Vesta Equity’s mortgage exit feature helps homeowners exit the burden of debt while giving investors direct access to solid & verified real estate assets.

— Michael Carpentier

LOS ANGELES, CALIFORNIA, USA, November 16, 2022 /EINPresswire.com/ — Vesta Equity, an innovator at the intersection of financial services, real estate, and blockchain is pleased to announce that over $12 million US of home equity is available on its platform following the launch of its mortgage exit feature.

Vesta Equity’s mortgage exit solution allows homeowners to end their mortgage and have an opportunity to never worry again about debt and costly monthly payments. The compounding impact of interest results in significant payouts to banks over the term of a loan. As we now step into a cycle of rising interest rates, even more homeowners are going to be forced into higher costs of living. They will be scraping by, not living life to its potential, or saving for their future.

With Vesta Equity’s mortgage exit solution, homeowners with a primary mortgage or existing liens can designate a minimum dollar amount required to pay them off. During the listing process, homeowners simply present the documents indicating the total dollar amount due to the lender – such as a payoff letter. These are then validated by Vesta Equity and its title partners. Homeowners can also include closing costs as part of the minimum target. Investor funds that are committed to the listing are held securely in escrow until the listing reaches its target. At this point, funds are used to execute the payoff and reconveyance of title. In addition to the minimum, homeowners can also opt to sell more equity. These additional funds will be transferred directly to the homeowner’s wallet once the property has been secured. This allows homeowners to sell enough equity to become mortgage-free while accessing more equity for cash to pursue their life’s ambitions and financial goals.

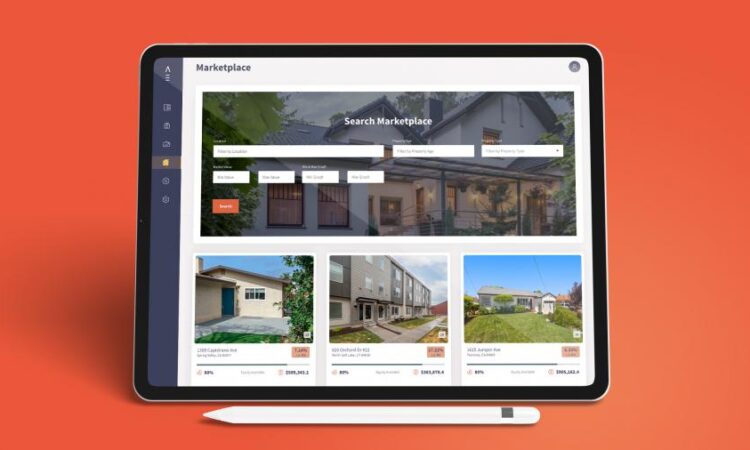

For investors the process of acquiring assets is as easy as buying stocks. They can build a portfolio of properties across regions, home types, and more. They can view properties on the marketplace, get up-to-date valuations, view inspection reports & recent photos, and access tools that allow them to make offers for the share of the equity they wish to purchase.

“Right now, the ecosystem is rife with blockchain use cases that offer no genuine real life utility and are not backed by real assets and, not so surprisingly, this results in catastrophic failures,” said Michael Carpentier, CEO and Co-Founder of Vesta Equity Inc., “Our mortgage exit feature is another example of our effort to use blockchain to build useful solutions for homeowners and investors – we solve a genuine problem and, in turn, create a solid stable investment opportunity backed by real verified properties.”

“The market should be less concerned with hype and speculation and more focused on where blockchain solves real world issues,” said Imran Rahaman, COO and Co-Founder of Vesta Equity Inc., “Accessing the equity in your home has not changed in over a century and now we offer an easy-to-use point and click environment that disintermediates an institutionalized paradigm that puts homeowners and investors in control – no need to be a blockchain expert and there are no unpredictable cryptocurrencies involved.”

For more information on Vesta Equity and their home equity marketplace, please visit: https://www.vestaequity.net. Click here to sign up as a property owner and access the equity in your home. Click here to sign up as a property investor to build a portfolio of real estate assets.

Michael Carpentier

Vesta Equity

email us here

Visit us on social media:

Facebook

Twitter

LinkedIn

![]()