House prices in Cornwall could plunge as mortgage rates soar and second home buyer demand dries up

Houses in Cornwall are set to undergo the biggest price drop in England as mortgage rates soar and demand from second home buyers dries up following Covid ‘staycation’ boom

- Cornwall house prices could see the biggest fall in England as demand drops

- The ‘second home’ market has been threatened by higher mortgage rates

- An end to the Covid ‘staycation’ trend could also be adding to falling figures

House prices in Cornwall could plunge as the county recorded one of England’s largest drops in demand from second home buyers amid turmoil in the mortgage market.

The end of the Covid ‘staycation’ trend coupled with higher mortgage rates since the government’s mini budget announcement has threatened the second home market.

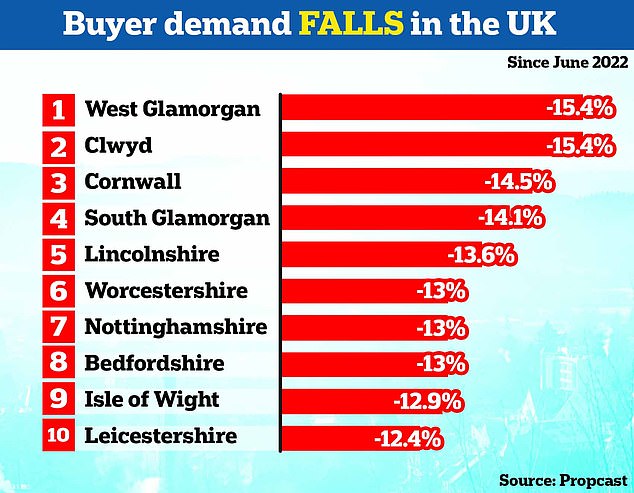

Demand has reportedly fallen in every UK county between June and September – but rural and coastal holiday properties have been hit the hardest, data shows.

The share of homes under offer in Cornwall fell by 14.5 per cent in this period, while the Isle of Wight saw a 12.9 per cent drop and West Glamorgan and Clwyd in Wales each recorded a 15.4 per cent decrease, data company PropCast told the Telegraph.

Duncan Ley, of Humberts estate agents in Cornwall, told the newspaper sales had dropped since last month.

He said sales were up 15 per cent on pre-Covid levels at the beginning of September – before the mini budget announcement.

‘Now we are probably doing 50pc of the transactions we would normally expect at this time of year,’ he said.

Second home buyers have dropped in Cornwall since their peak last summer, an estate agent has said (stock image)

Demand has reportedly fallen in every UK county between June and September – but rural and coastal holiday properties have been hit the hardest, data shows

Another estate agent in Cornwall, Jonathan Cunliffe, said they’d seen second home buyers fall by up to 75 per cent since the summer peak last year.

He added: ‘Some people were buying because they couldn’t go abroad, and now they can. Then there were a lot of people who brought forward planned moves, maybe by five years which means, inevitably, that there will now be a lag in demand.’

He said there was ‘no way’ house sales in far flung parts of the country seen in the pandemic could be sustained.

Rural and coastal holiday homes have been hit the hardest by a fall in demand (stock image)

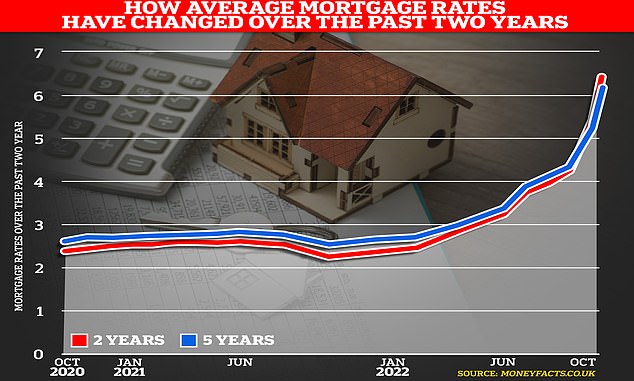

Pictured: This graphic shows how average mortgage rates have risen in the past two years

It comes as The Bank of England today made clear interest rate hikes are still looming while warning mortgage distress could soar.

Chief economist Huw Pill said he still thought a ‘significant monetary policy response’ will be required when the next rates decision is made early next month, suggesting the mini-Budget has added to inflation pressures.

The intervention – which briefly bolstered the Pound – came as the Bank warned that the share of households struggling to service their mortgages might return to pre-financial crisis peaks next year.

The average two and five-year fixed mortgage rates available are at already their highest levels since the financial crash in 2008, pushing up costs for borrowers.

Across all deposit sizes, the average two-year fixed mortgage on the market now has a rate of 6.43 per cent – while the average five-year fix is now at 6.29 per cent.

Advertisement