William_Potter

How can buying MGIC (NYSE:MTG), a home mortgage insurance company, make sense when the country has clearly entered a housing recession? My argument starts with two basic facts:

1. MGIC has a specific housing risk, namely mortgage defaults. The business of MGIC and its peer home mortgage insurers is to insure Fannie Mae and Freddie Mac against the risk of default on low down payment (less than 20% of the home value) mortgages. If an insured loan defaults, MGIC has to pay Fannie or Freddie a cash claim. In turn, MGIC is paid an insurance premium by the borrower.

Does MGIC care if home construction declines? No. Or if home sales drop? Irrelevant to its business. MGIC’s risk is only a default, which requires some combination of:

- Bad lending standards

- An excess of housing

- A sharp rise in unemployment

- A sharp decline in home prices

2. Top-line growth is irrelevant for MGIC. MGIC’s stock price is only about 6 times expected reported and cash EPS. That’s a 16% yield. If you earned a 16% cash return with no growth again ever, would you take that deal? Me too.

So I’m not going to waste your time discussing falling home sales or MGIC’s revenue outlook. What I will do is help you think through these issues for the next few years:

- What are the odds of a large home price decline?

- What are the odds of a large rise in unemployment?

- How well is MGIC protected if the two risks above occur?

- Could MGIC’s accounting mislead you?

- Can MGIC take advantage of its low valuation?

What are the odds of a large home price decline? Pretty small, I believe.

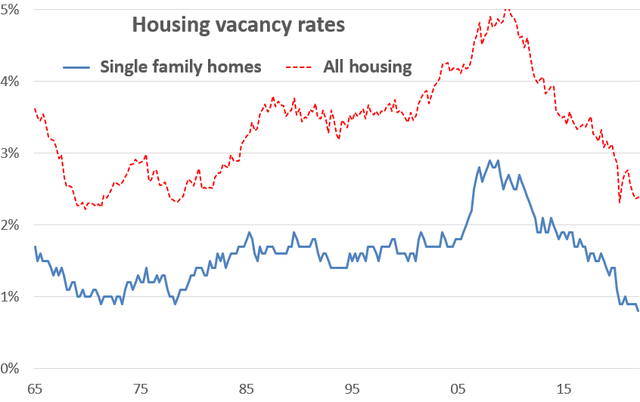

My confidence is based on two charts. The first shows the percent of U.S. homes that are vacant:

Source: Census Bureau

The U.S. today has the lowest vacancy rate in at least 6 decades. That is a serious housing shortage. With excess demand so high, any material decline in home prices will turn loads of wannabe buyers into actual buyers.

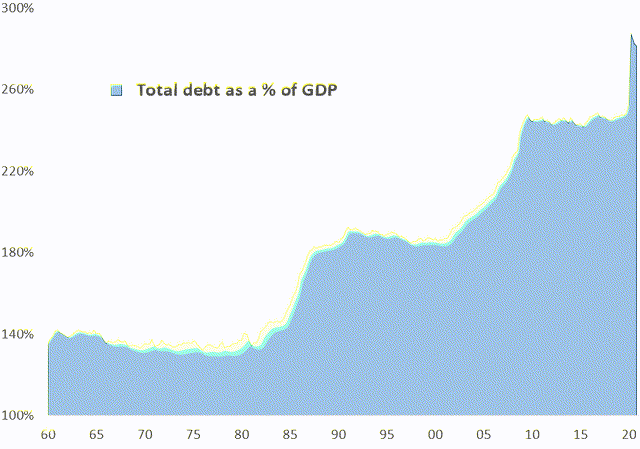

My second chart supporting home prices may seem odd – the amount of total debt (government, consumer and business) in the U.S. as a percent of GDP:

Federal Reserve and Bureau of Economic Analysis

Sources: Federal Reserve and Bureau of Economic Analysis

The importance of this chart is that it shows that the higher debt levels are relative to GDP, the greater the burden higher rates will have on the economy. For example, the U.S. currently has $68 trillion of total debt outstanding. A 1% interest rate increase requires $680 billion of extra debt service, or 3% of GDP. A 2% rate increase reduces GDP by 6%, etc. Which means that the Federal Reserve can’t keep interest rates high for very long without serious negative consequences. So I expect home mortgage interest rates to start to decline in the not-too-distant future, which will also support home prices.

If you aren’t buying this story, check out Japan’s debt-to-GDP and its interest rates over the past 3 decades.

What are the odds of a large rise in unemployment? Again, I believe pretty small.

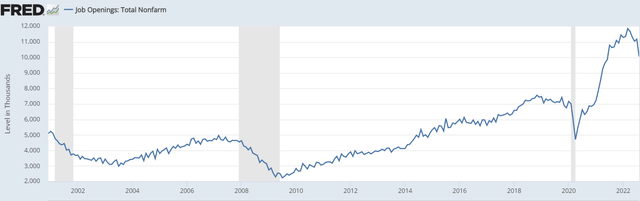

Keep in mind that MGIC doesn’t care about job growth; it only worries that the households it insures become unemployed and can’t make their mortgage payments. The current unemployment rate is at present a tiny 3.5%. I think the two upcoming charts support my view that a large increase in that low unemployment rate over the next few years is unlikely, even if a recession unfolds. The first chart is the “JOLT” report. “JOLT” stands for Job Openings and Labor Survey. Here is its history:

Source: Bureau of Labor Statistics

Even after a recent decline, the 10 million unfilled jobs at present is way above historical norms. This tells us that business demand for workers today greatly exceeds supply. This fact provides a cushion for workers; businesses can cancel a lot of unfilled jobs before they start firing.

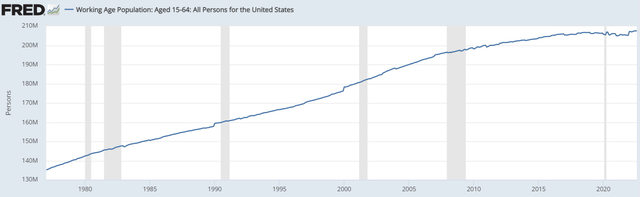

The second chart shows the size of the U.S. working population, defined as people aged 15-64:

Source: OECD

For reasons I won’t detail here, the U.S. working age population stopped growing nearly a decade ago. With the supply of labor not growing, businesses can’t afford to leave many willing workers unemployed.

How well is MGIC protected if the two risks above occur? Very well protected.

Even if I am wrong and home prices fall sharply and unemployment rises sharply, MGIC has never been better protected. Here is some data from MGIC’s Q2 ’22 Quarterly Supplement:

- 83% of MGIC’s insurance in force was originated in the last four years.

- That business has an average FICO score of 749, compared to the national average of 716. Only 5% of it had a FICO below 680.

- Only 2% of loans insured are second homes, and none are to investors who don’t occupy the home.

- The average loan insured was originated at the end of 2020. Since then, home prices increased by 30%. The great bulk of MGIC’s loans insured therefore have a substantial equity cushion.

- The great bulk of MGIC’s loans insured have fixed mortgage rates below 4%.

- If all else fails, over 95% of MGIC’s loans insured are reinsured, which transfers some of MGIC’s default losses to third parties. MGIC’s main regulator puts the value of MGIC’s reinsurance at the equivalent of over $2 billion in capital, so this is serious protection.

Could MGIC’s accounting mislead you? Yes, it could.

What is more boring than accounting? Not much. But understanding one accounting practice of MGIC and other financial companies will be very important if you are holding this stock over the next few years. The accounting issue of concern is recognizing default losses through the income statement.

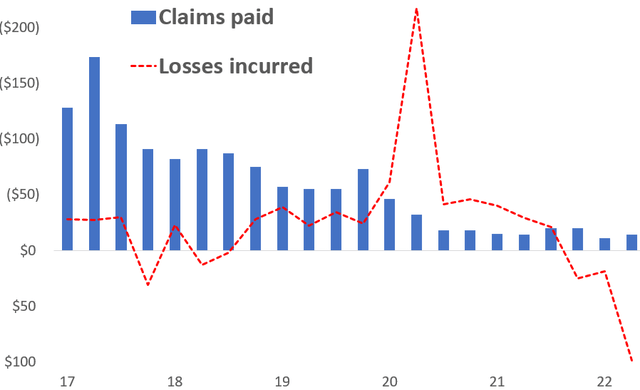

The cash payment to Fannie Mae or Freddie Mac made on a defaulted loan is called a “paid claim”. But you can’t see MGIC’s paid claims on its income statement. Rather, you will see “incurred losses, net”. Incurred losses are MGIC’s estimate of changes in its reserve for future paid claims. These numbers are usually very different, as this chart shows:

Source: MGIC financial reports

You can see that MGIC’s cash claims payments have been steadily declining from the trauma of the Great Recession (yes, it took more than a decade!). But losses incurred were all over the place, with a pattern. Despite ’17/’18 claims payments of $100+ million quarterly, MGIC barely expensed for them because it over-reserved for claims payments prior to ’17. COVID was similar. MGIC expensed through its income statement about $350 million during ’20, anticipating a big jump in claims. As it turned out, COVID created nearly no new cash claims.

Now that a recession is here or looming, I expect MGIC to set aside more in losses incurred, perhaps a lot more. But I will measure earnings by expensing claims paid, not losses incurred. So, over the next two years, MGIC’s reported EPS may fall below $2.00. But I am confident from all I said above that MGIC’s cash earnings will remain above $2.00 this year, next year and likely after that.

Can MGIC take advantage of its low valuation? Oh boy, can it.

MGIC’s stock price sits at $13 today, and only briefly exceeded $16 since COVID. Yet, its cash EPS (using paid claims, not losses incurred) consistently exceeded $2 a share since 2017. MGIC has been taking advantage of this low valuation by buying back its stock. Since ’17 MGIC has reduced its shares outstanding by 21%. I expect further significant declines.

At the end of Q2, MGIC’s regulatory capital requirement to back its $287 billion of insurance in force was $3.2 billion. Assuming a cushion of 35%, it needs to hold $4.3 billion of capital. It has $5.8 billion, or $1.5 billion of excess. At its current stock price, MGIC could buy back 110 million shares with that excess capital, or a remarkable 35% of its outstanding shares. 35%!

But it gets better. MGIC over the last four quarters earned $700 million in cash. Its $0.40 dividend will use about $125 million of that cash. Growth in its insurance both should be modest (the housing recession, remember?), so supporting that growth over the next year should use up no more than $150 million of capital. That leaves $425 million of free cash available for share repurchase, or another 10% of shares outstanding. Per year!

Summing up – this is a cheap stock despite the housing recession.

At $13 a share, MGIC is selling at only a 6 P/E ratio, or only 40% of the S&P 500 P/E. And at only 85% of book value. That in my view is far more than a reasonable discount for the impact of the current housing recession on its cash earnings.

And think about where this stock should be when the recession is past. Especially with the share repurchases, MGIC should be able to consistently earn $2.50 a share or more. Its book value should be approaching $20. A $25 stock price seems very reasonable. That’s a double.

I’m in big on MGIC and its peers. I suggest you take a nibble yourselves.