Mortgages will remain high in the future but that could help first-time buyers, Paul Johnson, director of the Institute for Fiscal Studies (IFS), has said.

Interest rates are likely to fall this year but will remain much higher than they have for most of the last 16 years and this is likely to keep house prices in check, he said as he answered i readers’ questions about what the upcoming election means for them.

He also suggested that raising council tax for people living in the most expensive properties could be an effective way to raise money to fund public services.

The expert economist for the IFS, one of the UK’s leading independent economics research institute, has been vocal throughout the election campaign, interrogating what the major parties’ manifestos really mean for voters.

He has already questioned Labour’s “dizzying” manifesto spending plans, criticised the Conservatives’ “uncertain and unspecific” financial pledges and accused the Liberal Democrats of failing to tackle big challenges.

But with the election just a matter of days away, many still have questions about what party policies actually mean for them and their finances.

To help the electorate decipher what the different parties really plan do with your money, Paul answers i readers’ questions here about the election – from what will happen to interest rates to whether the next government can realistically avoid more economic hardship.

Do any of the parties have a sensible offer for the future funding of social care? Paul Wheeler

The straightforward answer is no. Nobody has got anything to say about putting more money into the social care system. Actually, one of the problems that we face more broadly in local government is that the demands of the social care system have really risen over time, not just for older people, but for adults of working age as well.

Many people need social care and it’s taking up more and more of local authorities’ budgets. It’s one reason why some authorities have gone bust. I’ve not seen any party say there’s more money available.

Then there’s the second issue, which is about whether people who have assets or income should pay for it at all. The proposition from the current government a while ago was that if you have spent up to £86,000 on personal care over your lifetime, the state would pick up the rest of the costs.

My understanding is that the two main parties are still committed to achieving that. However, this was supposed to happen a couple of years ago and it still hasn’t.

What would be the best way to alter or replace council tax to make it fairer but to raise more money for local government? Helene Grygar

Council tax is definitely one tax that needs changing. We’re in the absurd situation where the amount of tax you pay is based on what your house or flat was worth in 1991.

The government should revalue homes. However, the problem is that this is very favorable to people in London and the south and very unfavourable for people in the north and the Midlands as property values are a lot higher in the south.

The other issue is that the current system is essentially regressive, so the more valuable your house, the lower the fraction of the value you pay in council tax. Put all that together and you’ll find that Buckingham Palace has less council tax on it than many three bed properties in Blackpool.

If you wanted to raise more money for local government, I think you would essentially increase the amount that you’re asking people in more expensive properties to pay.

Labour suggests it will fund its pledges through economic growth and chasing down tax dodgers, both of which seem vague at best. If their plans fail if they come to power, would this mean a massive addition to our huge national debt pile? Michael McErlean

I don’t really know what a Labour government would do if growth doesn’t rise. The issue is that, unless we get considerably more growth than we’re currently expecting with taxes at their current level, there is basically going to be no more money for most public services.

At worst, it means further cuts to some public services. But in one way, I’m a little optimistic. I think growth might turn out a bit better than we currently expect.

Labour also talks a lot about planning reform, to boost housebuilding. I think that could make a real difference to growth.

However, the amount of money you can get from clamping down on tax avoidance is fairly small and uncertain. Ultimately, my answer is – and I think this is my beef with all the manifestos released – we don’t know whether this will add to our national debt pile.

What have the parties promised?

All of the major parties have released manifestos outlining the policies they would deliver if they were to win the election. Below are some of the key promises.

Is the cost of Brexit standing at £150bn? Assuming we had stayed in the EU would this cost be avoided and clear the UK’s public sector financial black hole? Tim White

We have to think about what would have happened to the economy in a world in which we didn’t leave the European Union. There have clearly been costs to leaving but the question is whether some of those costs are actually just created by the political chaos that we have had, particularly in the years following the Brexit vote.

I think that even if we stayed in the EU, the difference might have been less than people expect.

That said, we’ve clearly made trade with our biggest, nearest and richest trading partner more expensive. The trade intensity of the UK economy has dropped in a way that it hasn’t in other economies and that is bad.

You can also see that investment in England has dropped. The number of firms trading in the EU has dropped precipitously, although the big firms that do most of the trade are still trading.

How much effect has this had on the size of the economy? Well, the Office for Budget Responsibility (OBR) thinks that in the long run our economy might be about 4 per cent smaller as a result of Brexit, which is roughly £125bn. Whether we’ve lost that amount already is uncertain.

Clearly in a more stable world and a world without Brexit, we would be somewhat better off and we would therefore have more money to spend on public services and things.

So yes, we would be somewhat better off had Brexit never occurred. I don’t know how much by but that it would mean we had more money for public services. However, we’ve had poor growth for a long period, as have many other countries.

What will happen to interest rates? How long will it take for the property market to rally and sale prices to improve after the election, if at all? BM Shaughnessy

I think we could expect interest rates, which currently sit at 5.25 per cent, to start falling after the election, but I’d be very surprised if they fall anywhere near back to where they were in the 2010s.

This means mortgage rates won’t go down to where they were over the last period, when rates were as low as 1 per cent, which probably means that house prices are not going to grow much at all. There’s still a lot of adjustment to come in the property market as people get used to higher interest rates. Mortgages are going to be more expensive than they were.

But I think there’s some real upside to this. In my view, more than a decade of zero interest rates was actually very damaging to the British economy and certainly to the distribution of assets between older and younger generations.

In a strange kind of way, higher interest rates might help younger people get on the housing ladder as the barrier for many over the last few years was being able to scrape together a deposit.

If house prices don’t go up or even come down, that makes it a bit easier to scrape that deposit together.

I’d be surprised if we get any kind of big take-off in prices given where we are with interest rates. It’s also worth saying if Labour are successful in building many more houses, then over the long run you might see that house prices stop rising in the way that they have.

Given the recent answers from Labour concerning taxation, placing a reliance on growth, how realistic is the achievement of its objectives in a period of 5 years? Brian Blackshaw

Labour’s manifesto is interesting in the sense that it hasn’t got very much at all in terms of specific spending commitments.

There’s no money committed, for example, to reducing child poverty but there is a clear ambition to reduce child poverty. The manifesto has lots of strategies and reviews, for example, to get rid of waiting lists but that’s a really hard thing to achieve unless you’re going to spend a lot of additional money.

Broadly speaking, they have been reasonably careful not to be precise about exactly what they want to achieve.

You get the sense that they want to deal with big issues but haven’t given very precise numerical targets. They haven’t allocated any cash to achieving those things.

Is there any way the incoming government can avoid a period of economic hardship – whether via spending cuts or tax rises – in its first Budget? And what about over a whole five-year term? Hugo Gye, i’s Political Editor

All of this depends on what the OBR says about growth. Currently they’re very optimistic. That’s not good news, in a way, for the new government, because all of the forecasts at the moment are made off the basis of these forecasts. If the OBR changed its mind and said it now thinks things will look worse for growth, then you’ve really got some difficult choices.

This is what is going to be interesting about the first Budget, which we’re expecting in the autumn of this year. I think there are multiple possible scenarios. One is where growth is much stronger than we think at the moment.

In that world, everything’s not easy. You won’t need to be cutting spending and you don’t need to be doing much to raise taxes but it’s going to be quite tight. Just about avoiding cuts is probably not quite where a new government’s going to want to be, particularly given all the pressures on spending.

Another scenario is if growth forecasts go down. You are either absolutely going to have to raise taxes, cut spending or say that your fiscal rules no longer bind. The pressure has been very, very clear.

Rachel Reeves wants to see fiscal austerity and if she’s serious about that, then there will be no avoiding tax rises or spending cuts. Let’s hope that doesn’t happen, but whatever does happen, there is going to be some quite difficult decisions.

The triple lock plus policy that has been put forward by the Tories has been encouraged by some and criticised by others. Is it possible to put it into practice? Grace Gausden, i‘s Money Editor

The triple lock on the state pension is quite expensive, however, how pricey it is depends on what you’re comparing it to. For example, prices and earnings have risen more quickly than the triple lock since 2010.

It’s also worth saying that if you look at what’s happened to taxes over the last 15 years for a pensioner, on, say, £35,000 a year, taxes have gone up while for someone of working age on the same amount, taxes have gone down quite a lot.

Tax policy has favoured people on average earnings more than pensioners partly because this government got rid of what was a much higher tax allowance for pensioners which existed through to the mid 2010s. The policy they’re now suggesting is partly a reversal of this policy.

Is the policy affordable? Yes. It wouldn’t cost the government an enormous amount to increase the tax allowance of pensioners. The reason they want to do it is that if they don’t, then the basic state pension or the new state pension starts to be slightly higher than the tax allowance, which might drag a lot more pensioners into paying tax.

Verdict

Grace Gausden, i‘s Money and Business Editor, says: Paul Johnson and the IFS have been among the most prominent voices throughout the election campaign.

The economic think-tank has painstakingly scrutinised each party’s manifesto, releasing detailed analysis of the suggested policies and questioning how realistic the often ambitious plans actually are.

It is one of the only institutions with enough freedom to describe the state of the economy as it stands and the impact upcoming changes will truly have on households up and down the country.

The IFS has already said the UK has the highest debt level for more than 60 years, taxes are near a record high while spending has soared at the same time that public services are “visibly struggling”.

Paul went so far as to say the major parties are part of a “conspiracy of silence”, adding they are not facing up to the difficult economic years ahead we can expect.

He criticised the manifestos for shying away from the problems the next government could face in the next five years, with a stark choice between raising taxes further beyond what any major party has promised or cutting spending and increasing borrowing.

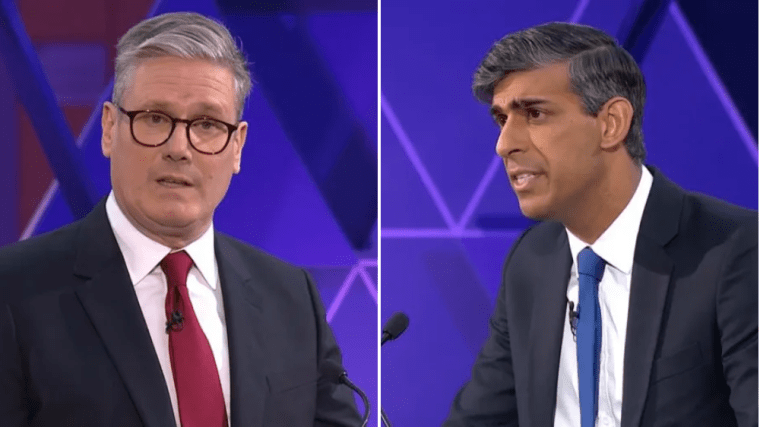

While both Rishi Sunak and Keir Starmer have countered the IFS’s assessment, arguing their plans are “clear”, the country’s leading economists are providing vital analysis on how much public money there really is to spend, whoever wins.