Nonbank lenders lost ground in the mortgage space in 2022 as higher rates hammered home lending activity.

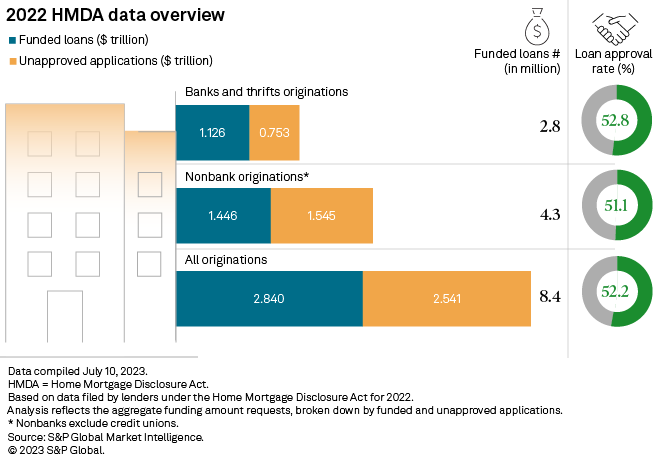

Nondepository institutions originated $1.446 trillion in mortgages in 2022, down 50.2% from $2.904 trillion a year earlier, according to newly released Home Mortgage Disclosure Act data collected by S&P Global Market Intelligence. Nonbank mortgage lenders’ loan approval rate also slipped year over year to 51.1% from 58.2%; their unapproved applications totaled $1.545 trillion.

Nonbanks accounted for 50.9% of funded loans in 2022, down from 60.7% in 2021, while banks gained ground in 2022, accounting for 39.7% of funded loans compared to 32.6% in 2021. However, nonbank lenders still funded more mortgages than banks and thrifts, which booked $1.126 trillion in mortgages in 2022.

Across all lender types, mortgages originated in 2022 amounted to $2.840 trillion, a significant decrease from $4.781 trillion in 2021.

Top originators

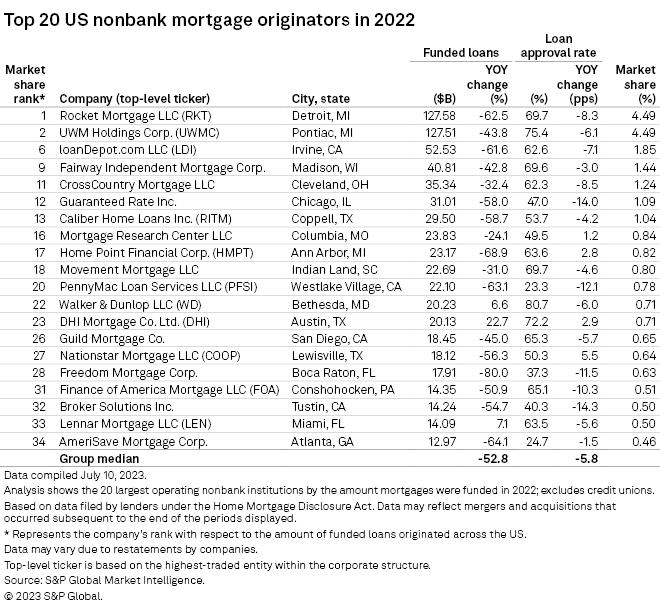

Rocket Mortgage LLC kept its title as the top nonbank mortgage lender, though the volume of mortgages it funded more than halved year over year. The Rocket Cos. Inc. unit logged $127.58 billion in funded mortgages in 2022, compared to $340.19 billion in 2021.

“We’ve seen players across the industry struggle to adjust to the volatile environment, facing liquidity issues, retrenching or exiting the industry altogether. Against this backdrop, Rocket Companies continued to invest and innovate,” CFO and Treasurer Brian Brown said during a Feb. 28 earnings call.

UWM Holdings Corp. ranked second on the originators list with $127.51 billion in funded mortgages, down 43.8% from the prior year.

“We finished 2022 strong with fourth-quarter production volume on the high end of our outlook and gain margin well within the range we expected,” Chief Accounting Officer and CFO Andrew Hubacker said during a March 1 earnings call. “Our fourth-quarter profitability was impacted by negative [mortgage servicing right] fair value marks, but we delivered strong net income for 2022 in a challenging and volatile mortgage market.”

Rocket Mortgage and UWM Holdings each had market shares of 4.49% at the end of 2022.

LoanDepot Inc. was a distant third, originating $52.53 billion in mortgages, representing a 61.6% year-over-year decrease. The company expects the mortgage market to stay challenged in 2023 and will continue to reduce its costs and optimize its operating model, President and CEO Frank Martell said during a March 8 earnings call.

Among the top 20 originators, only three companies logged yearly increases in funded mortgages: Walker & Dunlop LLC, DHI Mortgage Co. Ltd. and Lennar Mortgage LLC. Walker & Dunlop’s funded mortgages rose 6.6% to $20.23 billion, DHI Mortgage’s increased 22.7% to $20.13 billion and Lennar Mortgage’s climbed 7.1% to $14.09 billion.

Biggest movers

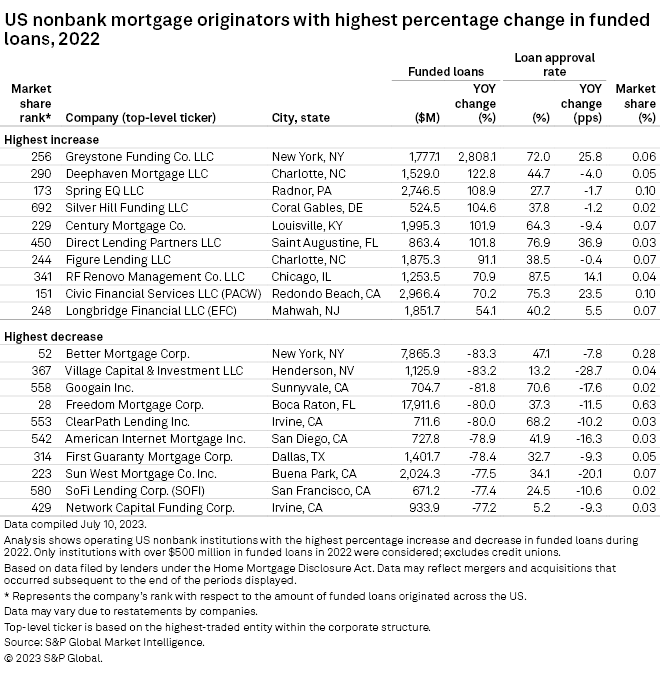

Better Mortgage Corp., a big gainer in 2021, was the nonbank mortgage originator with the highest decrease in funded mortgages in 2022. The company’s funded mortgages totaled $7.87 billion, down 83.3% from the previous year.

SoFi Technologies Inc. unit SoFi Lending Corp. was also among the biggest losers, as its funded mortgages plunged 77.4% year over year to $671.2 million.

Greystone Funding Co. LLC was the biggest relative gainer. Its funded mortgages skyrocketed 2,808.1% to $1.78 billion.

The funded loans of Civic Financial Services LLC, a subsidiary of PacWest Bancorp, amounted to $2.97 billion, an increase of 70.2% from the prior year. PacWest acquired Civic in February 2021; Roc Capital Holdings LLC purchased the origination assets of Civic in May 2023.

Originations solid thus far in 2023

The second quarter has shaped up to be relatively strong for mortgage originators and servicers, Piper Sandler analysts said in a July 12 note.

“Competition within the three production channels seems to be close to what we would consider ‘normal’ and gain on sale margins are poised to increase despite higher mortgage rates in [the second quarter],” the analysts wrote.