Each year more than 300,000 individuals leave Britain to start a new life overseas. We explain the ins and out of moving abroad from the UK including how to start and how to tell HMRC.

Exciting as moving abroad can be it is also intimidating.

Whether you’re moving abroad for work, to relocate or to retire, here we outline some top tips to make the transition a little smoother.

This guide will cover:

1. Do I need to tell HMRC if I move abroad?

Once you have made your decision to move abroad, for life, work or retirement reasons, there are a number of people you need to tell, and I don’t just mean friends and family – who should of course come top of your list!

HM Revenue & Customs

You might think that if you leave the country, there will be no more paying tax at home.

Alas, no. British expats may be exempt from certain additional taxes, but that doesn’t necessarily mean they pay no income tax in the UK.

What you have to pay depends on your personal circumstances, how, where and whether you are being paid, and where your financial assets are; if you are working, you may also be liable for national insurance.

In order to ensure that you pay the right amount, you need to fill in a P85 form on the HMRC website and include parts 2 and 3 of your P45 form from your employer.

If you normally fill in a self-assessment tax return, perhaps because you’re self-employed, you can use this instead.

You could be fined for not completing a tax return each year should HMRC believe that you need to.

If you are going to be working full-time for a UK-based employer for at least one year, then send both a P85 and a tax return.

UK homeowners considering renting their properties out, and who live abroad for more than six months of the year, are classed as non-residential landlords and must join the Non-Resident Landlord Scheme (NRLS).

This is the system by which tenants and letting agents in the UK pay tax on behalf of landlords abroad.

Paying tax as an expat can be complicated, so it’s worth speaking to a financial expert who specialises in this area and understands the rules of your home country as well as the country you are moving to.

Local authority

Let your local authority know that you will be leaving and give it a forwarding address so it can send you your final council tax bill.

If you are claiming benefits, you will also need to inform the relevant authorities, which will tell you if you can continue to claim while abroad.

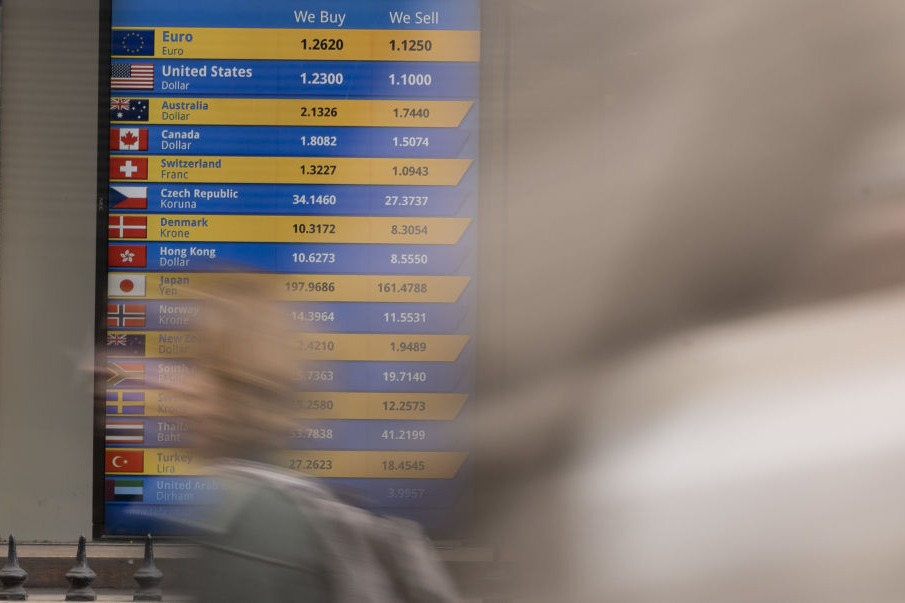

Send money abroad with Xe

Whether it be buying a new holiday home in Spain, sending money back home to friends and family or paying international business invoices use Xe for all your money transfer needs. As well as getting access to Xe’s online platform, which is designed for speed, security, and simplicity, you can also use their dedicated managed service providing tailored solutions to meet your unique currency needs. With Xe, you’re not just a client; you’re a valued partner in a global financial journey.

Mortgage provider

If you have a mortgage and you plan to rent your home out, then it is important you contact your mortgage provider to ensure you are not breaking the terms of your loan agreement.

Looking for a mortgage? Try this free mortgage comparison tool to help you find the best deal

Utilities

You will need to contact utility providers, such as for your gas and electricity, water and broadband, as well as your banks and private pension providers, to tell them your new address.

Do so at least one month before you are due to leave your current address.

International Pension Centre

If you have paid enough UK national insurance contributions to qualify, you can claim a state pension even if you live abroad – but you will need to inform the International Pension Centre first.

Post Office

So you don’t miss any important mail, you can get it all redirected for up to 12 months using the Post Office’s mail redirection service.

It costs from £33.99 for three months to UK addresses or £120.99 for overseas addresses, or £68.99 and £249.99 respectively for 12 months.

Medical services

It is good practice to inform your GP and dentist, if nothing else, so that they don’t send information out to you, wasting their time.

Childcare

Give plenty of notice to your child’s school or childcare provider of your intention to leave the country.

Many private schools have a notice period during which you must inform them of any changes; after this period, you could be charged.

Student Loans Company

If you have a student loan outstanding and are leaving the UK for more than three months, you need to contact the Student Loans Company.

It will work out if you have to repay while you’re abroad and if so, how much you need to pay.

You then make repayments through your online student loan account or by international bank transfer (IBAN).

2. What happens to your home?

Once you have made your decision to move, you need to think about your home – both the one you have now and your future home.

While selling your property may seem the obvious answer, it might be a little hasty; just in case things don’t work out abroad and you want to return home, renting your place out – at least in the short term – could be a better option.

You will have to do your research, though, to ensure, first, that you are aware of the tax implications of becoming a landlord.

Check that the current terms of your mortgage also allow you to rent your home out.

Using a letting agent can help in that they will do everything on your behalf so you don’t have to worry.

To do this, they will command a property-management fee of 10%-20%, as well as a “finder’s fee” for getting new tenants in.

You are also financially responsible for any repairs.

It is important to understand the rules on capital gains tax if you do decide to keep your home in the UK but sell it at a later date, as you may have to pay CGT.

Related to whether you rent or sell your home is whether you rent or buy abroad.

Once you know what you’re doing with your UK property, you will have a better idea of your overseas budget.

Next up, you should register, as a buyer or renter, with a number of local estate agents.

Research the property market and visit any properties you are considering buying (or renting, if possible) before you move out there. Subject your search to the same due diligence that you would at home.

3. What documents do I need?

Before January 1, 2021, UK citizens had an automatic right to live in an EU country without the need for a visa.

That is no longer the case, although, if you meet certain requirements, you can apply for an EU Blue Card.

This allows highly qualified workers to live and work within the EU.

If this does not apply to you, check your destination country’s living in guide and UK-based embassy for information about what documentation you will need.

If you do require a visa, make sure you apply in plenty of time as the application process can often be lengthy. You will usually have to send your passport off and pay a fee.

4. Do I need to tell the bank?

Banking

You can of course keep and continue to use any UK bank accounts, but opening one in your new country can help you avoid paying unnecessary transaction fees, making day-to-day living cheaper and easier.

It can also iron out currency fluctuations for any money transfers.

If you have any regular transactions back in the UK, keeping your UK account open is a sensible move.

While you are in the process of setting up a new local bank account, it may be worth getting a credit card that is well suited for foreign spending – see our best buy table.

Investments

You are typically required to have a permanent UK address if you hold an ISA. Therefore you may not be able to continue paying into it if you move abroad.

The Financial Conduct Authority only really offers consumer protection for financial services for people living in the UK. It is best to speak to an independent financial adviser about your options.

Insurance

Do your homework about what insurance you will require when you move to your new country – for example, home, life and car cover.

If you are renting out your home, you will also need to get expat landlord insurance to cover your property and any legal fees that may arise.

Moving abroad may also affect insurance policies that you have now, such as life insurance, because it is based on risk levels that have to be assessed by the provider.

5. How can I access healthcare abroad?

In order to gain access to the healthcare system in your new country, you will probably have to register with the relevant authorities as a resident.

Once you are working and making social security (national insurance) contributions, you should be entitled to the same state-run healthcare as a resident of that country would be entitled to.

Some countries expect you to make contributions, even if you are not working, to join a national healthcare scheme.

If you are in an EU country on a temporary basis, up to 90 days, you can still use your UK-issued European Health Insurance Card (EHIC) or UK Global Health Insurance Card (GHIC) to get access to healthcare.

However, once you are living in an EU country, you should return your UK EHIC and replace it with the equivalent in your new country for travel purposes, where possible.

If you move abroad and are in receipt of a UK state pension then you may be entitled to have your healthcare paid for by the UK. To receive this, you will have to fill out an S1 form once you start drawing your state pension.

You will not be covered for healthcare paid for by the UK if you’re going to live permanently outside the EU.

Although Britain does have agreements in place with a number of other countries, so check first what healthcare provision you can expect. You may need to take out private healthcare insurance.

6. Pensions

Pensions are not just a concern for those retiring abroad but for anyone who has been making national insurance contributions or has a private or workplace pension.

There are a number of options open to you – if you are not yet at retirement age.

You can leave your pension invested in your current UK plan until you are able to withdraw money from it – currently, at the age of 55 (57 from 2028).

You can transfer your pension to a scheme abroad or you can pay into a UK scheme from your new country of residence.

British citizens can be members of a UK-registered pension scheme regardless of where they live or where their employer is based, but you may find the tax benefit to be limited or non-existent.

There is more information on the Pensions Advisory Service website.

In terms of your state pension, you can live in another country and receive your pension if you have contributed the required national insurance contributions.

You will get an increase every year if you live in the European Economic Area or a country that has a social security agreement with the UK.

It may be possible for you to pay voluntary Class 3 NICs if you need to fill in any gaps in your NIC record, but you need to call HMRC Residency on 0191 203 7010 for further information.

Again, if you are unsure about how your move will affect your long-term financial planning, it is best to speak to an independent financial adviser.

7. Do I need a new driving licence?

It sounds obvious, but make sure you are clued up about the local driving laws, customs and regulations if you plan to be behind the wheel, including getting a local driving licence.

In some countries you may need to take a test, while in others they will allow you to exchange your UK licence instead.

Even within the EU, these requirements vary from country to country, so make sure you check the rules.

If you’re moving further afield then you need to request an international driving permit from the Post Office.

It costs £5.50 and is an internationally recognised document that will allow you to drive as long as you have a valid UK driving licence. But again, check first, as you may still need to get a local licence too.

Read more: How to renew you UK driving licence and passport

8. Can I take my pet with me?

If you want to take Rover with you overseas, start planning as soon as possible.

You should investigate what animals are allowed, what documentation you need and any medication or immunisations that are required.

Pets will need their own passport, to be microchipped by a vet, to receive immunisation against rabies at least 21 days before they leave the country, and, with some countries, to have had treatment for tapeworm if they are a dog.

Make sure that you get the entry requirements correct; if you don’t, you will have to pay any charges.

There are specialist pet-transportation companies that will be able to let you know everything that is required before your pet can travel.

They can also help with the logistics of the move and make sure your pet is properly cared for on the journey.

9. How can I ship my possessions over?

If you’ve ever had to move your belongings from one property to another within the UK then you know what an expensive headache it can be – so imagine the hassle of moving it all to another country.

You do have the option, of course, of selling all your old stuff and buying everything new in your new country, but this could be very expensive.

Saying that, the more stuff you ship abroad, the more expensive it will be – so a bit of a clearout might not be a bad idea.

Finding a specialist removal company is a good option, rather than attempting to go it alone; they can sort out all the logistics for you and ensure your possessions arrive safely and on time.

There are a number of options on the Experts for Expats website.

10. Registering to vote

Just because you have left the country, that doesn’t mean you aren’t eligible to have a say in how it is governed.

You can vote if you are a British citizen and have registered to vote within the last 15 years; you will have to renew every year.

Government policy will still affect you as part of the expat community.

This includes in taxation, pensions and investment – especially if you still have assets, like a home or investments, in the UK.

Important information

Some of the products promoted are from our affiliate partners from whom we receive compensation. While we aim to feature some of the best products available, we cannot review every product on the market.