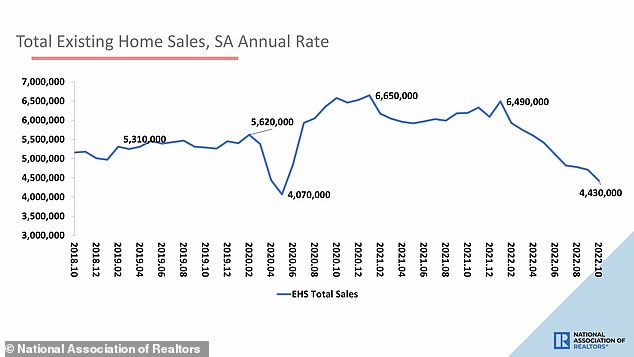

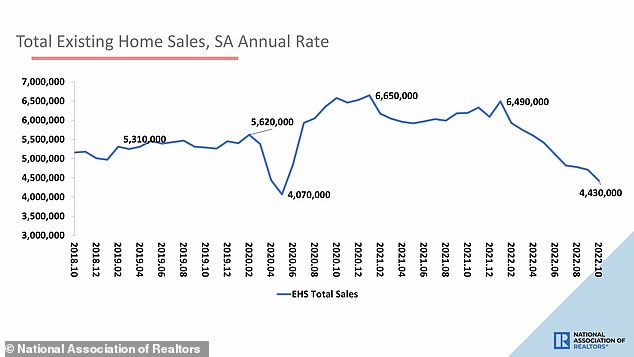

Sales of previously occupied US homes fell in October for the ninth month in a row, as prospective homebuyers grappled with sharply higher mortgage rates, elevated home prices and fewer properties on the market.

Existing home sales fell 5.9 percent last month from September to a seasonally adjusted annual rate of 4.43 million, the National Association of Realtors said on Friday.

October sales fell 28.4 percent from a year ago, and are now at the slowest annual pace since December 2011, excluding the steep slowdown in sales that occurred in May 2020 near the start of the pandemic.

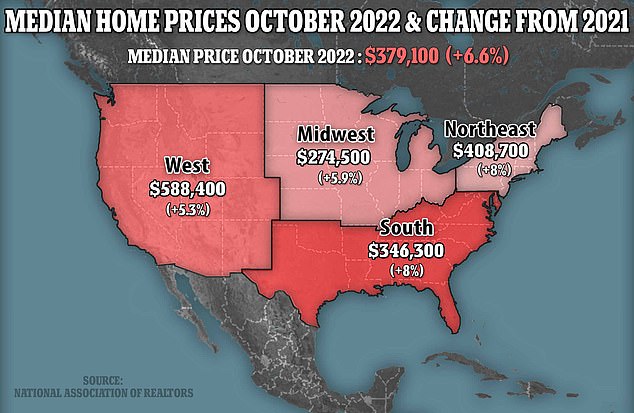

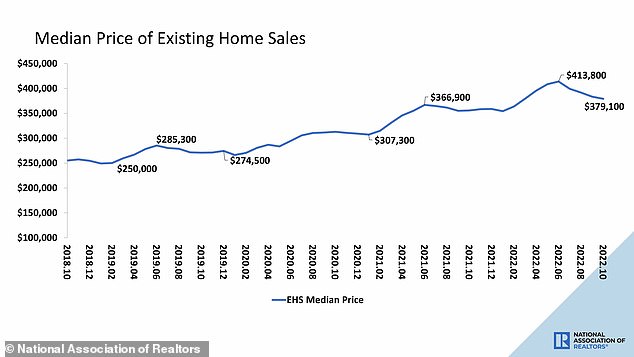

Despite the sharp slowdown in transactions, the national median home price rose 6.6 percent in October from a year earlier, to $379,100. That marked 128 straight months of annual house price increases, the longest such streak on record.

Existing home sales (above) fell 5.9 percent last month from September to a seasonally adjusted annual rate of 4.43 million, the National Association of Realtors said Friday

Despite the sharp slowdown in transactions, the national median home price rose 6.6 percent in October from a year earlier, to $379,100. Prices rose in all four regions

Though prices are still rising, they are growing much more slowly than they did during the pandemic buying frenzy, when home values were rising as much as 20 percent on the year.

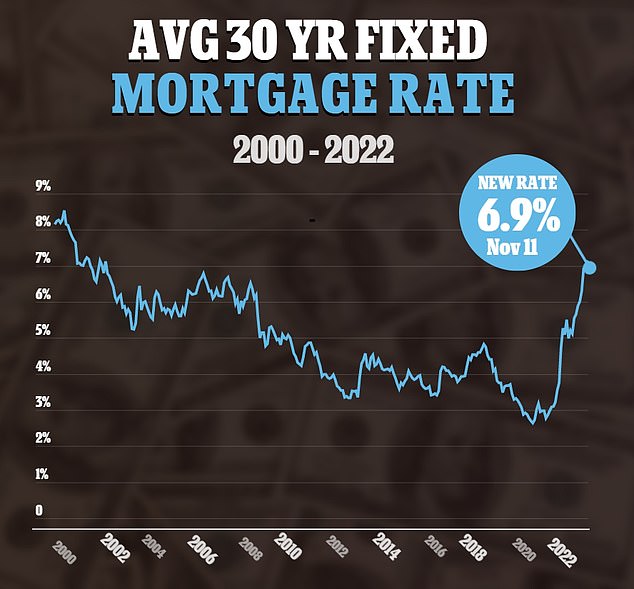

Now, the combination of still-high home prices and rising mortgage rates is severely impacting sales volume, by pushing home affordability out of reach for many Americans.

‘More potential homebuyers were squeezed out from qualifying for a mortgage in October as mortgage rates climbed higher,’ said NAR Chief Economist Lawrence Yun.

‘The impact is greater in expensive areas of the country and in markets that witnessed significant home price gains in recent years,’ he added.

Average mortgage rates peaked in early November at more than 7 percent, the highest in 20 years, dramatically raising the monthly payments to buy a home.

But last week, amid signs inflation is decelerating, mortgage rates dropped sharply, dipping back below 7 percent, and applications for home loans increased.

The average contract rate on 30-year fixed mortgages dropped to 6.9 percent last week, from 7.14 percent the prior week

‘Mortgage rates have come down since peaking in mid-November, so home sales may be close to reaching the bottom in the current housing cycle,’ Yun said.

The housing market has been slowing as average long-term US mortgage rates have more than doubled from a year ago, making homes less affordable.

Though higher mortgage rates are depressing demand from homebuyers, there are also signs they are weighing on supply, discouraging homeowners who are already locked in at lower rates from listing their homes.

Last month, house hunters had fewer properties to choose from as the inventory of homes on the market declined for the third month in a row.

Some 1.22 million homes were on the market by the end of October, which amounts to 3.3 months’ supply at the current monthly sales pace, NAR said.

‘Inventory levels are still tight, which is why some homes for sale are still receiving multiple offers,’ Yun noted.

‘In October, 24 percent of homes received over the asking price. Conversely, homes sitting on the market for more than 120 days saw prices reduced by an average of 15.8 percent,’ the economist said.

The national median home price rose 6.6% in October from a year earlier, to $379,100, marking 128 straight months of year-over-year house price increases

Home prices are still growing on an annual basis, but at a much slower rate than seen earlier this year, as the market responds to rising interest rates

Sixty-four percent of homes sold in October 2022 were on the market for less than a month.

First-time buyers accounted for 28 percent of purchases, down from 29 percent in September and a year ago. All-cash sales made up 26 percent of transactions, up from 24 percent a year ago.

The report followed on the heels of news on Thursday that single-family homebuilding and permits for future construction tumbled to the lowest levels since May 2020. Housing inventory also declined.

Mortgage rates have jumped in response to high inflation, which has forced the Federal Reserve to unleash the fastest interest rate-hiking cycle since the 1980s.

The 30-year fixed mortgage rate breached 7 percent in October for the first time since 2002, according to data from mortgage finance agency Freddie Mac.

The rate fell to 6.61 percent last week in its biggest one-week drop since 1981. A year ago the average rate was 3.1 percent.