Goldman Sachs housing analysts no longer think home prices will fall this year. Instead, they are forecasting a slight increase.

“We are revising our home price forecasts higher, to 1.8% for full-year 2023 vs. -2.2% prior, and 3.5% in 2024 vs. 2.8% prior,” Vinay Viswanathan, a fixed income strategist at Goldman Sachs, wrote in a note for the firm’s housing team. “These forecasts imply home prices will remain roughly unchanged through [the] year-end and then return to trend growth levels in 2024.”

This comes as home prices have resumed an upward trend and mortgage rates remain elevated, creating a bleak homeownership situation for many Americans. Goldman Sachs analysts previously thought that higher mortgage rates would put more downward pressure on home prices.

After declining month over month for seven straight months late last year and into 2023, home prices reversed course in February have stayed that way through May, the latest month for which there is data from Case-Shiller’s national price index.

Craig Lazzara, managing director at S&P DJI, said the data backs the case that the final month of monthly declines was in January.

There are two key drivers supporting home prices, Viswanathan wrote.

First, housing supply remains tight. The share of available existing homes for sale is around 1 million now, while that inventory was closer to 2 million homes before the pandemic, according to data from the National Association of Realtors data cited by Goldman.

At the same time, while the supply of new homes continues to increase as builders step up their construction plans, “most of this new inventory is still under construction,” Viswanathan noted. “New completions, on the other hand, remain below pre-COVID levels.”

Housing starts for new single-family units increased by 6.7% in July from the month prior, according to the Census Bureau data out Wednesday, while completions registered a smaller 1.3% gain.

Second, demand for housing remains stronger than expected.

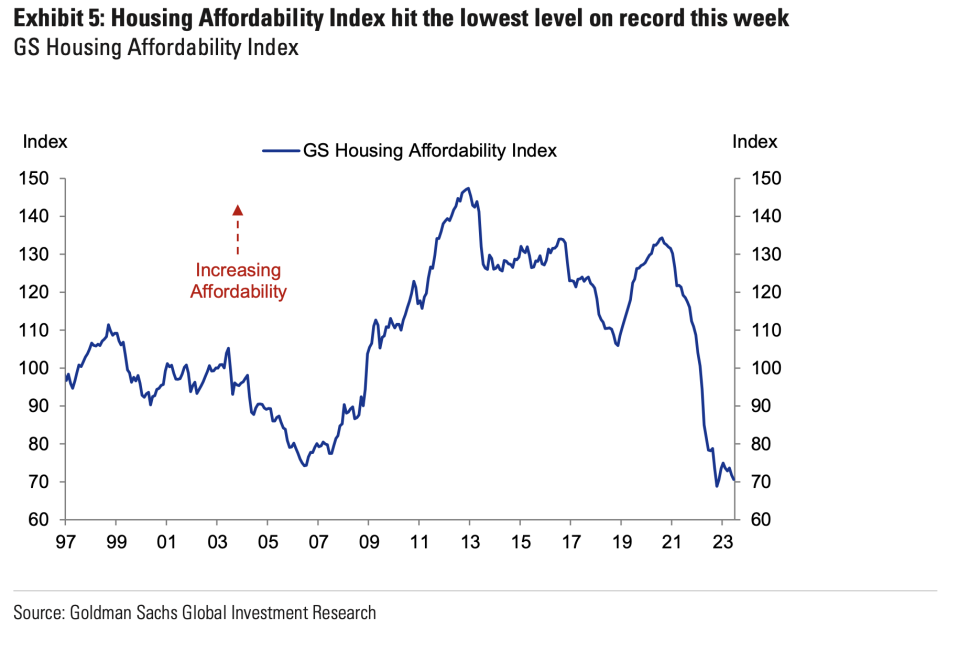

Based on the firm’s housing affordability index hitting record lows, the Goldman Sachs analysts expected that home prices would need to decline nationwide before buyers would bite. But that conclusion has changed.

“We trace most of this demand to non-economic sources: household formation and seasonal turnover,” Viswanathan wrote. “While high frequency data suggests housing turnover may moderate, household formation is well above its long-term trend.”

Housing affordability has worsened over the past year due to high mortgage rates, with the average rate on the 30-year fixed mortgage climbing north of 7% in the past week, Freddie Mac reported.

While so far many homebuyers have swallowed these increased costs, they “demonstrated behavior that, in our view, reflects unsustainable adaptations to elevated mortgage rates,” Goldman Sachs noted.

For instance, the average debt-to-income ratio on conforming purchase mortgages is over 38%, “a significant aberration from post-Global Financial Crisis averages,” Viswanathan wrote.

“In addition, smaller and lower price homes have seen stronger price growth than larger, higher-quality properties. That said, we expect mortgage rates fall by 100 basis point through the end of next year, somewhat stabilizing affordability,” Viswanathan wrote.

—

Dani Romero is a reporter for Yahoo Finance. Follow her on Twitter @daniromerotv.

Read the latest financial and business news from Yahoo Finance