With interest rates spiralling ever upwards, banks and building societies are coming under increasing pressure to offer flexibility to their mortgage customers as they struggle to cope with continuously increasing monthly repayments.

For those within the financial services industry this is a key period for both offering existing customers flexibility and deals to stop them from switching provider, whilst at the same time seeking to engage those who are thinking about moving their mortgage to a new provider in an effort to keep payments down.

Latest GB TGI data reveals that today, 16% of adults in Britain (8.6 million people) claim to have a mortgage and over a million of these are paying £1000 or more per month on their mortgage.

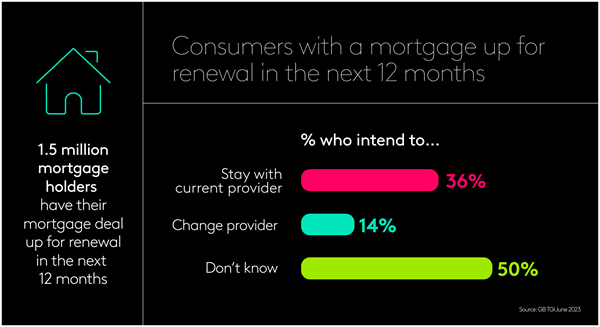

For 17% of mortgage holders (1.5 million people) their mortgage is up for renewal in the next 12 months. Of this group, only just over a third intend to stick with their current provider, whilst 14% are set on changing provider and the remaining 50% are not sure.

Those with a mortgage deal up for renewal soon represent a particularly key target for many marketers in the financial services space.

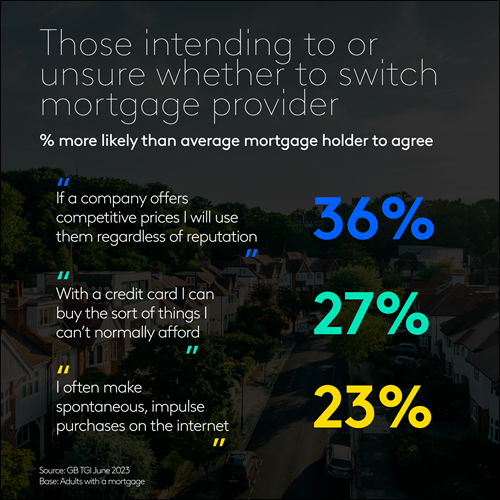

TGI shows that those who are either intending to switch mortgage provider or are not yet sure are particularly likely compared to the average mortgage holder to look for cheap prices over reputation, to have a relatively relaxed approach to use of credit and to spend in a spontaneous fashion.

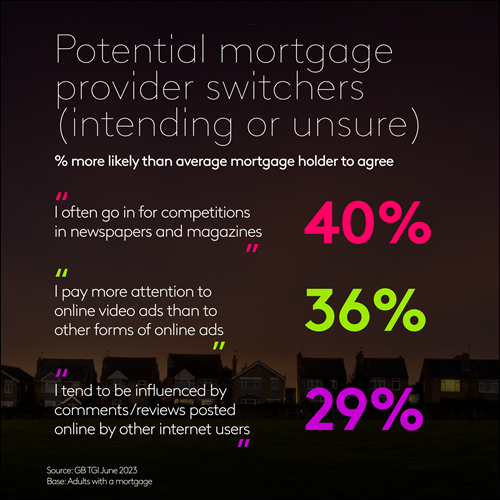

Those intending to switch mortgage provider or unsure about whether to do so are also considerably more likely than the average adult to engage with media in a number of ways.

These include engaging with competitions in newspapers and magazines, paying attention to online video ads and being influenced by what they read online from other people.