Green mortgages are used to finance climate-friendly house improvements. In the U.S. they already exist, but need to be made far more accessible and marketed widely. Greg Hopkins at RMI cites their report “Build Back Better Homes: How to Unlock America’s Single-Family Green Mortgage Market” to explain that the financial markets are looking increasingly favourably at lending that is certified as ESG (environmental, social, and governance). Combined with historically low interest rates, the opportunity to use green mortgages to fund and accelerate the uptake of household insulation, heat pumps, smart thermostats, residential solar etc., should be taken now. The full report lays out what needs to be done to streamline the green mortgage origination process to reduce friction for lenders, appraisers and homeowners, explains Hopkins. Success would create a whole new multi-trillion green bond market. It would cut emissions, deliver net savings to households, and create hundreds of thousands of home improvement jobs. That’s a very good alignment with the Biden administration’s economic and climate goals.

Green mortgages are used to finance climate-friendly house improvements. In the U.S. they already exist, but need to be made far more accessible and marketed widely. Greg Hopkins at RMI cites their report “Build Back Better Homes: How to Unlock America’s Single-Family Green Mortgage Market” to explain that the financial markets are looking increasingly favourably at lending that is certified as ESG (environmental, social, and governance). Combined with historically low interest rates, the opportunity to use green mortgages to fund and accelerate the uptake of household insulation, heat pumps, smart thermostats, residential solar etc., should be taken now. The full report lays out what needs to be done to streamline the green mortgage origination process to reduce friction for lenders, appraisers and homeowners, explains Hopkins. Success would create a whole new multi-trillion green bond market. It would cut emissions, deliver net savings to households, and create hundreds of thousands of home improvement jobs. That’s a very good alignment with the Biden administration’s economic and climate goals.

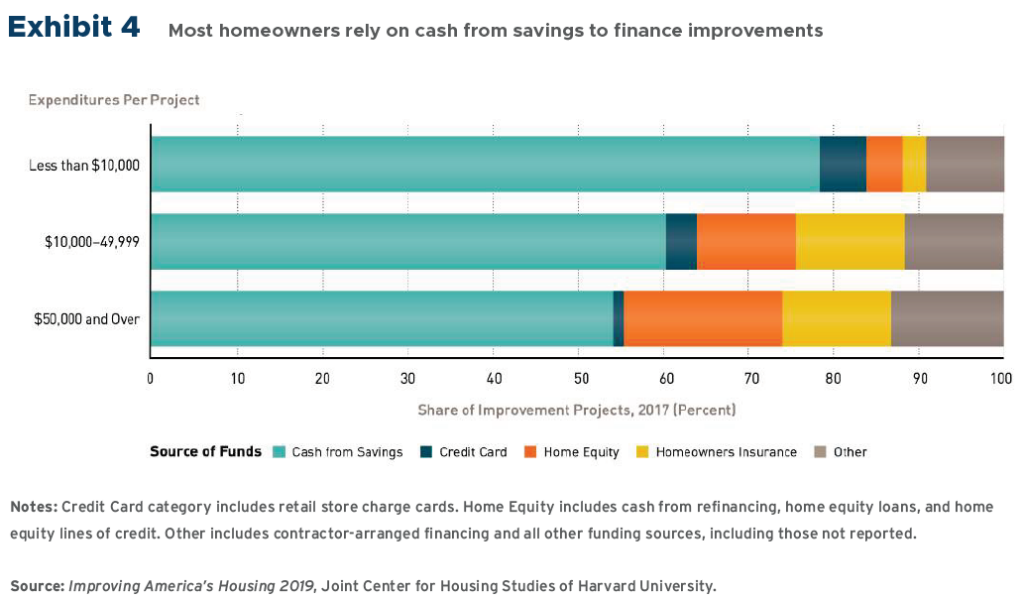

What if you could finance green home improvements—such as efficient new windows, a heat pump, added insulation, solar PV, even resilience upgrades—as part of your mortgage when buying or refinancing your home? Not only would this offer conveniently timed capital from a trusted source (your lender), but at current interest rates, that capital would come at perhaps the lowest cost available for these types of projects. What if every home could do this?

As a matter of fact, single-family green mortgage products like this already exist. If you’ve never heard of them, though, you’re not alone…

Lenders are interested in Green Mortgages…

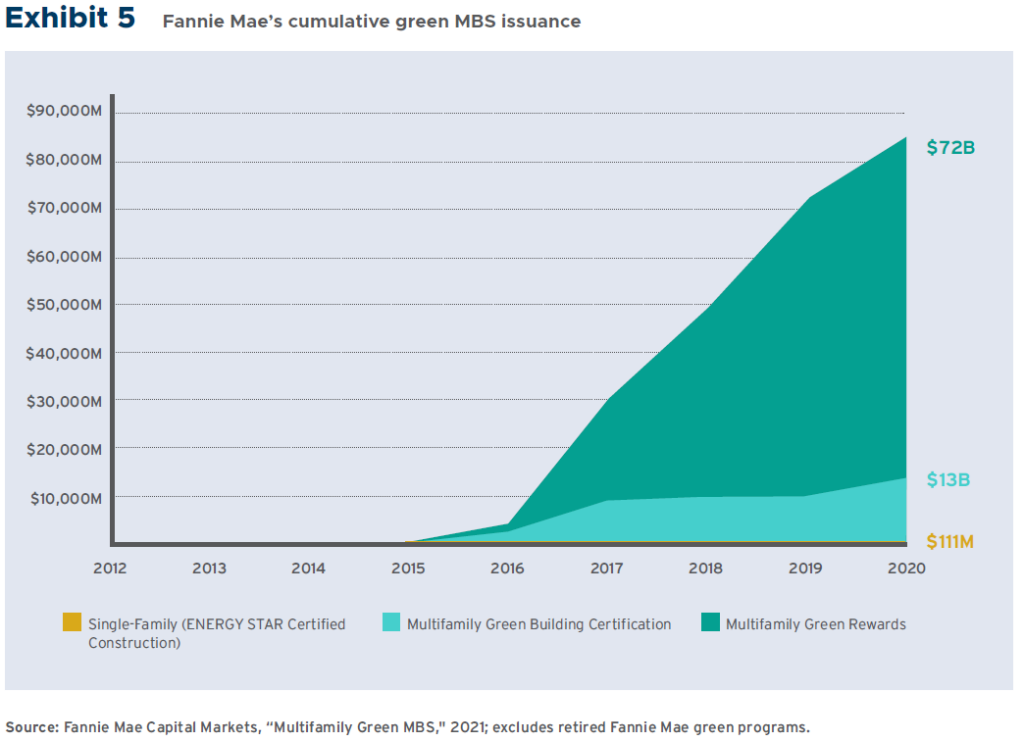

Financial markets are sitting on a huge untapped opportunity. Demand from investors for environmental, social, and governance (ESG) investment options and green securities continues to outpace supply. Additionally, more financial institutions—including some of America’s top mortgage lenders—set out to climate-align their lending and investment activities with 1.5°C targets. Scaling up green mortgages can help on both fronts while also improving and decarbonising the US housing stock, which produces one-fifth of our national emissions.

…but they need better marketing and accessibility

America is knocking on the door for more affordable, healthy, resilient, and low-carbon housing —and government-sponsored enterprises (GSEs) Fannie Mae and Freddie Mac hold the keys. The GSEs back almost half of all single-family mortgage originations each year (roughly $1 trillion worth) and set standards for lenders and appraisers nationwide.

They already offer their own single-family green mortgage products (Fannie Mae’s Homestyle Energy and Freddie Mac’s GreenCHOICE mortgage), but adoption remains extremely low. Why? Because of a lack of effective marketing to consumers and specific operational pain points that add complexity, time, and cost for lenders. But none of this is insurmountable.

SOURCE: Build Back Better Homes: How to Unlock America’s Single-Family Green Mortgage Market / RMI

RMI’s new report, Build Back Better Homes: How to Unlock America’s Single-Family Green Mortgage Market, proposes key interventions for the GSEs to streamline the green mortgage origination process from a home performance perspective. These interventions can reduce friction for lenders (and appraisers) to meet consumer and investor demand for greener homes. They should also help the GSEs convert green mortgages used to retrofit existing homes into a massive new green bond market—in addition to mortgages on high performance new construction, as Fannie Mae launched last year.

Scaling up the single-family green mortgage market is not only possible today at a national scale—given advances in housing data and automation as well as favourable financial market and policy trends—it is also necessary. Expanding access to green capital, including for low- to moderate-income households and underserved communities, is part of the GSEs’ Duty to Serve. It also aligns well with the Biden Administration’s stated priorities to address the economy, housing, inequities, and the climate crisis. In light of this, the report also offers strategies for federal regulators and policymakers to support these goals and the development of this market—most directly by requiring the GSEs to take specific actions.

SOURCE: Build Back Better Homes: How to Unlock America’s Single-Family Green Mortgage Market / RMI

Save money, reduce emissions, and more

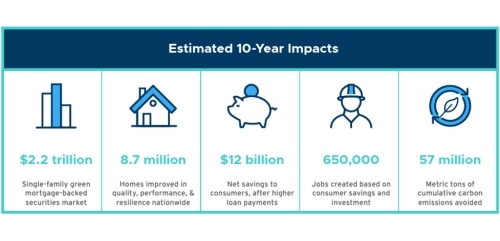

What could success look like? If green mortgages scale up to comprise only 15 percent of the GSEs’ annual single-family mortgage volumes (half the penetration level achieved by their green multifamily business), over a decade this could deliver enormous societal benefits and ESG impacts:

SOURCE: Build Back Better Homes: How to Unlock America’s Single-Family Green Mortgage Market / RMI

Through their inherent role in financing American homes, mortgages can soon become a primary investment vehicle for deploying billions of dollars a year to home improvements that save Americans money, improve health and safety outcomes, build resilience, and reduce residential emissions. Green mortgages can also play a role in future-proofing the mortgage industry itself by helping to mitigate ever-increasing climate risk (damages from extreme weather events cost $95 billion in 2020 alone).

As the leaders and primary engines of housing finance in America, the GSEs should follow the lead of many of the world’s largest financial institutions (representing over $18 trillion) that have committed to climate-align their portfolios. This will require dedicated efforts and collaboration between multiple stakeholders—the GSEs, FHFA and other federal agencies, market-leading lenders, technical partners, and community organisations—and time is of the essence to get started.

Find out more about green mortgages—download the Build Back Better Homes: How to Unlock America’s Single-Family Green Mortgage Market report.

***

Greg Hopkins is a Manager, Carbon-Free Buildings, Rocky Mountain Institute (RMI).

This article is published with permission. Copyright 2021, Rocky Mountain Institute