- Cheapest two-year fixed deal has fallen from 4.6% to 4.1% in just over two weeks

- One economist thinks banks are ‘a bit mad’ to be offering such a low rates

- One mortgage broker says current lowest rates be withdrawn by early next week

Experts are warning that mortgage rates are about to stop falling, after the surprise jump in inflation reported on Wednesday.

In recent weeks, mortgage lenders have engaged in somewhat of a price war. More than 50 lenders have cut residential rates since 1 January, according to Moneyfacts.

This is because lenders have been lowering fixed mortgage rates on the back of predictions that the Bank of England will soon cut the base rate, once inflation is under control.

Fixed rate mortgages hit a new low this morning, after Santander cut its cheapest two-year fixed rate deal from 4.55 to 4.1 per cent, which is a new best buy.

It means that in just over two weeks, the cheapest two-year fixed rate deals across the market have fallen from 4.6 per cent to 4.1 per cent.

Many across the mortgage market have been speculating that we may soon see two-year fixes fall below 4 per cent.

But it seems December’s CPI inflation reading, that was reported on Wednesday, has thrown a slight spanner in the works.

Related Articles

HOW THIS IS MONEY CAN HELP

The 4 per cent inflation reading was slightly higher than the 3.8 per cent that markets had forecast.

This led to financial markets rolling back slightly on their forecasts for base rate cuts this year.

While investors are still pricing in four or five interest rate cuts in 2024, this is down from previous expectations of six cuts for the year.

On 1 January, the market had been pricing 170 basis points of cuts, but that has now fallen to 115bps.

Andrew Wishart, a senior economist at Capital Economics believes it is likely that Santander made its decision to cut rates before the surprise increase in inflation in December released on Wednesday.

However, he thinks that Santander may still ultimately be able to make a small profit when considering the savings rates on offer.

‘It’s a bit mad that Santander is willing to lend to homeowners for two years for less than the risk-free 4.3 per it cent could get from buying a two-year Government bond this morning,’ says Wishart.

‘There is clearly quite intense competition between lenders for mortgages, perhaps based on lending volume targets or for PR reasons.’

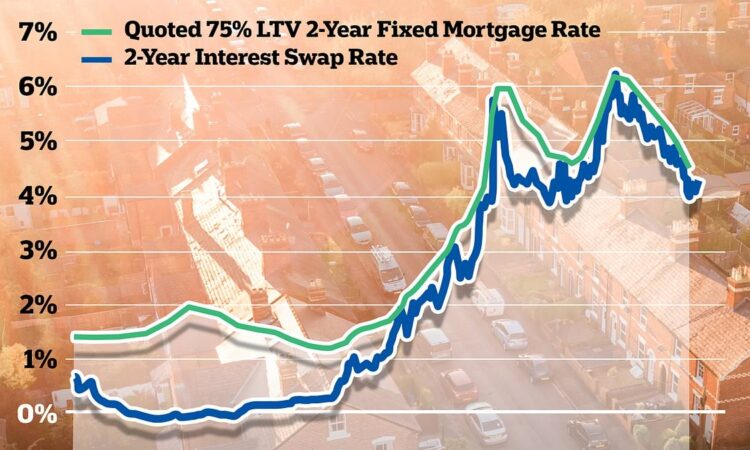

When it comes to fixed rate mortgage lending, market expectations are typically reflected in Sonia swap rates.

Mortgage lenders enter into these agreements to shield themselves against the interest rate risk involved with lending fixed rate mortgages.

Swap rates show what banks and building societies think the future holds concerning interest rates and help guide their fixed rate pricing.

Five-year swaps are currently at 3.71 per cent and two-year swaps at 4.26 per cent – both trending well below the current base rate.

However, this is slightly up compared to the start of the year when five-year swaps were 3.4 per cent and two-year swaps were 4.04 per cent.

According to Chris Sykes, technical director at mortgage broker Private Finance, it is very rare for the lowest priced mortgage rates to go below swap rates.

In the case of Santander, it has done exactly that. A 4.1 per cent mortgage rate compared to a 4.26 per cent swap.

Due to this, Sykes says he isn’t expecting the Santander deal to be available for long.

‘I expect this Santander rate to last until early next week and then be withdrawn,’ says Sykes. ‘It is too cheap, especially considering the swap rate increases since the inflation data on Wednesday.

‘It is very rare for us to see rates under swaps and the key with these is, they don’t last long.’

Wishart adds: ‘Our view has always been that after a drop in January mortgage rates would stabilise at between 4 to 4.5 per cent.

‘That’s because at that level they are already very close to swap rates which we don’t think will fall further until the Bank of England actually starts cutting.’

Looking further ahead to when and if the Bank of England begins cutting base rate, Sykes believes that this should put more downward pressure on mortgage rates.

However, with much of these cuts already priced into what lenders are currently offering in terms of mortgages, there may not be as much of a shift as some people think.

Sykes adds: ‘Average mortgage rates will fall once the base rate reduces as it automatically results in variable rate mortgage deals decreasing.

‘I also expect that the base rate falling may trigger good signals in the industry meaning swaps could fall further.

‘But it doesn’t mean we will see significant rate drops straight away when base starts falling.

‘This is because much of these lower rates have already been priced in because there is already an expectation rates will fall.’

Economist Andrew Wishart has one final word of warning, following Wednesday’s disappointing inflation reading.

‘The rise in inflation in December highlights the possibility that interest rates might not fall as soon or as far as expected, in which case swap rates and mortgage rates would rise again.’

Some links in this article may be affiliate links. If you click on them we may earn a small commission. That helps us fund This Is Money, and keep it free to use. We do not write articles to promote products. We do not allow any commercial relationship to affect our editorial independence.