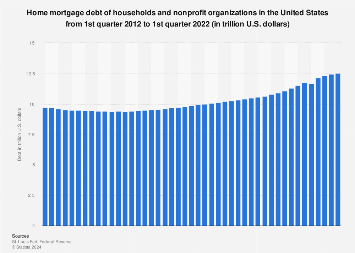

The home mortgage debt of households and nonprofit organizations amounted to approximately 12.6 trillion U.S. dollars in the first quarter of 2023. Mortgage debt has been growing steadily since 2014, when it was less than 10 billion U.S. dollars and has increased at a faster rate since the beginning of the coronavirus pandemic due to the housing market boom.

Home mortgage sector in the United States

Home mortgage sector debt in the United States has been steadily growing in recent years and is beginning to come out of a period of great difficulty and problems presented to it by the economic crisis of 2008. For the previous generations in the United States the real estate market was quite stable. Financial institutions were extending credit to millions of families and allowed them to achieve ownership of their own homes. The growth of the subprime mortgages and, which went some way to contributing to the record of the highest US homeownership rate since records began, meant that many families deemed to be not quite creditworthy were provided the opportunity to purchase homes.

The rate of home mortgage sector debt rose in the United States as a direct result of the less stringent controls that resulted from the vetted and extended terms from which loans originated. There was a great deal more liquidity in the market which allowed greater access to new mortgages. The practice of packaging mortgages into securities, and their subsequent sale into the secondary market as a way of shifting risk, was to be a major factor in the formation of the American housing bubble, one of the greatest contributing factors to the global financial meltdown of 2008.