Perenna obtained its licence from the Financial Conduct Authority in August 2022. The recent approval allows its to offer extended-term home loans to customers who seek long-term interest rate stability. Representatives from Perenna cited by the Financial Times emphasised the importance of stability in homeownership, noting the fluctuation in interest rates over time.

The same source reveals that the demand for longer-term mortgage deals has surged over the past two years, driven by a cost of living crisis and successive increases in the Bank of England base rate. This led to the average two-year fixed-rate mortgage reaching a 15-year high in August 2023.

Perenna’s launch of extended-term home loans coincides with comments from the Bank of England’s Governor, who expressed uncertainty about the necessity for further interest rate hikes.

Perenna anticipates its loan rates to range between 6.5% and 7.5%, in contrast to the 6.69% average rate for a two-year fixed-rate mortgage, as reported by data provider Moneyfacts. The lender is presently maintaining a waiting list and plans to open its services to all potential customers by October 2023.

Mortgage differences in the UK vs the US and Europe

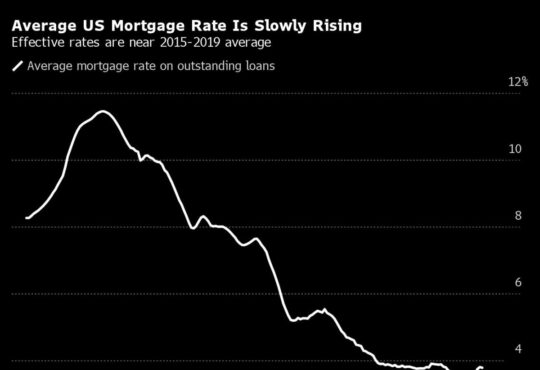

The Financial Times drew a parallel between the United States and the United Kingdom and highlighted that longer-term fixed-rate mortgages are much more common in the US, as the UK predominantly offers mortgages lasting between two and five years. This is partly due to customers’ reluctance to commit to longer-term products associated with high exit fees.

Officials from Knight Frank Finance explained that in the UK, fixed-rate mortgages often come with early redemption charges, and the longer the fixed rate, the higher the charge. They also cautioned that longer-term mortgages might be costlier when compared to their shorter-term counterparts.

Perenna intends to apply redemption charges only during the first five years of a mortgage, allowing consumers more flexibility to switch to a more economical product after this initial period. To finance its mortgages, Perenna plans to issue covered bonds to pension funds and insurers for long-term funding. Perenna raised approximately GBP 35 million from investors last year, including venture capital fund IAG Silverstripe.