Many readers focused on the fact that we decided to make extra principal payments, money they argued would have been better invested in the stock market.

I will admit it was the same point our financial planner made. When I told him I wanted to cash out money from retirement accounts rolled over from a former job, he advised against it. Why not let it continue to grow in the stock market, he asked.

The well-diversified funds have done well, although my accounts were down significantly from their highs at the end of 2021. He mentioned the tax break we were getting on the mortgage interest.

We talked at length about why we wanted to be rid of the mortgage. In the end, here’s why our planner’s advice wasn’t right for us.

We freed up so much of our cash by extinguishing our largest expense.

With the mortgage payment gone, we have room to handle other costs that may increase, such as health-care expenses.

We did not sacrifice other financial goals to pay off our home early. And, we are not house rich and cash poor, meaning all or most of your money is locked into the equity in your home.

I would never recommend someone deplete their savings or cash out a significant part of their retirement account to pay off a mortgage. You shouldn’t cripple your cash reserves to become mortgage-free.

The tax deduction wasn’t worth keeping the mortgage

The mortgage interest deduction is just that — a deduction. It’s not a tax credit, which reduces dollar for dollar the taxes you owe. A deduction eliminates a percentage of the tax. If you don’t have a mortgage, you may pay more in taxes — but not as much as you would have to pay in annual interest on the home loan, especially in the early years.

Since our mortgage rate was so low, we weren’t getting much of a tax break compared to the thousands of dollars we were paying in interest every year.

Paying off our mortgage early is a guaranteed return

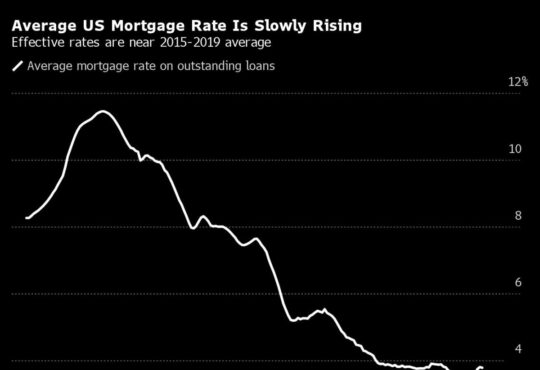

Some readers were outraged that we paid off a mortgage with a 2.75 percent interest rate.

They ignored the thousands of dollars in interest we avoided with our early payoff plan — a guaranteed return.

As I have pointed out before, you can do the math yourself using a mortgage-payoff calculator at bankrate.com. Let’s say you have a 30-year, fixed-rate mortgage for $400,000, with an interest rate of 6 percent. If you pay an extra $200 a month toward the principal, you can cut your loan term by more than 5½ years and save $98,277 in interest. If you increase the extra payment by $400 per month, you shorten your mortgage by nine years and save $159,602 in interest.

The stock market can be extremely volatile. Over time, investors have historically seen positive returns, but in any given period, that’s not a guarantee.

Plus, if we want, we can invest the money that would have gone toward the mortgage.

You don’t have to rush to tap your retirement savings

With no mortgage, my husband doesn’t have to take money out of his Thrift Savings Plan, which is the federal government’s version of a 401(k) retirement plan. He can allow that money to continue to grow, or in the case of the stock market downturn over the last two years, recoup paper losses.

He also can delay collecting Social Security.

For anyone born in 1960 or later, full retirement age is 67. By waiting to receive retirement benefits until after your full retirement age, your monthly benefit continues to increase. Every year you delay beyond your full retirement age up to 70, you get an 8 percent increase in your benefit.

Personal values matter, too

My husband and I value the psychological benefit of being free of debt. We didn’t want to drag the responsibility of a mortgage into retirement.

Critics overemphasize the possibility of making more money in the stock market. Yet, we all make decisions throughout our lives that pull money away from increasing our net worth.

If you want to maximize your investment dollars, then don’t take vacations, eat out or elevate your lifestyle by buying a bigger house.

Because of inflation, a middle-income married couple with two children will now spend about $300,000 to raise a child to the age of 17, according the Brookings Institution, which analyzed data from the U.S. Department of Agriculture. That does not include the cost of college, or “supporting them during their transition to adulthood,” Brookings pointed out.

We traded a higher net worth for the priceless joy that our three children bring into our lives. (Well, most of the time.)

I discourage decisions that are detrimental to your financial health. You don’t want to be reckless, but if you’ve crunched the numbers and have confidence you’re good financially, paying off your mortgage before you retire can be an appropriate financial move.

“Michelle, well done on achieving this important milestone,” one reader wrote. “A lot of the people who wrote negative comments may have missed the point about your being able to pay off your mortgage a month before your husband’s retirement. There is something unsavory/unsettling about still having to make mortgage payments in your twilight years. I also think that some people may have missed the important points you made about building up an emergency rainy day fund, saving enough for your kids’ college education and maximizing your retirement contributions. You also probably have a lower tolerance for risk, and so what you did over the past 30 years makes perfect sense. Others may be less averse to risk-taking behavior, and that is their choice too.”