By Harriet Alexander For Dailymail.com

00:21 22 Feb 2023, updated 00:47 22 Feb 2023

- The National Association of Realtors on Tuesday published their monthly update, which showed that existing-home sales fell for the 12th straight month in January

- The inventory of unsold existing homes grew from the prior month to 980,000 at the end of January, as mortgage rates remain above 6% for a 30-year fixed

- The median existing-home sales price increased by 1.3% from one year ago to $359,000

The U.S. housing market remains on unsteady ground with the latest data from the National Association of Realtors showing home sales falling for the 12th consecutive month.

The NAR’s survey, published on Tuesday, showed that home sales in January were down 36.9 percent to 4 million – down from 6.34 million in January 2022.

‘Home sales are bottoming out,’ said Lawrence Yun, NAR Chief Economist.

‘Prices vary depending on a market’s affordability, with lower-priced regions witnessing modest growth and more expensive regions experiencing declines.’

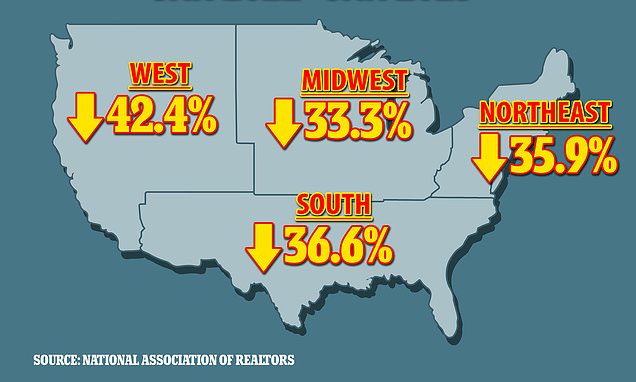

The decline was nationwide, but most pronounced in the West, where sales were down 42.4 percent year-on-year. The median price in the West is the most expensive in the country at $525,200 – down 4.6 percent from January 2022.

In the Northeast they were down 35.9 percent; in the South down 36.6 percent.

The Midwest fared slightly better, with sales of existing homes down 33.3 percent.

The average Northeast home was at $383,000; in the South it was $332,500; while in the Midwest it was the cheapest in the nation, at $252,300.

The median existing-home price for all housing types in January was $359,000, an increase of 1.3 percent from January 2022, when the figure was $354,300.

Cities where home prices are decreasing include San Francisco and San Jose, both in California, and Austin, Texas.

San Jose had one of the biggest drops but is still the most expensive place to buy a home in the country at a median price $1,577,500. Prices peaked at $1.9 million in early 2022.

San Francisco’s median home prices dropped by 1 percent to $1.78 million between 2021 and 2022 in the first annual decline the city has seen in a decade, according to new data from Compass.

And in Austin, homes remain expensive at a median price of $525,250 in December, but the figure represents a 5.4 percent drop from December 2021, according to KVUE.

The sluggish market is in a large part due to stubbornly-high mortgage rates.

A 30-year fixed mortgage will currently be at 6.32 percent – significantly higher than the below 3 percent rates seen in 2020.

Rates have been above 6 percent since mid 2022.

‘Homes are sitting on the market longer,’ said Yun.

‘But there are fewer fresh listings coming to market this January compared to last January.

‘This is due to homeowners loving their low interest rate and not wanting to give it up and put their home on the market.’

The typical home stayed on the market for 33 days in January, up significantly from 19 days a year ago.

Almost a third of sales in January – 31 percent – were completed by first-time buyers; a slight increase compared to January 2022.

Over a quarter, 29 percent, were all-cash sales, up from 28 percent in December and 27 percent in January 2022.

Distressed sales – foreclosures and short sales – represented 1 percent of sales in January, identical to last month and one year ago.

Earlier this month, NAR analysis showed 20 major cities in America that have seen house prices fall in the past year – four of which are in California.

‘A few markets may see double-digit price drops, especially some of the more expensive parts of the country, which have also seen weaker employment and higher instances of residents moving to other areas,’ said Yun.

Yun said the slowdown represents a break from markets that saw a massive price boom during the pandemic.

‘A slowdown in home prices is underway and welcomed, particularly as the typical home price has risen 42 percent in the past three years,’ he Yun, noting these cost increases have far surpassed wage increases and consumer price inflation since 2019.

Other markets that have seen prices decline include Boulder, Colorado at 2.0 percent; Austin Texas at 1.3 percent; and Boise, Idaho at 3.4 percent.

In fact, Bay Area homes are selling for below their listing price for the first time in 10 years, according to the San Jose Mercury News.

Daryl Fairweather, Redfin’s chief economist, told the Mercury News that it represents the larger exodus from the region, driven by remote work, especially in the tech sector.

‘We may see this new normal where the San Francisco Bay Area looks more like the rest of the country,’ she said.