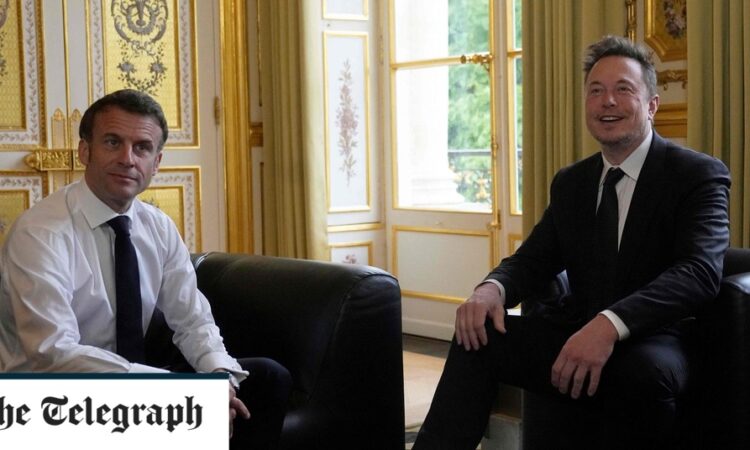

Billionaire Elon Musk is set to meet Emmanuel Macron in Paris today for the second time in just over a month, as France aims to curry favour and attract investment from the Tesla boss.

The French president confirmed during a visit to France’s biggest technology trade fair VivaTech earlier this week that he would meet the businessman to “tout the attractiveness of France and Europe”.

After talking to Mr Macron, Mr Musk will appear before an audience of thousands at VivaTech for what is billed as an hour-long “conversation” with the event’s French founder Maurice Levy.

5 things to start your day

1) Nationwide to increase mortgage rates for a third time | Lenders scramble to keep up with rising wholesale borrowing costs

2) Wall Street banker accidentally sent sex tape to colleague while working from home | Adam Dell paid several million dollars to the woman who received the recording

3) ECB raises interest rates to highest in 22 years | The European Central Bank raised interest rates to their highest level since 2001, triggering a jump in borrowing costs as president Christine Lagarde warned that stubborn inflation meant more increases were on the way

4) Imperialism is taboo in Britain – but it is making an extraordinary come-back in Europe | Captains of EU doctrine are challenging Leftist ideological tenets head on

5) Third Revolut investor slashes value of company after accounting problems | More trouble for fintech firm as it struggles to secure a banking licence

What happened overnight

Asian shares rose to a four-month high as US economic data stoked expectations that the Federal Reserve is near the end of its rate-hiking campaign.

However, the yen fell after the Bank of Japan maintained its ultra-easy monetary policy.

MSCI’s broadest index of Asia-Pacific shares outside Japan was 0.75pc higher and on course for 2.8pc gain in the week, its best weekly performance since January.

The Bank of Japan rounded up a central bank heavy week, keeping its pledge to “patiently” sustain massive stimulus to ensure Japan sustainably achieves its 2pc inflation target accompanied by wage increases.

As widely expected, the BOJ maintained its -0.1pc short-term interest rate target and a 0pc cap on the 10-year bond yield set under its yield curve control (YCC) policy.

China’s benchmark CSI 300 Index was 0.5pc higher while Hong Kong’s Hang Seng Index gained 0.8pc.

Wall Street stocks rallied Thursday, in a sign that the stock market sees the Federal Reserve’s campaign of raising interest rates as ending soon.

All three major indices jumped more than 1pc, a day after the Fed kept rates unchanged but signalled it expects further increases in 2023.

The Dow Jones Industrial Average rose 1.3pc to 34,408.06.

The broad-based S&P 500 climbed 1.2pc to 4,425.84, while the tech-rich Nasdaq Composite Index also advanced 1.2pc to 13,782.82.

The benchmark 10-year Treasury yield were down 8 basis points to 3.718pc, from 3.798pc late on Wednesday.

The two-year note was last was down 6.5 basis points to yield 4.6418pc.