Welcome to Thursday’s Early Edition from i.

“The British consumer and mortgage holder is about to get stuffed,” Torsten Bell, Chief Executive of the Resolution Foundation told BBC’s Newsnight, ahead of today’s expected interest rate rise. “About half the pain has come through and half the pain is still to come,” he said, predicting another two years of economic woes for mortgage holders, especially those on lower incomes. Many homeowners, and also tenants fearful of further steep hikes, will be watching the Bank of England’s rate decision today in despair. Those who looked to the government for help would also likely have been sorely disappointed by the PM’s appearance yesterday on LBC, in which he gave a tone deaf and “out of touch” response to a caller worried about his mortgage. Rishi Sunak’s response to Jack from Guildford, who is facing a whopping £1,300 a month mortgage hike, was to inform him that the average increase was just £200. It’s still not clear what poor Jack was supposed to do with this particular piece of information. So what options do homeowners facing ungodly repayments have? We’ll take a look at some of them, and what steps a number have already taken to try and save money, after the news.

Today’s news, and why it matters

Conservative MPs are increasingly concerned that interest rates and inflation could still be high at the next general election, and that the Government can do very little to “sweeten the pill” for the public before then. The Bank of England is widely expected to raise interest rates again today, which could mean further increased mortgage costs for millions of homeowners.

Rishi Sunak has been accused of allowing the UK to tip towards a recession after the Government ruled out easing the Bank of England’s “arbitrary” 2 per cent inflation target. Jeremy Hunt is not considering changing the Government’s mandate for the central bank which requires it to aim for 2 per cent inflation, i understands.

Artificial intelligence has been officially classed as a security threat to the UK for the first time, alongside flooding, pandemics, terrorism and nuclear war. The new version of the national risk register describes AI as a “chronic risk”, meaning it poses a threat over the long-term, rather than an acute one such as a terror attack.

The Government diverted £136m away from its electric vehicle supply chain fund to the UK’s main nuclear reactor project Sizewell C, i can reveal. The Automotive Transformation Fund, an initiative designed to make it easier for car manufacturers to build and develop electric vehicles in the UK, spent just 5 per cent of its initially allocated funding in the year to March 2023, according to documents seen by i.

The first group of British nationals have left Niger on a French flight. A Foreign Office spokesperson confirmed the group had made it onto the flight on Wednesday evening, adding: “We have a team in Paris ready to support them on landing. The UK’s Ambassador and a core team remain in Niger to support the very small number of British nationals who are still there.”

Four things mortgage holders can consider as interest rates rise again:

Take Rishi Sunak’s advice with a grain of salt (and don’t holdout hope for help in the Autumn Statement): Not only did Sunak give poor Jack from Guildford some irrelevant, and possibly not entirely correct information on averages, but he also said that struggling mortgage owners could extend the life of their product to save now on monthly repayments. While this is true, and might save in the short term, experts warn it will add on tens of thousands of pounds of debt in the long run. It’s the option being taken by many, construction company Taylor Wimpey said yesterday, with data showing 27 per cent of first time buyers are opting for mortgage terms of over 36 years, compared to 7 per cent in 2021. Second time buyers are also increasingly taking out mortgages with durations of more than 30 years, with 42 per cent choosing this, compared to 28 per cent in 2021. The PM’s other piece of advice, switching to an interest-free mortgage, was described by one expert as nothing but a “sticking plaster” that will come back to bite down the road. “All you’re doing then for those months, you’re just paying off the interest. So the principal then for those six months is piling on to the mortgage,” Riz Malik, director of R3 Mortgages, told i. Read the full fact check on Sunak’s comments here. On top of that, it appears unlikely that the government will offer any kind of mortgage relief in the upcoming Autumn Statement.

Read up on the new mortgage charter: The Treasury did, in June, introduce a “mortgage charter” which set out standards that lenders are asked to follow when helping their customers. Under it, banks signed up will offer borrowers increased flexibility to manage their mortgage payments over a short period. It also means lenders can allow customers to switch their home loans to interest-only for six months to reduce their payments – before switching back to their original deal – without taking a new affordability check or affecting their credit score. But as experts have said, this comes with its own risks. The charter also says lenders “will offer tailored support for anyone struggling and deploy highly trained staff to help customers. This could mean extending their term to reduce their payments, offering a switch to interest only payments, but also a range of other options like a temporary payment deferral or part interest-part repayment.” You can read the full document here.

Take out a very different kind of mortgage: Instead of looking at interest-only mortgages, one lender told i he has taken an unusual and potentially risky approach by taking out a tracker mortgage. “Things could go completely against us, but the way things are at the moment I don’t think we’re in a position where the interest rate will go up by a whole percentage point,” Roopesh Darbar said. He says his 5.5 per cent tracker was cheaper than the other 6.2 per cent fixed products offered, meaning his payments are around £3,000 per year lower. Simon Gammon, at Knight Frank Finance mortgage brokers said opting for a tracker was becoming more common. “Many more borrowers are now opting for trackers, betting that rates will keep easing and they will have the opportunity to fix at more attractive rates in a few months,” he said. Read the full story here.

Do something entirely different, and take in a lodger: The latest Government figures show that as of last year, there were 131,000 households with lodgers – 1 per cent of all properties. Those who do so can get a maximum of £144.23 per week tax-free. One told i: “I would say it took three months for us to properly know each other, learning how to live alongside each other, but now we live harmoniously.” It certainly won’t be for everyone, but this is the solution i’s Jessie Hewitson took when working out how to cling onto her family home. Here, she explains how the Rent a Room scheme works and what you need to do to qualify.

Around the world

Donald Trump is due to appear in court today facing criminal charges over efforts to overturn the 2020 US presidential election. The former US president is expected at a courthouse in Washington DC, not far from the scene of the 2001 Capitol riots, at around 4pm local time, 9pm BST. Writing in capital letters on his TruthSocial platform on the eve of his appearance, Mr Trump said he had “never had so much support on anything before”.

Canadian Prime Minister Justin Trudeau and his wife Sophie Gregoire Trudeau are separating after 18 years of marriage. They made the decision after “many meaningful and difficult conversations”, they wrote on Instagram, adding: “As always, we remain a close family with deep love and respect for each other and for everything we have built and will continue to build.”

A vegan social media influencer who said she existed only on fruit and vegetable juices has died of a reported cholera-like infection and starvation. Zhanna Samsonova, who was originally from Russia and posted under the name Zhanna D’Art, had tens of thousands of followers on TikTok and Instagram where she detailed the supposed benefits of a raw vegan diet.

Deforestation in the Brazilian Amazon fell by at least 60% compared in July compared to the same month last year, the country’s environment minister has told the Guardian. The exact figure is due to be released shortly, but independent analysts described the preliminary data as “incredible”.

An ancient whale whose fossilised bones were dug up in the Peruvian desert could be a new contender for the heaviest animal to live on Earth. Scientists believe the Perucetus colossus could have weighed up to 200 tonnes.

Watch out for…

banks – who are under pressure to pass on better savings rates to customers as interest rates go up, and protesters, who are planning to rally outside the Bank of England today demanding a windfall tax on bank profits.

Thoughts for the day

Shocked by Donald Trump’s indictment? Look more closely at what’s happening in the UK. Things might not appear as stark in Britain, but the same process is taking place, argues Ian Dunt.

My husband and I live apart and it’s been great for our marriage. To honour my midlife values in my day-to-day married life we negotiated living apart together, reveals Dr Julie Hannan.

If these Lizzo allegations are true, they are heart-breaking for fat black girls like me. I know what it means to have people take cheap shots at your body when they want to silence or humiliate you, writes Kuba Shand-Baptiste.

Culture Break

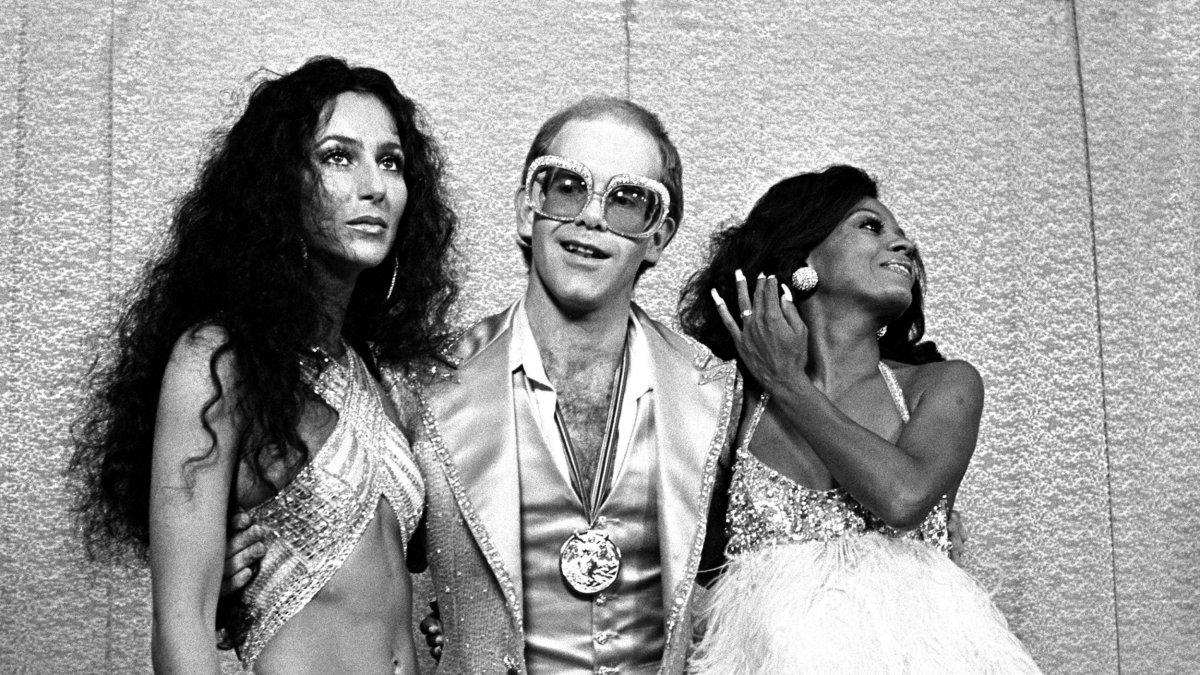

The V&A’s glorious reclamation of the diva, from Zsa Zsa Gabor to Beyoncé. The diva has been gloriously reclaimed in the past few decades – a new exhibition at the V&A celebrates her in all her complicated glory, writes Christina Newland.

The Big Read

What science says about supermoons and human behaviour. Some scientific questions, like on the effects of the supermoon, come and go, never quite being fully ruled out, writes Stuart Ritchie.

Sport

Ipswich Town’s big gamble has paid off – and now they’re targeting the Premier League. Ipswich manager Kieran McKenna has repaid the owners’ faith in him by bringing the good times back to Portman Road.

Something to brighten your day

‘My son decommissioned an aircraft toilet’: The case for leaving children at home when you go on holiday. Going away as a family is meant to be one of the high points of the year, but, as some parents will admit, it can feel like bloody hard work. Rebecca Armstrong talks to those who have abandoned the idea and those who embrace it.