By James Tapsfield, Political Editor For Mailonline

09:08 26 Jun 2023, updated 12:29 26 Jun 2023

Brits are paying thousands of pounds more for new mortgages than Europeans as interest rates soar, it was claimed today.

Analysis by Labour suggests that the typical household in the UK faced £2,000 a year more in costs than they would in France, even before the latest interest rate hike last week.

For a £200,000 loan paid back over 25 years, annual UK mortgage payments are around £1,100 annually higher than in Belgium and Ireland, and about £800 more than in Germany and the Netherlands.

The Tories insisted the UK was ‘not alone’ in facing higher interest rates, and stressed that combating inflation is the only way to address the problems.

Mortgages are set to be a major battleground for the general election next year, with Conservatives alarmed at polls suggesting the impact is already hitting their support.

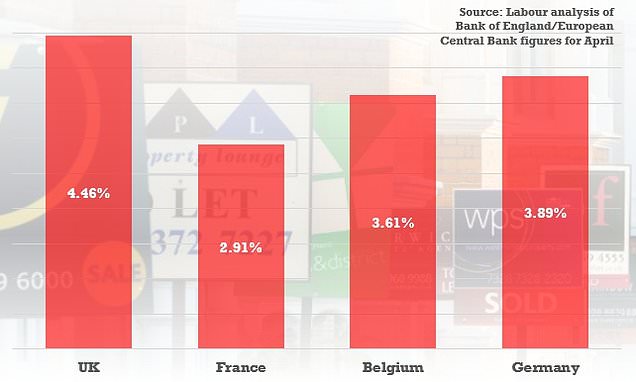

The Labour analysis was based on Bank of England data which shows that effective interest rates on new mortgages in April were on average 4.46 per cent.

European Central Bank figures show that equivalent interest rates were on average 2.91 per cent in France, 3.61 per cent in Belgium, and 3.89 per cent in Germany.

Last week Chancellor Jeremy Hunt agreed measures with banks aimed at cooling the crisis, including allowing people to switch to interest-only term for six months and a minimum year grace period before repossessions.

Shadow chief secretary to the Treasury Pat McFadden said: ‘These figures lay bare the cost of the Tory mortgage penalty.

‘Yet again the Tory Government’s refusal to step up and offer proper support is forcing families into a far worse financial situation than in neighbouring countries.

‘The Government’s failure to make the measures announced on Friday mandatory means around 2 million households could miss out on the mortgage support they need.’

Ministers are scrambling to find ways of easing the pressure on households, as interest rates soar to control inflation. Rishi Sunak used an interview yesterday to beg the public to ‘hold our nerve’.

Interviewed on the BBC‘s Sunday With Laura Kuenssberg, the PM urged homeowners being crippled by soaring interest rates to recognise that inflation is ‘the enemy’.

He said he was taking the difficult decisions to ease surging prices and get the economy back on track – and ‘totally supported’ drastic action by the Bank of England.

Mr Sunak also delivered a stark warning to unions that he would not sign off big pay rises for the public sector this year.

A Conservative Party spokeswoman said: ‘High inflation is the cause of mortgage hikes – and that’s why it’s the Government’s number one priority to halve it. And with central banks increasing interest rates around the world, the UK is not alone in the fight against inflation.

‘We have acted quickly to support mortgage holders, protecting vulnerable families from repossession, protecting homeowner’s credit scores when they seek support and ensuring lenders are supporting their customers individually – Labour should try to keep up.’

A Tory former minister said his should be the party of homeownership which he said has ‘tragically’ narrowed under Conservative governments.

Lord Willetts, president of the Resolution Foundation think tank, told BBC Radio 4’s Westminster Hour: ‘There is a group of several million people who could be seeing their mortgage costs rise by about £3,000 in a year and that is a lot for a middle-income household to bear. So it is going to be tough for them.

‘And there is a wider point here. Conservatives believe in the property-owning democracy. We’ve seen tragically a narrowing of homeownership over the last decades.

‘That in turn means that if you’re trying to use interest rates, mortgage rates to drive disinflation, you’ve got a smaller group to operate on and they feel more intense pain.’