Markets Surprisingly Surprised by Unsurprising Powell Comments

2 Hours, 0 Min ago

We were pretty sure we knew what Powell would generally say in today’s press conference. He turned out to be generally predictable. After all, there are really only two things the Fed can think or say right now: A) still need to see more progress on inflation and B) data will determine when our job is done. Despite Powell’s unsurprising comments, the market was apparently surprised (or relieved?). This is surprising considering the simple list of routes in the Fed playbook. Perhaps it’s as simple as the market being overly prepared for a Hawkish smackdown from Powell and instead getting a logical approach.

-

- ADP Employment

- 106 vs 178 f’cast, 253 prev

- ADP Employment

-

- ISM Manufacturing

- 47.4 vs 48.0 f’cast, 48.4 prev

- ISM Prices

- Job openings and labor turnover survey (JOLTS)

- ISM Manufacturing

08:38 AM

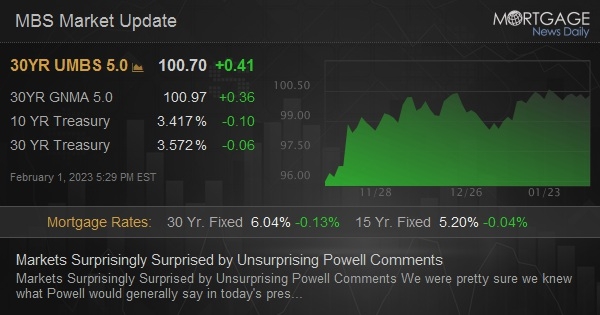

Flat in Asia. Slightly stronger in Europe. Additional gains after ADP Employment data. 10yr down 4bps at 3.472. MBS up nearly a quarter point.

10:24 AM

Weaker into and out of the 10am data. Still stronger on the day, but at weakest levels. MBS down 1 tick (0.03) in 5.0 coupons. 10yr down 1.3bps at 3.499

12:09 PM

Decent recovery now. MBS up at least an eighth in 5.0 coupons. 10yr down 3.5bps on the day at 3.479.

03:11 PM

Almost exclusively positive in response to the Powell press conference. 10yr down 11bps at 3.402 and MBS up half a point.

Download our mobile app to get alerts for MBS Commentary and streaming MBS and Treasury prices.