High-street lenders are holding steady on mortgages, despite the Bank of England’s decision to raise the base rate on Thursday.

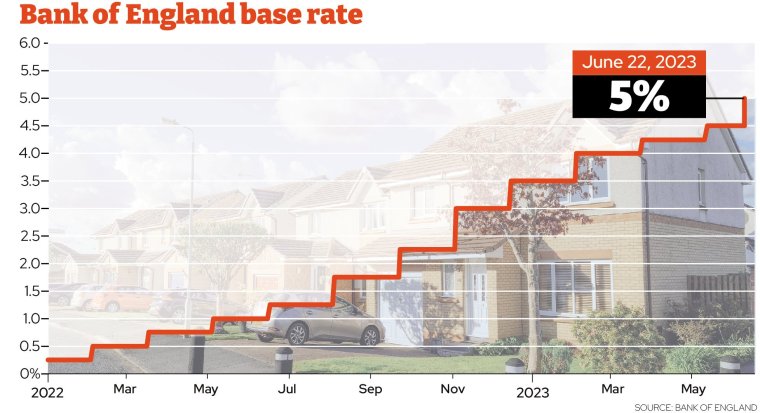

Confirmation that rates were going up by 0.5 percentage points sparked fresh concern that lenders would start withdrawing products, as has happened several times already this month.

But the “Big Six”, which control around 70 per cent of the mortgage market – Lloyds, NatWest, Nationwide, Santander, Barclays and HSBC – all said they were not withdrawing products on Friday.

Those on tracker mortgages will see their rates increase.

Santander, for example, said the rate for its tracker will go up to 8.25 per cent, but its Standard Variable Rate would remain unchanged at 7.5 per cent.

Only a few of the smaller banks, such as Aldermore, confirmed they were withdrawing products and repricing as a result of the base rate increase.

James Cowling, a financial adviser, told i on Friday afternoon: “The high-street banks are holding fairly steady. I’ve not had any notifications saying they’re withdrawing products or raising rates.

“It’s only the non-high street outfits I’ve heard from.”

Governor Andrew Bailey said the 0.5 per cent increase was needed to try to curb stubborn inflation in the UK economy, which has yet to fall significantly despite the Government’s pledge to halve it to around 5 per cent by the end of the year.

The decision will mean misery for homeowners who are due to come to the end of their fixed-rate deals and face seeing their mortgage costs increase by thousands of pounds. Some Conservative MPs have accused Mr Bailey of being “asleep at the wheel” for failing to act sooner on inflation.

Mr Cowling suggested it is perhaps because the central bank has been forced to act more decisively this week that mortgage lenders appear more relaxed.

“I think the last time the lenders knew this was coming and so they have already priced in this one,” he added.

“There’s no panicky emails, last month they were saying ‘get your applications in before 7.30pm on the Monday’ because we’re withdrawing on Tuesday or Wednesday.

“I’m hoping it’s not going to be too bad.”