Mortgages granted in July in Spain fall by -18.8% year-on-year, average interest rate rises

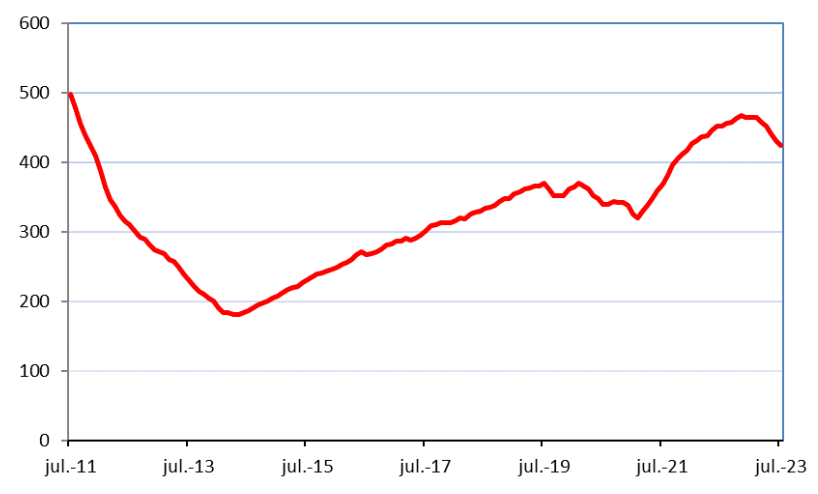

Santiago Martinez (Ibercaja) | The number of mortgages granted in Spain fell by -18.8% year-on-year in July, the average amount by -2.1% (to €143,412) and the total amount granted by -20.9%. These data are in line with what we have been seeing throughout the year, an expected correction from levels that were considered unsustainable after the emergence of pent-up demand during the pandemic, as well as changes in buyer preferences in the aftermath. So far this year to July, the fall in the number of mortgages granted is -14.4%, in the average amount of mortgages -1.9% and in the total amount granted -15.8%. The number of mortgages granted had reached a peak of 467,000 accumulated in the twelve months to November 2022. In July, this figure had fallen to 425,000.

Number of mortgages granted in 12 months:

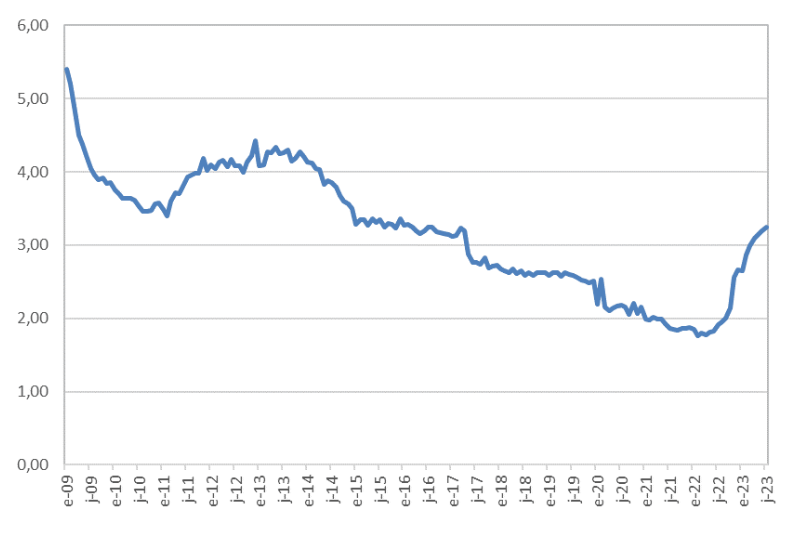

Behind the cooling of the mortgage market, in addition to the high starting levels, is undoubtedly the rise in the price of mortgages. According to INE statistics, which are based on Land Registry data, the average interest rate at the start of mortgages taken out was 3.24% in July, 132 b.p. compared with 1.92% a year earlier, reflecting changes in international financial market conditions and, in particular, the policy of the European Central Bank, which from July 2022 to July 2023 raised the intervention rate by 350 b.p., a move that was passed on to a rise of 365 b.p. in the 12-month Euribor.

Average interest rate at the start of the mortgages taken out:

Unlike the real estate bubble cycle, there have been no excesses in this market, something that can be seen for example in the evolution of house prices, which are still rising despite the fall in sales and purchases, or in the small correction in the average amount of mortgages granted. However, as announced by the European Central Bank, high interest rates will remain for a prolonged period, so that the fall in mortgages granted can be expected to continue in the coming months, although the pace will moderate as we approach sustainable transaction levels in the medium and long term.