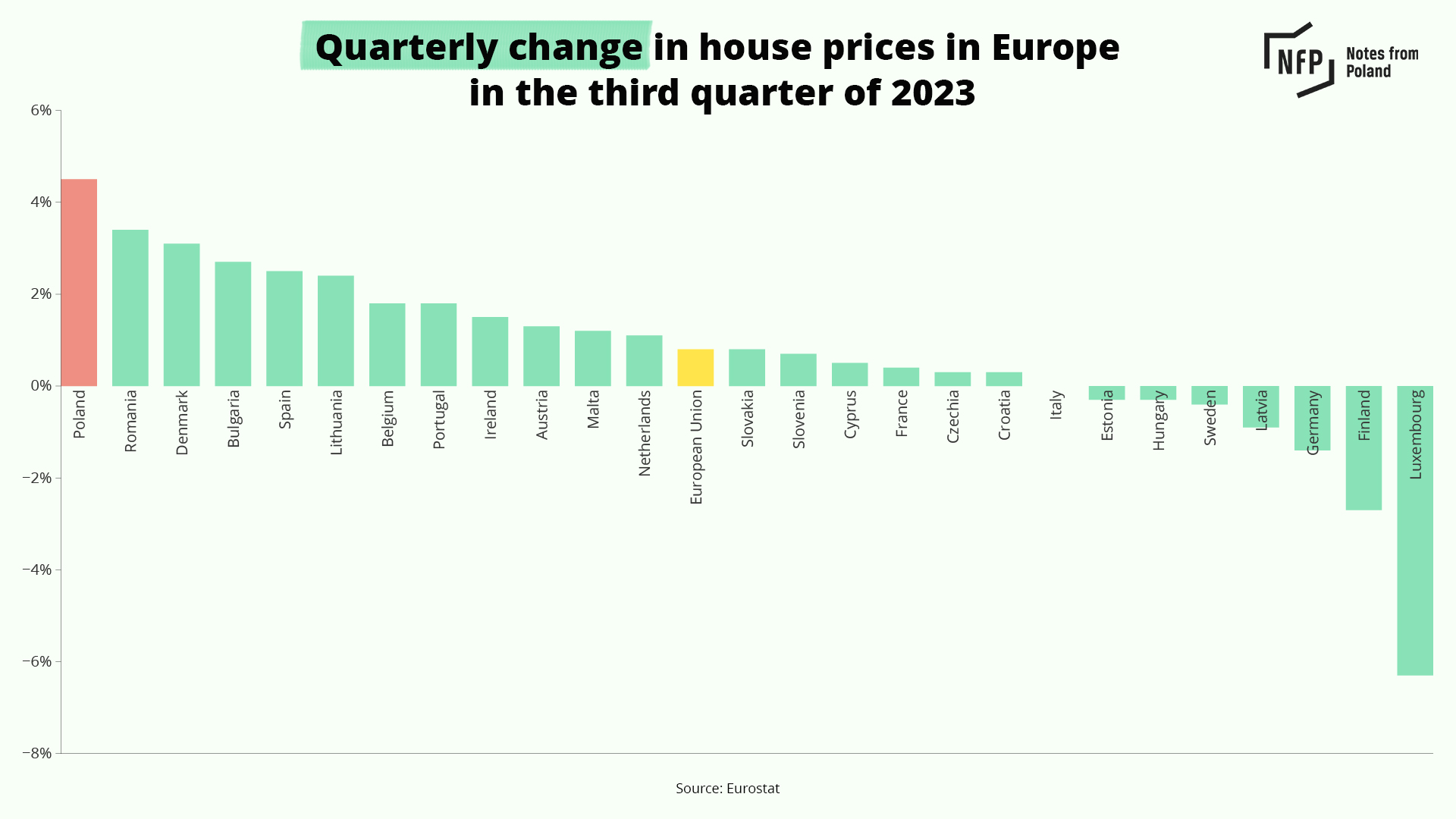

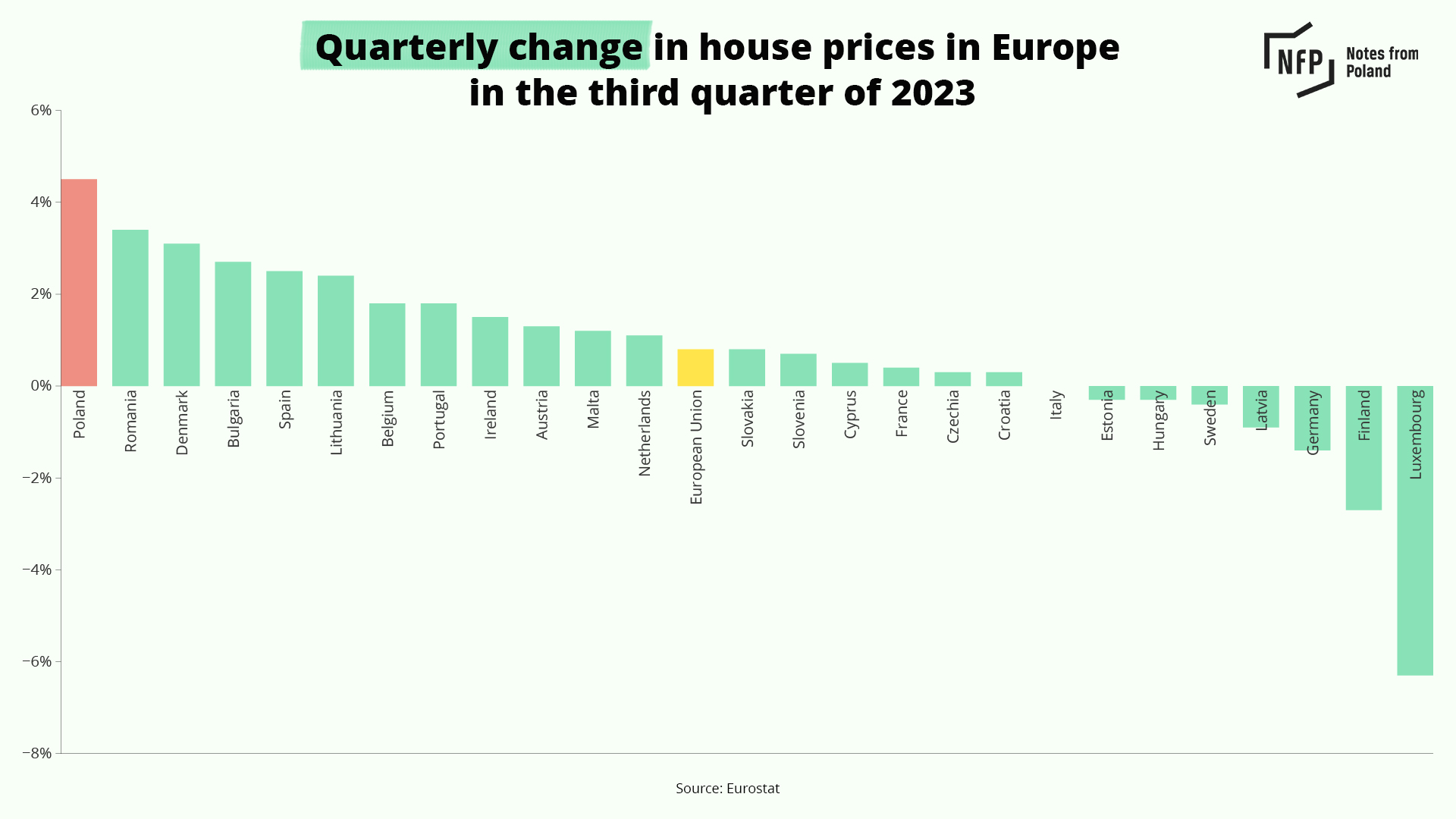

In terms of price changes from the previous quarter, Poland saw the highest growth of 4.5%, followed by Romania (3.4%) and Denmark (3.1%).

That jump came after the then Polish government in July introduced a programme offering first-time buyers mortgages with a guaranteed interest rate of 2% over ten years, with the state covering any differences compared to the market rate.

The scheme saw mortgage applications record a three-fold year-on-year increase in July. There was also a record number of applications in December as the scheme came to an end.

In the last quarter of 2023, house prices in Poland saw further increases, reaching an annual growth of up to 30% in some large cities, such as Poznań or Kraków.

Although the mortgage subsidy programme was halted in early January after the designated funding ran out, the new government, which took office in December, is considering introducing a similar, albeit more restricted, programme from mid-2024.

The total value of mortgage applications in Poland rose 421% year-on-year in December to a record high of over 10bn zloty as people rushed to banks ahead of the end of a popular subsidy programme for first-time buyers launched by the previous government https://t.co/M8X9EGK3Qn

— Notes from Poland

(@notesfrompoland) January 11, 2024

Prices have also been pushed up by a shortage of housing, with some estimates pointing to a shortfall of as many as 4 million units. That has made entering the market difficult for young Poles, nearly half of whom live with their parents, one of the highest figures in the EU.

According to the housing affordability index created by news service Politico Europe, Warsaw is the fourth-hardest EU capital for local residents to buy an apartment in, behind only Paris, Prague and Bratislava.

To buy a 75-square-metre flat in Warsaw, one would have to put aside an average local salary for almost twenty years, compared to just over 23 years in Paris, Politico calculated.

CEE capitals lead unaffordability ranking for home buyers. In Warsaw, you’d need to save an entire average salary for almost 20 years to buy a 75m2 flat. Rent isn’t cheap either.

Bad news for us, 30-somethings, looking to enter the property ladder.

Source: @POLITICOEurope pic.twitter.com/3BFPlSDq1s

— Alicja Ptak (@AlicjaPtak4) December 11, 2023

Notes from Poland is run by a small editorial team and published by an independent, non-profit foundation that is funded through donations from our readers. We cannot do what we do without your support.

Main image credit: Jenia Flerman/Unsplash

Alicja Ptak is senior editor at Notes from Poland and a multimedia journalist. She previously worked for Reuters.