Editorial Note: We earn a commission from partner links on Forbes Advisor. Commissions do not affect our editors’ opinions or evaluations.

Mortgage interest rates are dynamic and unpredictable, and can fluctuate many times between when you file a loan application and your closing. If you want to avoid uncertainty and preserve the rate in your mortgage loan offer, get a mortgage interest rate lock.

Interest rate locks can offer peace of mind to borrowers, but they are not foolproof—you could miss out on a lower interest rate after you lock and your loan might not close before the lock expires.

What Is a Mortgage Rate Lock?

When you receive a mortgage loan offer, a lender will usually ask if you want to lock in the rate for a period of time or float the rate. If you lock in, the rate should be preserved as long as your loan closes before the lock expires.

If you don’t lock in right away, a mortgage lender might give you a period of time—such as 30 days—to request a lock, or you might be able to wait until just before closing on the home.

Make sure you get multiple mortgage loan offers and see which lender’s mortgage interest rate offer is the best one. Once you find a rate that is an ideal fit for your budget, lock in the rate as soon as possible. There is no way to predict with certainty whether a rate will go up or down in the weeks or even months it sometimes takes to close your loan.

Consequences of Failing To Lock In Your Mortgage Rate

If you don’t lock in your interest rate, rising interest rates could force you to make a higher down payment or pay points on your closing agreement. When you pay an up-front fee—or mortgage points—to a lender, you’re providing more money initially in order to get a lower interest rate.

For example, the cost for a $200,000 loan at a 30-year fixed rate could go up by more than $60 per month if the rate goes up from 5% to 5.5%, resulting in $22,000 more in interest over the loan term.

“Rate locks provide consumers certainty when it comes to the economic terms of their loan—most importantly, their monthly payment,” says Sebastian Hart, capital markets associate at online homeownership company Better. “Without rate locks, borrowers would not know the final terms of their loan until the very end of the process.”

How Does A Mortgage Rate Lock Work?

A mortgage rate lock can reduce financial uncertainty in the home purchase process because it protects you from major interest rate increases.

Locks are usually in place for at least a month, to give the lender enough time to process the loan. If the lender doesn’t process the loan before the rate lock expires, you’ll need to negotiate a lock extension or accept the current market rate.

It’s possible the market rate for your loan could fall below your locked-in rate, but you won’t be able to take advantage of the lower rate unless you have a “float down” option.

Even if you have a lock in place, your interest rate could change because of factors related to your application such as:

- New down payment amount

- Appraisal on your home that is different from the estimated value in your application

- Decrease in your credit score because you are delinquent on payments or took out an unrelated loan

- Income on your application that can’t be verified

An interest rate lock agreement will include the rate, the type of loan (such as a 30-year fixed-rate mortgage), the date the lock will expire and any points you might be paying toward the loan. The lender might tell you these terms over the phone, but it’s better if you get them in writing, as well.

What To Do If Interest Rates Fall After Your Rate Lock

If you locked in your rate early but interest rates are dropping, you might consider withdrawing the current mortgage application and starting a new one. There are some risks to this approach, however. You could:

- Lose money you’ve already paid on an appraisal and other costs, such as a credit check; you’ll end up paying for them again with a new loan application

- Pay more for processing the new application if the lender or mortgage broker has higher fees

- Wait longer to close on a home, which could complicate your planned purchase of a home if the seller needs the transaction to close on an exact date. This is not as much of a concern when refinancing.

However, if there is a big difference between your possible new rate and the current locked-in rate, it might be worth dropping the loan application and spending a few hundred dollars to obtain a rate that saves you thousands over the life of the loan.

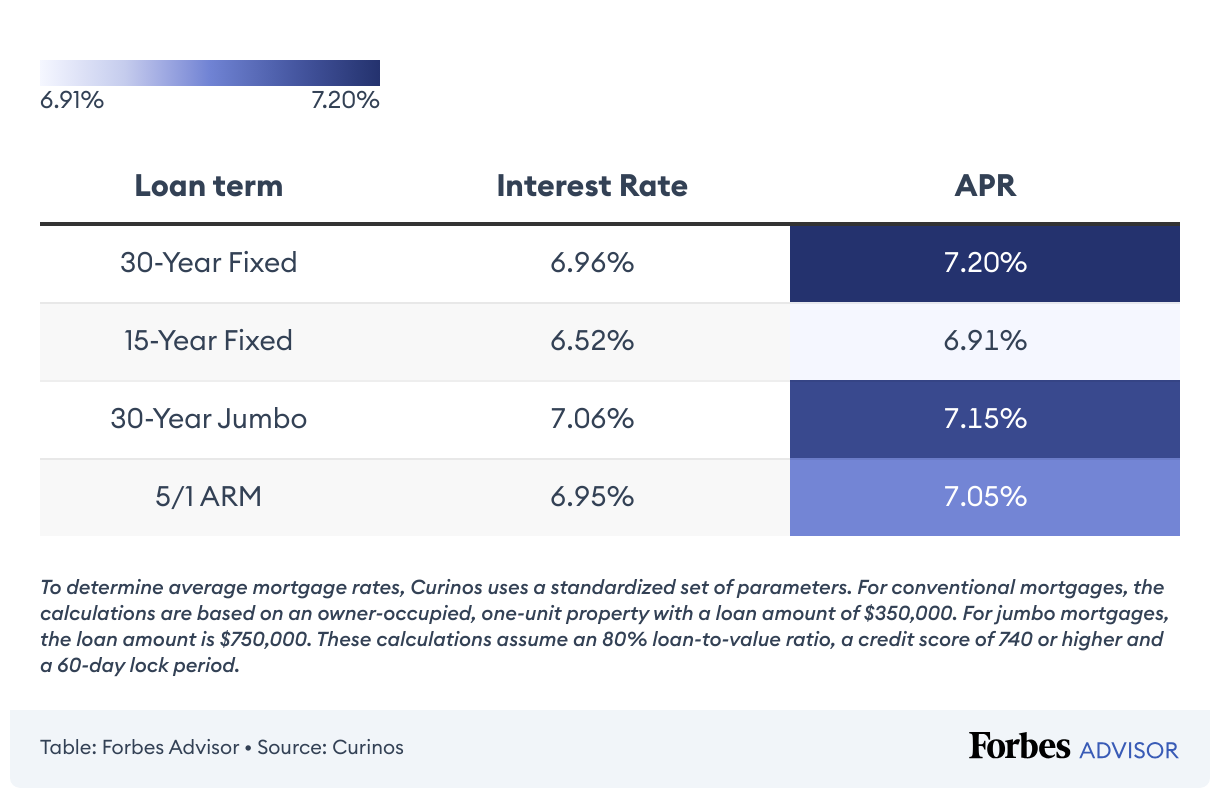

Mortgage Rates Today

When You Can Lock Your Mortgage Rate

The most common time to lock in a mortgage rate is when you accept a loan offer.

“When applying for a mortgage, customers typically talk with their mortgage banker up front about rates and terms,” says Tom Parrish, head of retail lending product management at BMO Harris Bank. “If mortgage rates are attractive to the customer, many of them lock shortly after applications, as they do not want to risk rates moving higher.”

If you feel like you’ve received the best rate possible and fear a rate increase, lock it in now. But if you’re willing to gamble that the rate will drop in the coming days or weeks, lenders could let you wait and provide a lock-in at a later date. Make sure to ask lenders whether they will allow you to lock in at a later date and what restrictions might be tied to it.

How Long Is a Mortgage Rate Lock Good For?

Rate locks usually range from 30 to 60 days, but you need to take into consideration how long it takes to close a loan in your area when you discuss the length of the lock with your lender. For example, if your lender has a major backlog of mortgage applications because of historically low rates, choose the longest length of time possible.

Also, when you discuss the mortgage rate lock with your lender, ask if it will prioritize the application for a new home mortgage purchase over a refinance. If so, make sure you get a lock period that’s long enough to cover your mortgage application process.

You need to do your part to move the mortgage application process along by quickly turning in documents requested by the lender, such as:

- Banking account statements

- Proof of income

- Income tax returns

- Photo ID

If you delay your response, the lock may expire before the home loan closes. If that’s the case, the lender might ask you to pay for a rate lock extension or split the costs. In some cases, the lender might be at fault and pay the entire cost.

Should You Use a Mortgage Rate ‘Float Down’?

A mortgage rate “float down” improves your chances at getting the lowest interest rate before closing. If you’re locked in and the loan rate drops during the application process, a float down allows you to change to the lower rate.

You should ask your lender about this option before you lock in your rate so you know the rules under which it would apply, as well as potential costs. For example, the lender’s policy might require that the rate drop by a certain percentage point before you can make a change, charge a fee for the move to the new rate and require that the loan be conditionally approved pending potential further documentation requests.

“Each lender has their own unique float down policy and qualification standards,” Hart says. “Usually, a float down will be triggered by a significant move lower in a benchmark rate between the date the borrower locked their rate and the closing date.”

The float down option might be best if you have plenty of time before the loan closes and if the loan application is fairly straightforward.

Mortgage Rate Lock Fees

You might get charged for a mortgage interest rate lock, but many lenders provide it for free. Charges could be the equivalent of a very small percentage of the loan—such as .025%, which can amount to several hundred dollars on a $300,000 mortgage loan—but that cost can be offset by savings across the life of a loan with a lower interest rate.

Costs can also vary based on the length of the lock.

“It is in the consumer’s best interest to ask about any fees a lender may charge and where to identify them before applying,” Hart says.

How Much Does It Cost To Extend a Mortgage Rate Lock?

The rate lock extension fee depends on the lender and duration. Fees can range from 0.125% to approximately 1% of the mortgage amount.

Shorter extensions incur lower fees, such as 0.125% to 0.25% for a rate lock of 180 days or less. Periods closer to a year can cost at least 1%.

Mortgage Rate Lock Pros

- If you like the rate you have, you can keep it unless your loan changes or the lock expires prior to closing.

- You don’t have to worry about changes to monthly payments because your interest rate is set.

- You can avoid a last-minute financial scramble before your closing if you need to provide a higher down payment or make a points purchase because of a higher interest rate.

Mortgage Rate Lock Cons

- You could miss out on a lower interest rate, which could save you thousands of dollars over the life of the loan.

- If the rate lock expires, you might be charged hundreds of dollars to extend it or miss out on the rate altogether.

Should You Lock In Your Mortgage Rate?

Locking in your mortgage rate is generally worth it when rates are trending higher and you want to protect yourself from paying a higher rate at closing. A rate lock is also helpful on construction loans that take several months to complete and are subject to building delays.

Forbes Advisor Mortgages Writer Josh Patoka contributed to this article.

Faster, easier mortgage lending

Check your rates today with Better Mortgage.

Frequently Asked Questions (FAQs)

How does a six-month mortgage rate lock work?

A six-month rate lock is when the lender reserves the current interest rate for 180 days. Before you decide to lock in your mortgage rate for six months, ask your lender if it offers a float down option. Since interest rates can fluctuate considerably over half a year, a float down option would allow you to close at a lower rate should rates fall over that time period. Float down options typically involve a fee.

How do you get out of a mortgage rate lock?

Mortgage rate locks are usually non-cancelable. Even if rates go down, you’ll have to close at the locked rate unless you switch lenders or allow the lock to expire. That said, some lenders offer a float down option—for a fee—that lets you bring your rate down to current market levels in the event that interest rates drop.

Some lenders also offer a rate match guarantee when a competitor offers a better rate with similar loan terms. However, you may need to submit the better offer within three business days of your original rate lock date to be eligible.

The lender may also cancel your rate lock if there are changes to your:

- Credit score

- Income

- Property appraisal value

- Requested loan amount

- Down payment

Is it better to lock in your mortgage rate?

Locking in your mortgage is helpful when it appears that market rates will increase before your closing date, or when you want to know your rate early in the underwriting process to estimate your monthly payment. Long-dated construction projects can also benefit from a rate lock.

Can I change the loan amount after the rate lock?

Yes, however, changing the requested loan amount or down payment may lead to a higher mortgage rate since you’re adjusting one of the factors determining the initial locked rate.