Thousands of homeowners face starting 2024 with financial woes because of a steep mortgage interest rise.

Around 460,000 households in the UK will see their fixed deals run out in the next three months, according to analysis by household money-saving tool Nous.co.

With the average five-year fixed rate now at 5.5 per cent, up from 1.29 per cent two years ago, people who owe £200,000 will see their monthly payments leap from £781 to £1,244 a month – a rise of £463 a month or £5,556 a year, the research reveals.

Furthermore, there are fears that a fall in house prices could lead to higher mortgage rates for many, according to experts.

The Bank of England‘s staff blog – Bank Underground – said if property prices declined sharply many borrowers would find themselves pushed into higher loan-to-value ratios (LTVs).

Written by Foreign, Commonwealth and Development Office deputy chief economist, Fergus Cumming, and the Bank’s private secretary and chief of staff, Chris Walker, it gave a scenario where house prices fall by 10 per cent and high LTV spreads rise by 100 basis points, which could cause an estimated 350,000 mortgagors to be pushed above an LTV of 75 per cent.

The post said this could increase their annual repayments by an extra £2,000 on average, which would “have a material impact on the economy“.

‘We need to find an extra £1,500 a month’

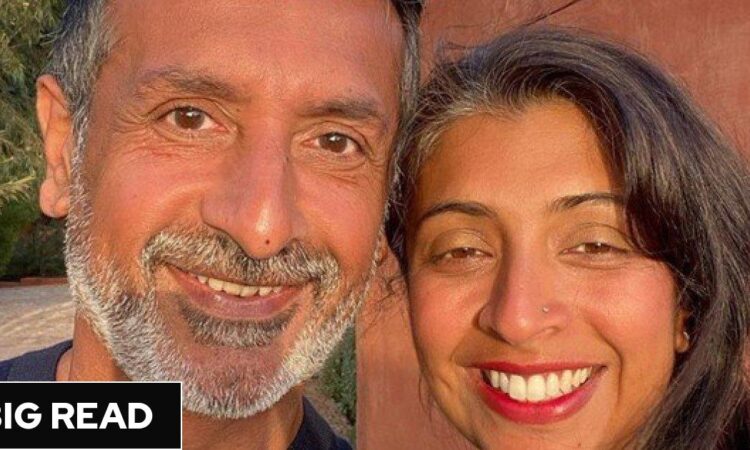

Intensive care doctor Rosie Kalsi, 46, and husband Josh Dhaliwal, 50, face a steep rise of £1,500 a month when their mortgage deal ends early next year. Their payments will jump from £3,000 to £4,500 – a rise of 50 per cent.

The couple, who have three school-age daughters, had already stretched their budget by remortgaging and taking out equity from their home two years ago to renovate their 500-year-old home in Hampshire.

The family had to cancel one family holiday last summer because of the cost of living crisis and have had to penny pinch at Christmas.

Mr Dhaliwal, who is a head of sales and marketing, said: “We are both in decently-paid jobs but we are now looking at serious sacrifices we will have to make to find an extra £1,500 a month.

“It’s scary. Our energy bill has already trebled.

“We were spending about £150 a month and now it’s closer to £450 a month. Then there’s the rising cost of food prices and fuel. I have this overwhelming feeling that I can’t do anything about it.

“We’ve already forgone a summer holiday this year, and there are no plans for holidays next year. Rosie has a very stressful job. She’s been at the forefront of Covid as a hospital intensive care doctor. She needs that time away to go and relax.”

The couple regret spending all their savings on their house, which was very outdated when they bought it with some rooms not having any electric sockets or ceiling light sources.

“Had we known what the situation was going to be like two years ago, then maybe we would have spaced out our spending on redeveloping and renovating this house over a longer period of time,” said Mr Dhaliwal.

‘I can’t afford to do my animal rescue work’

Nurse Kate Bettley recently saw her mortgage go up from £400 a month to around £900 – a 125 per cent increase.

She says she regrets not locking into a deal when she spoke to her mortgage adviser six months earlier. “I thought interest rates would go down,” said the 41-year-old from Wirral, Merseyside.

Ms Bettley said she finds the rise especially tough as she lives alone. “I took out a car loan in August last year and then we’ve had the cost of everything going up including energy bills, and now my mortgage,” she said.

“It’s hard to magic up the extra £500 plus a month. If I lived with someone I’d be able to half the costs but it’s all down to me.”

Ms Bettley is a huge animal lover and rescues chickens and wildlife and fosters cats. She currently has eight chickens and five cats and is rehabilitating a baby peacock and a hedgehog.

She is worried that she won’t be able to continue with her voluntary work. “I’ve spent thousands on vets bills,” she said. “I’ve spent £2,000 on a chicken with a tumour. I typically fork out a couple of hundred a month on vet bills and food for my animals.

“I have a passion for wildlife. People like their pets and I feel injured wildlife are often forgotten about so I like to do my bit. I’ve lost count of how many seagulls, pigeons and hedgehogs I’ve care for so they can be released back into the wild.

“I would love to take in more animals but I just can’t afford to.”

‘I’m stuck with two mortgages paying £3,000 a month’

Jemma Harrison has found herself stuck with two mortgages – paying £3,000 a month for her home loans and other bills – causing her to get into debt.

For years, the 42-year-old owned one house she rented out in Hull to students while she rented elsewhere. Then about a year ago, she put the Hull property on the market and bought a house in Cornwall she had fallen in love with for her to live in.

She had expected the Hull house to sell quickly, but five offers have fallen through.

Furthermore, Ms Harrison had to ask her tenants to leave due to new regulations earlier this year for houses in multiple occupation, meaning she’d have to spend £8,000 on property works.

Then her £85-a-month for interest-only mortgage for the Hull house jumped up to £500 and her Cornwall home almost doubled to £1,500 per month.

The private chef, who runs Four Twentea selling CBD teas, said: “I went ahead and bought the house thinking my Hull properly would sell straight away.

“The estate agents told me the offers had fallen through because of people deciding to stay put with rising interest rate announcements.

“I’ve maxed out my credit cards. I had been concentrating on my tea business but things got so bad financially over the last few months I took a two-month job abroad working flat out.

“It put a strain on relationship with my boyfriend. I had to stop renovations on my new house, I’m living without carpets at the moment.

“And I’m now drastically dropping the price of my old house – I’ll lose about 20 per cent of the value from when I listed it 18 months ago.”

Rates could fall to under 4% – but not until early 2025

Mortgage deals have fallen in recent months, and some brokers have said they expect lenders to continue cutting rates in the coming weeks, with five-year fixed mortgages potentially going to below 4 per cent.

However, Pete Mugleston, mortgage expert and MD at OnlineMortgageAdviser, warns that it may take a year or more for rates to drop to that level.

“If inflation increases slightly over the next few months post-Christmas, there is a chance the mortgage rate may increase slightly at the start of 2024.

“However, mortgage rates should begin to fall in the second half of 2024 in anticipation of the Bank of England reducing its base rate if inflation begins to fall,” he said. “We likely won’t see a 4 per cent rate till the very end of 2024 or into 2025.”

Homeowners are also being warned to watch out for fees. The analytics company Moneyfacts says that low-rate mortgages can carry some of the highest.

Mr Mugleston urged homeowners to be proactive and not bury their heads in the sand.

“When your mortgage is coming to an end, the first step is to find out exactly how long you have left on your current deal to not get caught out.

“If you decide to take no action, you will automatically be moved over to your lender’s standard variable rate. Which is often higher than the average two and five-year rates.

“To avoid this you should speak to your lender and other mortgage brokers to get the best support for your specific situation especially if you believe your monthly payments will be going up.

“When you are planning, be aware that you may be able to lock in a new rate up to six months before your current deal comes to an end, so if future rates are looking to rise it may be worth locking in a cheaper price earlier.

“It is also advisable that you budget for upcoming increases in repayments if your mortgage rate has increased. Drawing up a budget in advance will help give you an idea of how much you will need to be setting aside to mitigate the impact of increased payments.”

Do you have a real life story? Email claudia.tanner@inews.co.uk.