As the cost of homeownership continues to grow out of reach for many Americans, mortgage interest rates have become a central concern for both homebuyers and policymakers. The Federal Reserve’s ongoing effort to curb inflation is keeping interest rates elevated for longer than many analysts expected, making home loans persistently expensive. These high interest rates have somewhat cooled the housing market but have not been sufficient to balance the rise in borrowing costs. As a result, many prospective buyers face the daunting combination of steep home prices and expensive financing.

Trends in Mortgage Rates

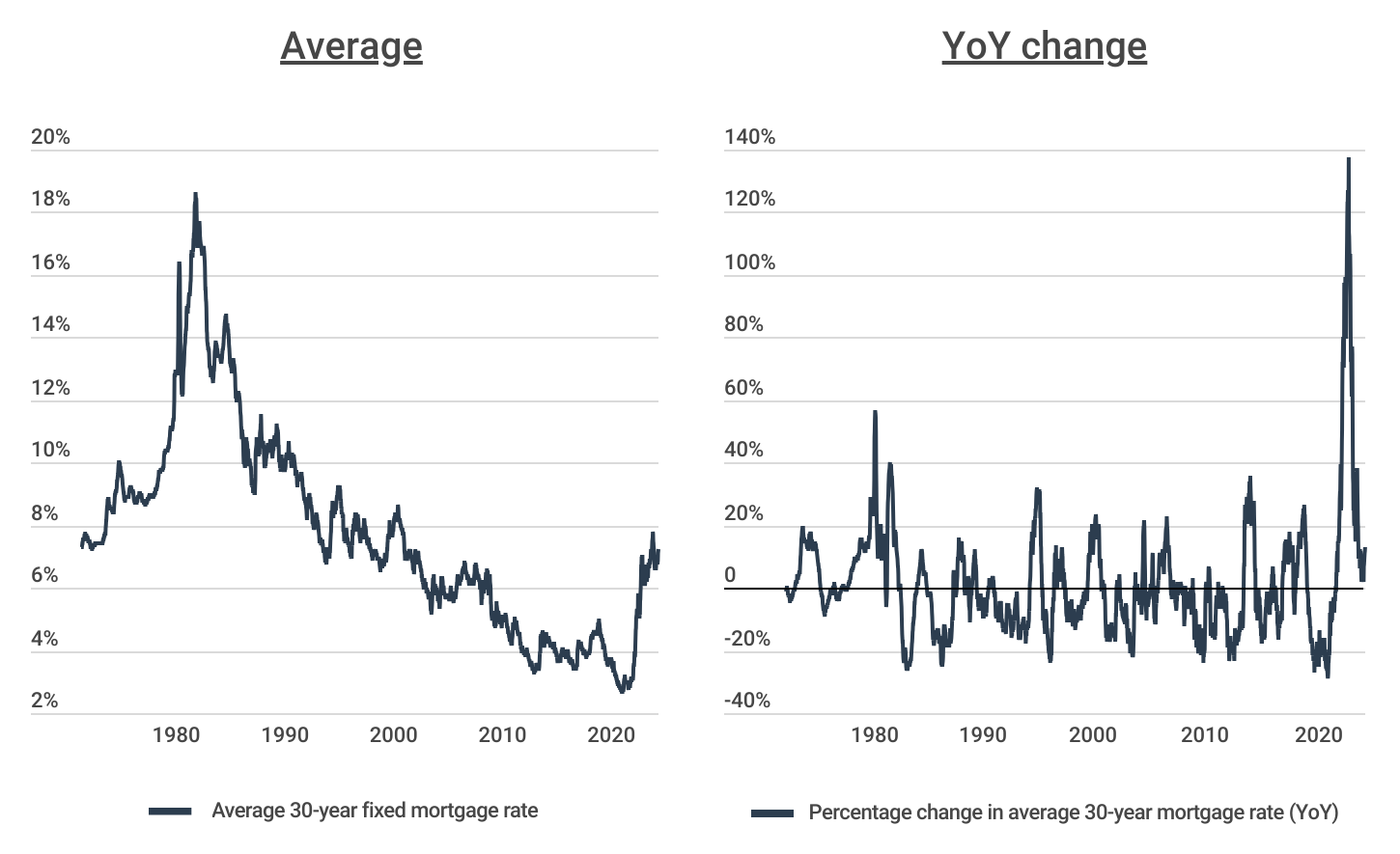

Mortgage interest rates have plateaued after rising at their fastest pace in more than 50 years

Source: Construction Coverage analysis of Freddie Mac data | Image Credit: Construction Coverage

After climbing to a staggering 18.63% in the early 1980s, the average 30-year fixed mortgage interest rate steadily declined until reaching a historic low of 2.65% in early 2021. However, since then, rates have risen considerably, reaching 7.79% in October 2023 and sitting at 7.22% in May 2024.

But perhaps most remarkable is the speed at which mortgage rates have risen. Even faster than in the early 80’s when rates climbed at over 50% year-over-year, rates shot up at an unprecedented 138% in November 2022 in response to pandemic-era inflation. This has had a major impact on housing costs, with an estimated monthly mortgage payment for the median-priced U.S. home being over 50% higher today than it was just two years ago.

Mortgage Rate Characteristics by Location

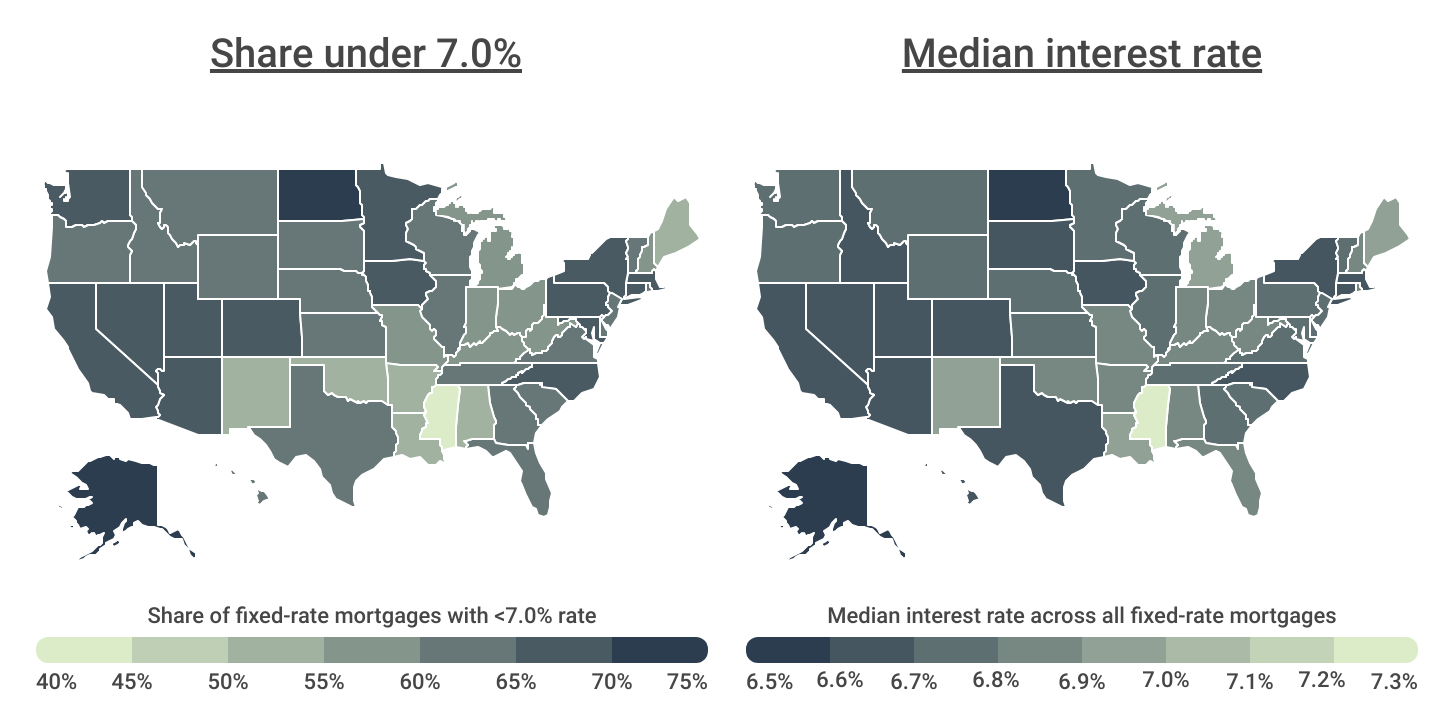

Homebuyers in North Dakota and Alaska landed the best mortgage rates in 2023

Source: Construction Coverage analysis of Freddie Mac data | Image Credit: Construction Coverage

Interest rates vary geographically due to local market conditions, the financial health of residents, and laws governing lenders. Across the U.S., 62.8% of all approved home purchase loans had interest rates below 7% in 2023. However, an even larger share of homebuyers in some parts of the country were able to secure mortgage rates below this figure. At the state level, North Dakota and Alaska had the largest share of fixed-rate mortgages with rates below 7% in 2023, at 73.0% and 72.3% respectively. In comparison, fewer buyers in the South received favorable rates. Just 42.6% of approved mortgages in Mississippi had rates of less than 7%—the lowest level in the country.

This analysis was conducted by Construction Coverage, a website that provides construction software and insurance reviews, using the latest data from the Federal Financial Institutions Examination Council’s 2023 Home Mortgage Disclosure Act. Researchers ranked states according to the share of all fixed-rate mortgages with less than a 7% interest rate. Only conventional home purchase loans approved in 2023 were included in the analysis.

Here is a summary of the data for Oklahoma:

- Share of fixed-rate mortgages with <7.0% rate: 54.0%

- Share of 30-year mortgages with <7.0% rate: 59.6%

- Share of 15-year mortgages with <7.0% rate: 68.8%

- Median interest rate across all fixed-rate mortgages: 6.875%

- Change in median interest rate across all fixed-rate mortgages (2022–2023): +1.500 pp

- Median home sale price (financed w/ 30-year mortgage): $255,000

- Median home sale price (financed w/ 15-year mortgage): $245,000

For reference, here are the statistics for the entire United States:

- Share of fixed-rate mortgages with <7.0% rate: 62.8%

- Share of 30-year mortgages with <7.0% rate: 67.1%

- Share of 15-year mortgages with <7.0% rate: 80.1%

- Median interest rate across all fixed-rate mortgages: 6.750%

- Change in median interest rate across all fixed-rate mortgages (2022–2023): +1.625 pp

- Median home sale price (financed w/ 30-year mortgage): $405,000

- Median home sale price (financed w/ 15-year mortgage): $395,000

For more information, a detailed methodology, and complete results, see Homebuyers in These U.S. Cities Get the Best Mortgage Rates on Construction Coverage.