Kirk Fisher

As the broader market anxiously awaits whether it will be a soft or hard landing following the rapid interest rate hikes, it increasingly appears that homebuilding will have a soft landing despite being one of the areas most directly affected by interest rates. Lennar (NYSE:LEN), despite its now higher market pricing, remains opportunistic. In particular, I like the class B shares (NYSE:LEN.B) due to their ~11% discount.

In this article we will detail why I believe it will be a soft landing and that perhaps minimum earnings are already in followed by a quick recovery.

The trough

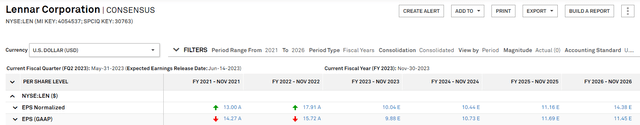

In 2022, Lennar earned $17.91 normalized earnings or $15.72 in GAAP earnings. That forms a 6.4X multiple on normalized earnings for the trailing year which is nominally cheap, but fairly normal for a cyclical peak. The market expects LEN’s earnings to drop substantially to about $10.04 in 2023.

S&P Global Market Intelligence

Consensus then expects earnings to mildly recover in 2024-2026. So, today’s market price represents an 11.35X multiple on expected trough earnings.

I agree with the 2023 number but believe LEN earnings will recover faster than expected for the following reasons

- Lumber pricing

- Long-term home shortage

- Dearth of sellers of existing homes

- Pent-up demand

Lumber Pricing

Lumber is a substantial input cost for homebuilders but lumber pricing has come down materially.

Tradingeconomics

Those who have been watching lumber futures for a while may recall seeing lumber in the $300s which is mysteriously not on this chart.

Well, that is due to a change in the methodology of futures as the futures used to be priced for a delivery to British Columbia and are now priced for delivery to Chicago. Since the methodology change, futures register about $100 to $150 higher per 1000 board feet but the actual cost to homebuilders is the same because the delta is transportation costs.

Not a whole lot of lumber is used in BC, but Chicago is a nice central hub for homebuilding in the U.S.

I believe this methodology change to timber futures is masking the extreme cheapness in lumber right now. $500 does not seem cheap according to historical recollection of the old futures, but it is very cheap on the new futures scale.

A European spruce beetle epidemic killing a large portion of Europe’s forests is the main reason for the low pricing. Trees can still be harvested and used for lumber if done in the next year or so. This is pulling forward European timber/lumber production and a significant portion is being exported to the U.S.

Timber REIT Potlatch (PCH) CEO Eric Cremers believes imports from Europe to be about 10% of U.S. consumption (per the 1Q23 conference call) which is highly unusual because the U.S. is usually the low cost producer.

It simply is the case that Europe has to harvest now or lose their inventory. As such, they are selling at discounted prices. The homebuilders are benefitting.

Long Term Home Shortage

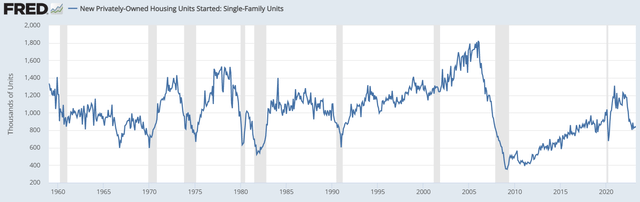

I believe this chart is well known among homebuilder investors, but it remains a crucial piece of the puzzle.

FRED

Homes were dramatically underbuilt following the financial crisis as building did not keep up with demand for a 15-year period. Even as housing starts returned to a normal level around 2020, it did not correct the shortage.

This undersupply necessitates that more homes need to be built, it is just that the catch-up building has been delayed by interest rates. The well-known impact here is that higher mortgage costs make home-ownership more expensive which has priced out a good number of would-be buyers.

Thus, as the Fed hiked, homebuilders sold off in the market and there was indeed a cyclical earnings trough which is happening presently.

I think less known is the other side of interest rates which is the stifling of sales of existing homes. High interest rates do not necessarily stifle sales, but the pace of change does. Most existing homeowners have mortgages at rates far below current rates. If someone who currently has a 3.5% mortgage moves, they lose their 3.5% mortgage and would have to get maybe a 7% mortgage on the new house.

That is a bad deal financially, so there is a tendency for anyone with a pre-existing mortgage to stay in place. The result is dramatically reduced sales inventory of existing homes.

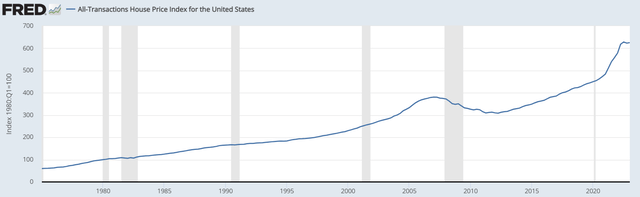

So, while the Fed intended to cool the home pricing market with their hikes, it has in this particular regard, backfired. The dearth of sales of existing homes is so severe that even with the higher mortgage cost related reduced buyer pool, there are still bidding wars and home prices have spiked reaching their highest ever levels.

FRED

Pent-up demand

As expensive mortgages priced out a significant portion of buyers, homebuilders pulled back on construction, but these buyers are not gone, just delayed. A priced-out buyer represents pent-up demand.

I believe this aspect of the equation is being overlooked:

- Reduced buying is temporary.

- Reduced home inventory is permanent until corrected.

The only way to correct the housing shortage is through building which bodes well for Lennar and its peers. Eventually, those priced out buyers will save up larger down payments and be able to afford homes.

Lennar’s positioning in this environment

Through the trough of this cycle, LEN has taken an interesting stance.

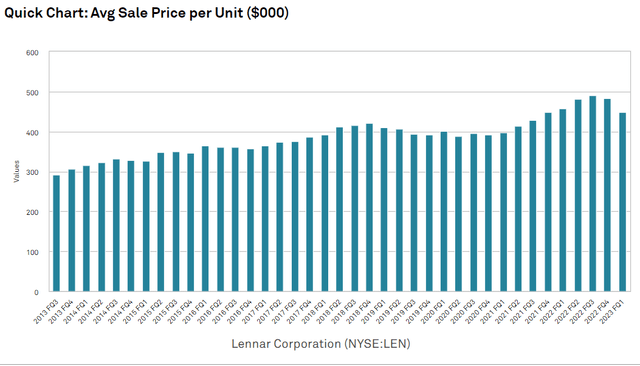

It announced it was going to cut margins and then did so through voluntary price cuts. As seen in the FRED chart above, home prices are at record highs, yet LEN materially reduced their prices in the last couple quarters.

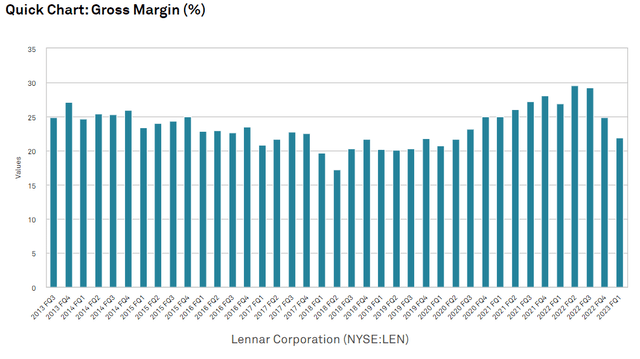

S&P Global Market Intelligence

The strategy took a bite out of margins, knocking gross margin down to just over 21%.

S&P Global Market Intelligence

However, I see 3 key benefits to the strategy.

- Increased market share

- Maintenance of supply chain channels

- Ability to reprice higher and restore margin as soon as the environment permits.

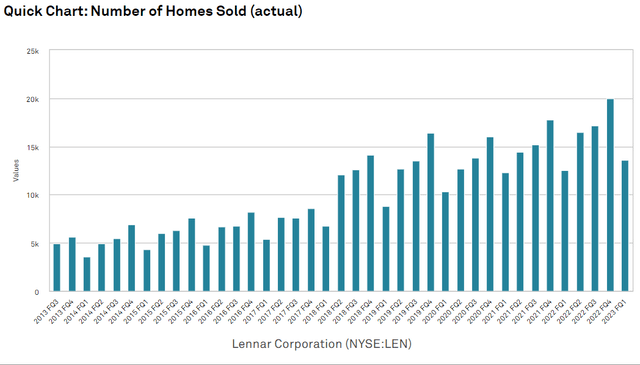

LEN’s number of homes sold hit record levels in 1Q23. That is a rare statistic amidst a cyclical downturn. First quarter is typically the lightest seasonally, but note that 1Q23 home sales came in higher than any previous 1Q.

S&P Global Market Intelligence

While cutting margins this significantly hurts in the short term, LEN has the balance sheet and liquidity to pull off such a move. If they instead kept prices high and took the hit to volume it causes other problems. Supply chains get shut down which makes it difficult or expensive to ramp back up.

By maintaining its volume LEN maintains its position at the top of the food chain with regard to their supply channels. Operations remain smooth and prices, unlike volume, can be ramped back up instantly. Thus, when the mortgage environment gets a bit friendlier, LEN can instantly raise prices and return to full earnings power.

Valuation

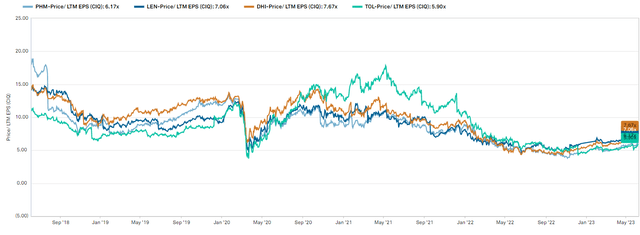

Multiples within homebuilders have consolidated.

S&P Global Market Intelligence

Given the shortage in housing inventory and the tremendous demand for homes over the next 10 years, I think the whole industry can perform well.

LEN and D.R. Horton (DHI) are trading at a slight premium to peers which I believe is warranted due to track record and larger size. Given this premium I am largely indifferent between the main homebuilders as I think the whole sector will outperform the broader market by a similar magnitude.

Advantaged position with LEN.B

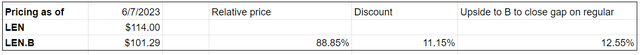

That said, there is still an advantaged play in the form of an arbitrage between LEN and LEN.B.

Portfolio Income Solutions Arbitrage Tracker

Despite having equal claim to assets and cashflows as well as enhanced voting power, Lennar’s class B shares trade 11.15% cheaper than the class A.

Over time, this gap should close, which suggests that LEN.B has an additional 12.55% upside as compared to LEN.

Risks to ownership

While I believe interest rate risks are overemphasized by the market, there are a few other risks which are worth watching.

- Lumber prices will not remain low forever. Europe will run out of beetle impacted inventory which will cut off imports from Europe and take pricing back up. Additionally, mills in British Columbia are expected to start to shut down as it is a high cost of production region and many are presently operating at a loss. The homebuilders will get to enjoy maybe a year or 2 of really cheap lumber input costs, but the margin gains are fleeting.

- Recession can significantly reduce demand. It remains unknown as to whether the U.S. will have a recession with economists quite split on the forecast. While recession does not permanently reduce demand for homes, it can certainly delay it.

- Speculative risk from 3D printing. Although Lennar is one of the pioneers of 3D printed homes, the technology has the potential to dramatically reduce the cost of homebuilding which eventually reduces the prices they can charge. At this point in time, 3D printing is an irrelevant fraction of the market, but if it becomes a more accepted form of homes it could solve the housing shortage with less overall revenue. Such an event could be a good thing for families affected by the affordable housing crisis, but it would be a new competing supply in the form of substitution.