During the first lockdown, the average payment fell to a low of £657 per month – almost £250 below current levels.

The surge in mortgage costs has coincided with rising prices across the economy, putting pressure on household finances.

Martin Beck, chief economic adviser to the EY Item Club, said mortgage payments have risen more rapidly than earnings since the pandemic struck, hitting families’ spending power.

He said: “Even strong wage growth has not been sufficient to compensate for higher mortgages.

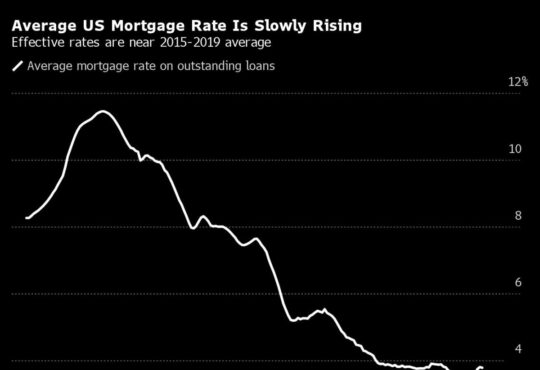

“Things are probably going to get worse as wage growth slows at the same time as mortgage payments continue to climb, reflecting the fact that 1.5m households are going to refinance this year at higher rates.”

The aim of the Bank of England’s interest rate increases is to crack down on inflation, which rampaged to a peak of 11.1pc in October 2022, far above the Monetary Policy Committee’s 2pc target.

The Bank achieves its aim by draining households’ spending power through higher interest rates, reducing demand in the economy until prices slow down.

Mortgage rates offered by lenders have fallen back in recent weeks as banks and building societies expect the Bank of England to start cutting rates this year.