Mortgage rates climbed again last week, while a key measure of housing sentiment dropped back close to the record lows recorded last year, as higher interest rates roil the housing market.

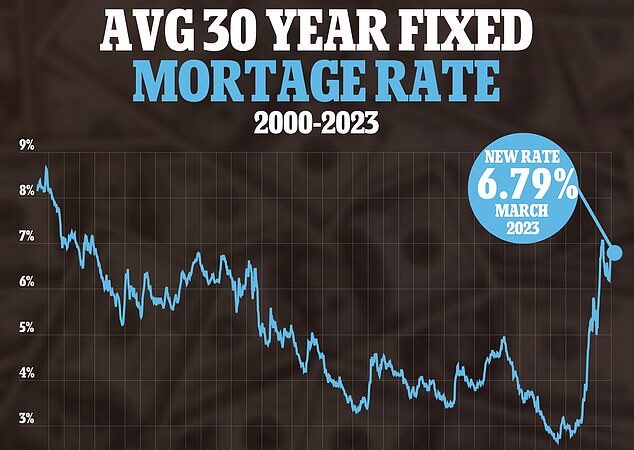

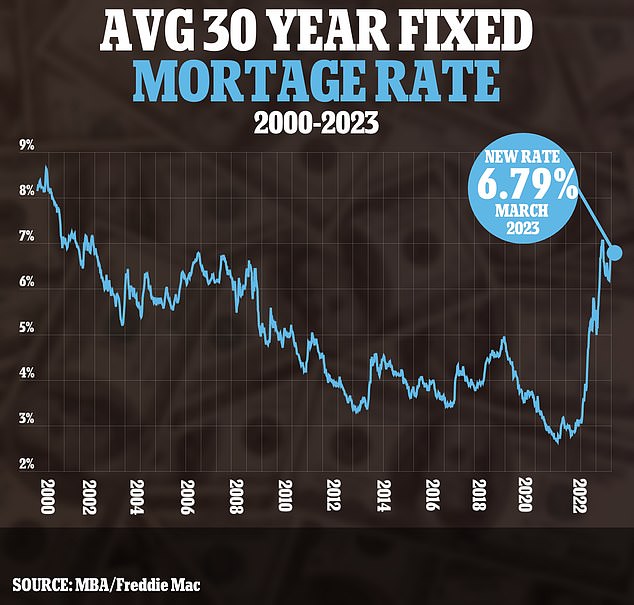

For the week that ended March 3, the average contract rate on a 30-year fixed mortgage increased to 6.79%, from 6.71% the prior week, the Mortgage Bankers Association (MBA) said on Wednesday.

It marked the fourth weekly increase in mortgage rates after a period of declines, as rates climbed back toward the 20-year high above 7% reached last fall.

Despite the rising rates, mortgage applications increased 7.4 percent from one week earlier, though the increase may in part be due to the recent President’s Day holiday, said Joel Kan, MBA’s Vice President and Deputy Chief Economist.

‘Even with higher rates, there was an uptick in applications last week, but this was in comparison to two weeks of declines to very low levels, including a holiday week,’ said Kan.

For the week that ended March 3, the average contract rate on a 30-year fixed mortgage increased to 6.79%, from 6.71% the prior week

Mortgage rates climbed again last week, while a key measure of housing sentiment dropped back close to the record lows recorded last year (file photo)

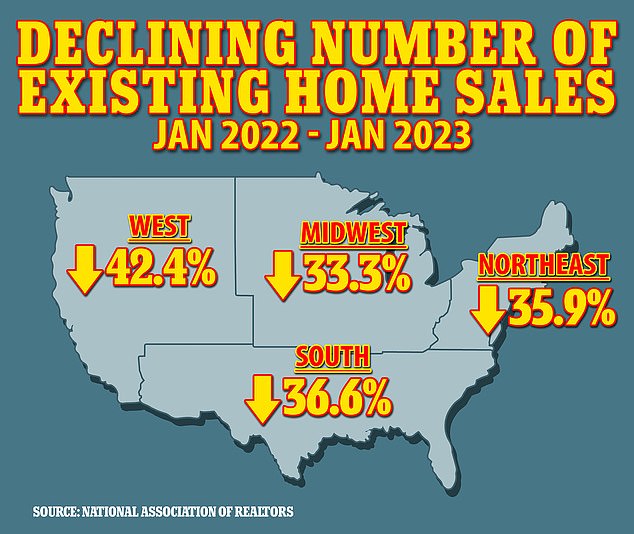

‘Comparing the application indices from a year ago, purchase applications were still down 42 percent, and refinance activity was down 76 percent. Many borrowers are waiting on the sidelines for rates to come back down,’ he added.

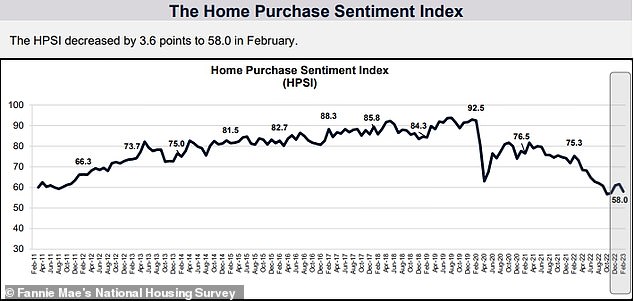

Meanwhile, Fannie Mae’s monthly gauge of housing sentiment dropped 3.8 points in February to 58.0, falling close to its record low seen in October.

As mortgage rates rise, both buyers and sellers were pessimistic about the market, according to Doug Duncan, chief economist and senior vice president at Fannie Mae.

‘With home-selling sentiment now lower than it was pre-pandemic – and homebuying sentiment remaining near its all-time low – consumers on both sides of the transaction appear to be feeling cautious about the housing market,’ said Duncan in a statement.

‘We believe these results corroborate our expectation for subdued home sales in the coming quarters, particularly now that mortgage rates have begun rising again,’ he added.

The survey found that 44% of consumers believe it’s a bad time to sell, up from 39% the prior month.

According to Duncan, most respondents who indicated it’s a bad time to sell cited unfavorable economic conditions and mortgage rates as the primary reasons for that belief.

Fannie Mae’s monthly gauge of housing sentiment dropped 3.8 points in February to 58.0, falling close to its record low seen in October

As well, 24% of respondents expressed concern about losing their job in the next 12 months, up from 18% last month.

Other results showed that the share of respondents who said their household income was significantly lower than it was a year ago increased to 12% from 10% the month before.

The percentage of respondents who said their household income was significantly higher than 12 months ago remained unchanged at 22%.

However, the share of consumers who said the economy was on the wrong track decreased 2 percentage points to 71%. The share who said the economy was on the right track increased 2 percentage points to 28%.

The monthly survey of 1,000 American adults found that sentiment about the housing market remains generally negative, as the Fed’s rate hikes push mortgage rates higher and depress homebuying activity.

Fears that inflation will linger, driving the Fed’s interest rate hikes higher for longer, have been the key factor in volatility in the housing market and on Wall Street this year.

On Tuesday, Wall Street’s major stock indexes plunged following Fed Chair Jerome Powell’s warning that ‘the ultimate level of interest rates is likely to be higher than previously anticipated.’