Contracts to buy U.S. previously owned homes have fallen for a fourth straight month, as the housing market buckles under the strain of higher mortgage rates.

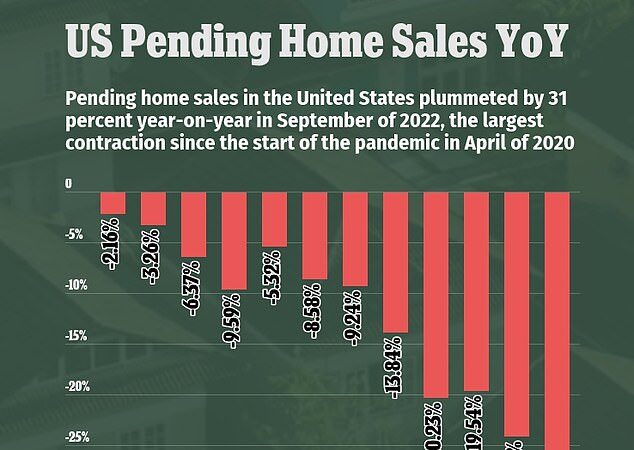

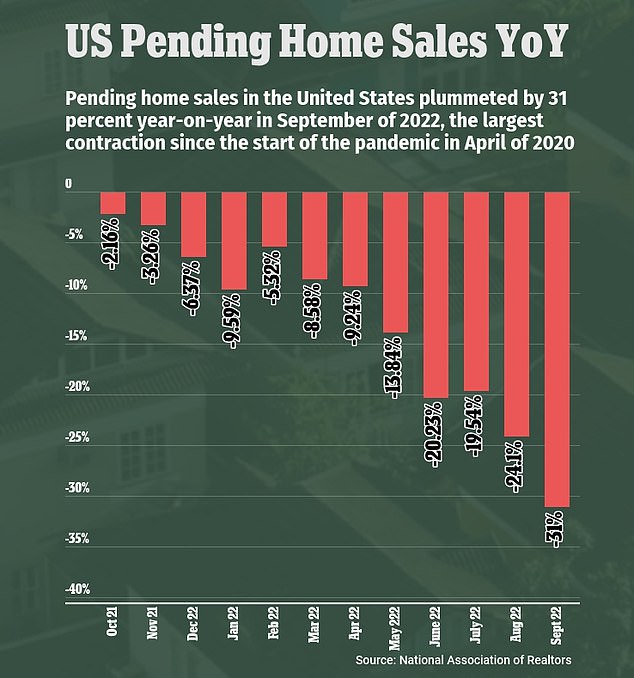

The National Association of Realtors (NAR) said on Friday its Pending Home Sales Index, based on signed contracts, dropped 10.2 percent last month from August, and 31 percent from a year ago.

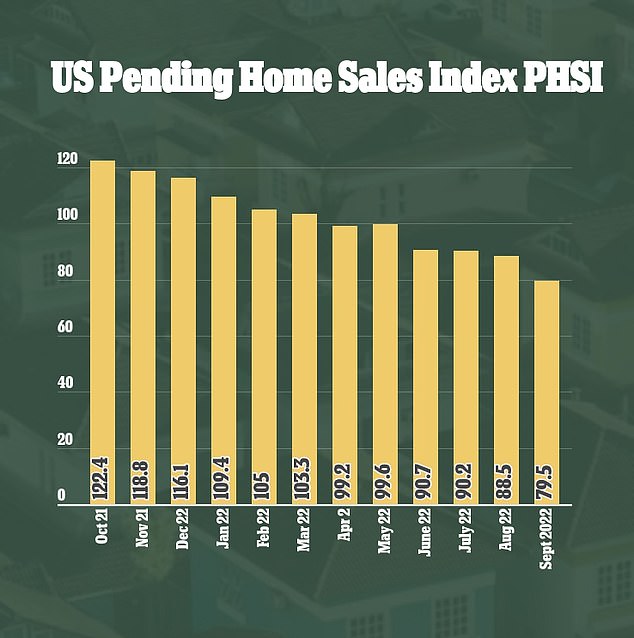

The index, in which 100 is equal to the level of contract activity in 2001, dipped to 79.5 in September, its lowest level since 2010.

‘Persistent inflation has proven quite harmful to the housing market,’ said NAR Chief Economist Lawrence Yun in a statement.

‘The Federal Reserve has had to drastically raise interest rates to quell inflation, which has resulted in far fewer buyers and even fewer sellers,’ he added.

The National Association of Realtors (NAR) said on Friday its Pending Home Sales Index, based on signed contracts, dropped 31 percent in September from a year ago

Contracts to buy U.S. previously owned homes have fallen for a fourth straight month, as the housing market buckles under the strain of higher mortgage rates

The index, in which 100 is equal to the level of contract activity in 2001, dipped to 79.5 in September, its lowest level since 2010

Yun said new home listings are down compared to one year ago, because many homeowners are unwilling to give up the rock-bottom mortgage rates they locked in prior to this year.

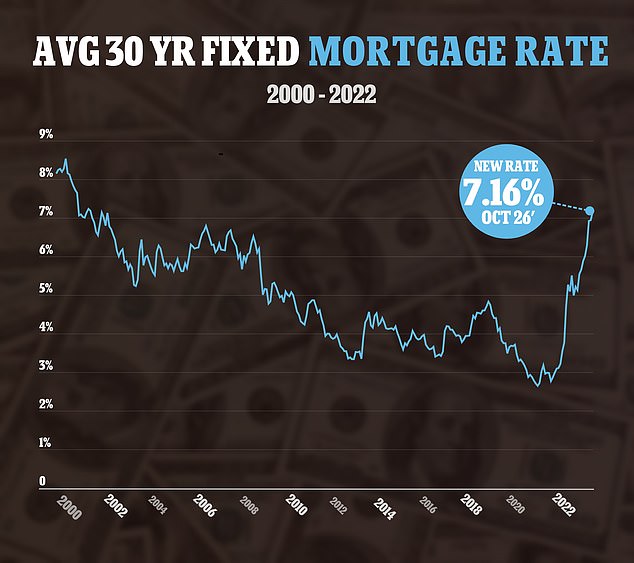

‘The new normal for mortgage rates could be around 7 percent for a while,’ Yun said, more than double rates a year ago.

‘On a $300,000 loan, that translates to a typical monthly mortgage payment of nearly $2,000, compared to $1,265 just one year ago – a difference of more than $700 per month,’ he added.

Contracts, which are a leading indicator for home sales figures, fell in all four regions last month.

Economists had forecast contracts, which become sales after a month or two, would drop 5 percent on the month, according to a Reuters poll.

The decline in signed contracts suggested that existing home sales will continue to fall this month after posting their eighth straight monthly decrease in September.

The housing market has been the sector hardest hit by the Federal Reserve’s aggressive interest rate hikes.

The U.S. central bank is tightening monetary policy to dampen overall demand in the economy, with annual inflation having risen at its fastest pace in 40 years.

The average contract rate on a 30-year fixed-rate mortgage rose to 7.16% for the week ending October 21, up from 6.94% the prior week

The Fed has raised its benchmark overnight interest rate from near zero in March to the current range of 3 to 3.25 percent, the steepest pace of policy tightening in a generation or more.

With further policy tightening expected, mortgage rates have soared in tandem with the yield on the 10-year note.

The 30-year fixed mortgage rate averaged 7.08 percent this week, breaking above 7 percent for the first time since April 2002, according to data from mortgage finance agency Freddie Mac.

Residential investment contracted for a sixth straight quarter in the third quarter, the longest such stretch since the housing market collapse in 2006, the government reported on Thursday.

Faced with higher borrowing costs, many prospective homebuyers are bowing out of the market for now, and the pace of new mortgage applications is at its slowest since 1997, according to the Mortgage Bankers Association.

The MBA’s Purchase Index, which measures mortgage activity to buy a home, decreased 3 percent compared with the previous week and was 42 percent lower than a year ago.

The Refinance Index dropped a staggering 86 percent from last year, reflecting the lack of demand for refinancing as rates rise.

One year ago, the average rate on a 30-year fixed-rate mortgage was just over 3 percent, meaning rates have more than doubled in the past 12 months.

However, median home prices are still up significantly from a year ago, as low inventory keeps prices high. Last month, the median US home price was $384,800, up 8.4 percent from one year ago, according to the National Association of Realtors (NAR).

The median sales price for newly built homes was $470,600 last month, up 13.9 percent from a year ago, according to Commerce Department data released on Wednesday.

US home sales dropped in September as mortgage rates (in yellow) surge and house prices (in red) stay stubbornly high

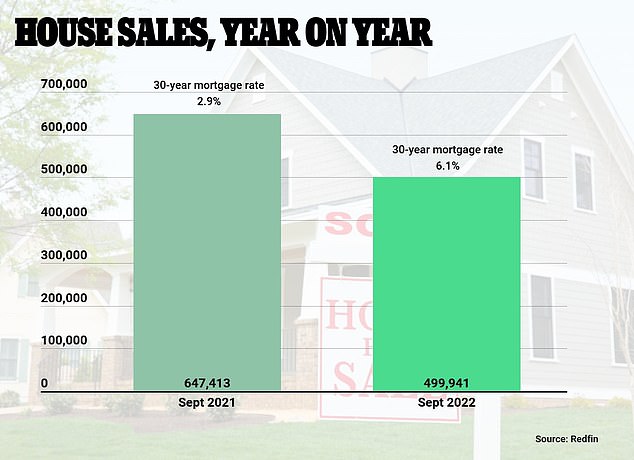

Home sales volume has dropped significantly as mortgage rates rise

The combination of higher rates and stubbornly high home prices means that many buyers are being priced out of the market, or are having to search for homes at a lower price point than they would have a year ago.

NAR economist Nadia Evangelou notes that while 7 percent mortgage rates were ‘normal’ in the 1990s and early 2000s, homes were relatively more affordable at that time.

During that period, when younger Baby Boomers were in their 30s and 40s, mortgage payments accounted for about 20 percent of household income, Evangelou wrote in a note last week.

Today, however, the combination of high inflation, high interest rates, and slow wage growth means that ‘home buying costs exceed 30 percent of a typical family’s income,’ wrote Evangelou.

‘While inflation outpaces wage growth, the typical family needs to stretch out its budget and spend more than 25 percent of its income on its mortgage payment,’ the economist added.