Effective tomorrow (16th February), NatWest is set to make changes to its product ranges for both new business and existing customers.

In terms of new business, borrowers can expect a rate increase of up to 0.10% and 0.20% on selected 2-year and 5-year deals.

For remortgages, rates will see a rise of up to 0.15% and 0.21% on specified 2-year and 5-year deals.

First-time buyers will face rate hikes of up to 0.10% and 0.11% on selected 2-year and 5-year deals, while those utilising Help to Buy shared equity for remortgages will experience increases of up to 0.10% and 0.21%.

Moreover, shared equity purchases will see rates increase by up to 0.10% and 0.20% on specific 2-year and 5-year deals.

Both Green purchase and remortgage deals will undergo rate hikes of 0.10% and 0.20%.

For Existing Customers, those looking to switch will face rate increases of up to 0.10% and 0.05% on selected 2-year and 5-year deals.

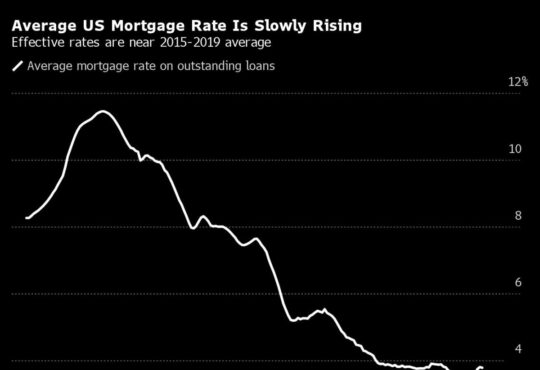

Nicholas Mendes, head of marketing at John Charcol, said: “Unfortunately, this is going to be a consistent theme amongst high street lenders over the next few weeks.

“As much as we would all want fixed rates to continue repricing downwards, swaps just don’t allow lenders the room to be able to hold where they are.

“Those who acted last month to secure a deal will no doubt feel an element of relief for acting quickly and not holding out in the hope rates were going to continue repricing downward.

“It’s still worthwhile securing a deal and continue to regularly review the market up until completion, or use a broker who can do this for you, which would certainly be less stressful.”