By John-paul Ford Rojas Associate City Editor

01:45 01 Jul 2023, updated 01:45 01 Jul 2023

- House prices falling in response to cost of living squeeze, with prices 3.5% lower

Households are running down savings and paying off mortgages at a record rate.

The figures from the Office for National Statistics provide fresh evidence of how families are adjusting their finances amid high inflation and soaring borrowing costs.

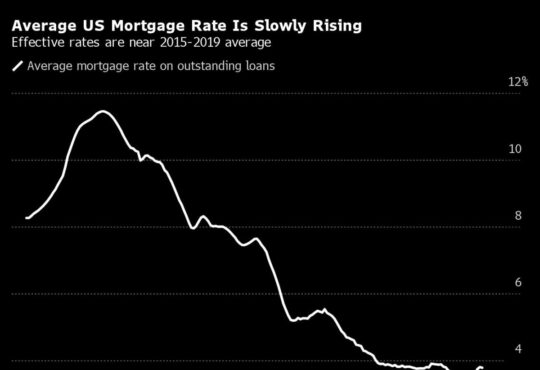

A separate report shows that rates on fixed-rate home loans are still rising and five-year deals are close to 6 per cent.

House prices are falling in response to the cost of living squeeze – with prices 3.5 per cent lower than a year ago, according to Nationwide, the sharpest drop since 2009.

Some economists are predicting a recession triggered by interest rates soaring in the Bank of England’s bid to rein in inflation.

The ONS said GDP grew by 0.1 per cent in the first quarter – a sluggish figure but better than the downturn many forecasters had feared.

Business investment was buoyant but possibly because of projects being brought forward to profit from a ‘super deduction’ tax break that ended on March 31.

Households took £1.9billion out of bank accounts in the first quarter of the year, the first net withdrawal on records going back to 1987.

A fall in the savings rate was blamed on the cost of living squeeze as well as stealth taxes dragging more workers into higher tax bands.

Income taxes claimed £5.4billion more in the first quarter while consumer spending rose by £5.2billion because of rising energy and housing costs.

Mortgage repayments exceeded new borrowing by a record £5.2billion amid fears about taking out new debt at soaring rates.

And a key measure of spending power – real household spending – fell for the fifth time in the past six quarters. The measure, which accounts for how much money is left after taxes and inflation, fell by 0.8 per cent.

HSBC economist Chris Hare said that it was different from the financial crisis of 2008-9 because many households were able to run down savings they had amassed in the pandemic.

Some of the cash is being shifted into higher return assets such as bonds while in other cases investors are looking to pay off lump sums on their mortgages.

Ashley Webb, UK economist at Capital Economics, said: ‘With around 60 per cent of the drag from higher interest rates yet to be felt we still think the economy will tip into a recession in the second half of this year.’

Andrew Wishart, senior property economist at Capital Economics, said high mortgage rates would cause ‘a new leg down in prices’.