- Property transactions relfect the standstill in activity late last year

- Mortgage rates soared in October but have since fallen and stabilised

- The average five-year fixed deal is back below 5% at 4.97% says Moneyfacts

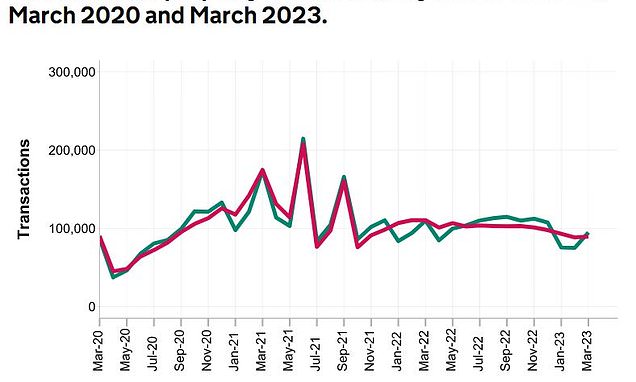

The number of property transactions in March increased 1 per cent on February highlighting a ‘Mexican stand-off’ in the property market.

In total there were 89,560 residential property transactions in March on a seasonally adjusted basis, according to the latest data from HMRC.

It comes as mortgage rates have dropped slightly. The average five-year fixed deal is back below 5 per cent at 4.97 per cent, according to Moneyfacts, and the average two-year is now 5.26 per cent.

Rates peaked at average of 6.65 for a five-year fix and 6.52 for a two-year fix in October, but there are now a number of deals on the market for below 4 per cent.

At the same time there are now more than double the mortgage products on the market than late last year.

This is good news for buyers who are still grappling with the rapid increase in mortgage rates seen at the end of last year when the Truss government’s mini-budget let to a sharp rise in borrowing costs.

Related Articles

HOW THIS IS MONEY CAN HELP

Graham Cox, from Self Employed Mortgage Hub, said: ‘Mortgage approvals fell off a cliff late last year, about 45 per cent lower than the year before.

‘So, it’s unlikely completed transaction levels will improve much for a while. Overall, there’s no doubt the housing market is flat.

‘Buyers are wary of overpaying, and there are still far too many vendors holding out for silly money. With one or two more base rate rises mooted, there’s a Mexican stand-off playing out.’

Time taken for house purchases to go through mean we are only now seeing the impact of budget on the market.

While transactions have seen a modest increase over the month, the figure is down 19 per cent compared to a year ago.

Ross McMillan, owner at Glasgow-based Blue Fish Mortgage Solutions: ‘The recorded sales, or lack thereof, that relate to that period are only now filtering through to the registered transactions and so it’s inevitable that the numbers for March this year are significantly down on the same month in 2022.

‘It’s clear that there is significant divergence in activity across local areas but, in general, it would appear that buyers and sellers have adapted to the new norm and the higher interest rates that now accompany this.’

However, there are signs that in some areas of the market buyers are still holding out for a long-awaited price drop, after years of rapid growth.

At the start of the year higher mortgage rates coupled with stubbornly high inflation led many to predict significant drops in house prices.

Savills predicted house prices would drop by 10 per cent over the year and the Office for Budget Responsibility said there would be a 9 per cent fall.

As yet prices have remained resilient despite the tough conditions.

Paul Neal of Missing Element Mortgage Services, said: ‘Many people appear to be waiting for a drop in prices and interest rates but are overlooking the fact that lower interest rates will ignite demand, driving prices up again. In short, the current market is a great time to buy.’

Asking prices for typical first-time buyer homes have hit a new record high of £225,000 in April according to Rightmove.

However, monthly growth slowed to just 0.2 per cent, significantly lower than usually seen at this time of year when it usually averages 1.2 per cent.

The average newly listed UK house now has an asking price of £366,247.

First time buyers are thought to be a significant driving force behind the market’s relative stability.

While house prices increased 1.7 per cent over the year to April, houses bought by first time buyers increased by 2 per cent – demonstrating the ongoing demand.

However, this month’s high inflation figure – 10.1 per cent- caught experts by surprise with many now expecting the Bank of England to further push up its base rate.

Previously it was hoped the March’s hike would be the last and the Monetary Policy Committee would opt to hold or even drop the rate at the next decision.

Currently the rate – which sets the cost of borrowing – is at a 4.25 per cent, the highest level for fourteen years. This adds the risk of mortgage rates going back up, putting off buyers.

Added to this, Mr Cox says that as more sellers put their properties on the market prices could fall rapidly later in the year.

Jeremy Leaf, former RICS residential chairman, adds, ‘Inflation and falling real incomes remain a concern, which is resulting in more hard bargaining and protracted sales.’

But others take a more optimistic view on the rest of the year.

Amit Patel, at brokerage Trinity Finance, says that if inflation drops as expected later in the year lenders will be more lenient with their affordability assessments and transaction levels will pick up.

Added to this is the sense among brokers that many buyers have accepted current rates are the new normal and they are unlikely to fall back to the low levels seen over the past few years.

Rhys Schofield director at Peak Mortgages and Protection, sayid: ‘We’re now in a world where sanity has prevailed, and mortgage holders are more accepting of yet another ‘new normal’ where rates are higher.

‘For sure, payment shock is still a very real threat to households, but we can’t escape the fact that people need homes to live in and will need to pay what it costs to keep doing so.’

Some links in this article may be affiliate links. If you click on them we may earn a small commission. That helps us fund This Is Money, and keep it free to use. We do not write articles to promote products. We do not allow any commercial relationship to affect our editorial independence.