City traders have placed their biggest bets on recession since February, when there were widespread forecasts of a major downturn from the Bank of England and the International Monetary Fund.

The Chancellor attempted to reassure markets that inflation was being brought under control on Friday.

Asked by Sky News if he was comfortable with the Bank acting to bring down inflation even if it could precipitate a recession, Mr Hunt said: “Yes, because in the end inflation is a source of instability.

“If we want to have prosperity, to grow the economy, to reduce the risk of recession, we have to support the Bank of England in the difficult decisions that they take.”

He added: “I have to do something else, which is to make sure the decisions that I take as Chancellor, very difficult decisions to balance the books so that the markets, the world, can see that Britain is a country that pays its way – all these things mean that monetary policy at the Bank of England (and) fiscal policy by the Chancellor are aligned.”

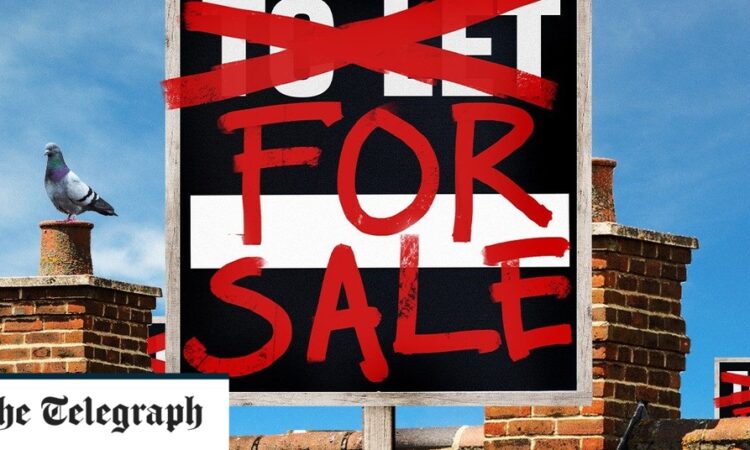

Capital Economics said landlords are being forced to sell their properties because of a government decision to slash tax relief on mortgage interest repayments, pushing up their costs.

It warned that increased mortgage rates will lead to the loss of hundreds of thousands of rental properties from the market by 2027, compared with 2021 figures.

The analysis is based on predictions that the Bank Rate will peak at 5pc and remain above 2.5pc until the end of 2027. Markets now expect interest rates to peak at 5.5pc, meaning the damage to landlords would likely be even worse.

Capital Economics said reversing the tax change would ease the financial burden on landlords and prevent the sell-off of 110,000 properties.

Downing Street has for much of this year tried to downplay expectations that major tax cuts are imminent, repeatedly pointing instead to the Government’s promise to halve inflation this year.