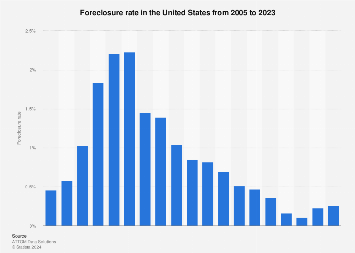

In 2023, the share of housing units with a foreclosure filing increased but remained below the long-term historical average. Approximately 0.26 percent of properties were in foreclosure in that year. Foreclosure results when a homeowner fails to pay their mortgage payments on time, so the lender files a default notice, followed by an auction, and repossession. The foreclosure rate reached its peak in 2010, just after the financial crisis of 2007-2009. Since then, the rate has steadily fallen. As the coronavirus (COVID-19) unfolded, the government imposed a foreclosure moratorium, a mortgage forbearance program, and mortgage servicing guideline which was the reason for the low rates recorded in 2020 and 2021.

The aftermath of the financial crisis

In the lead up to the financial crisis, the volume of outstanding mortgage debt rose. This fell in the aftermath of 2008, which is most likely connected to the fall in the rate of foreclosures in that period. The volume of outstanding mortgage debt began to rise again in 2013, albeit at a slower rate than pre-2018.

Perception among homeowners

In 2018, the majority of mortgage holders in the U.S. believed that it was unlikely that their residence would be foreclosed, which is reflected in the actual numbers. However, almost ten percent said that it was likely, which is much higher than the data shows. This indicates that the fear of foreclosure weighs heavily on the minds of mortgage holders, even in a time when the rate of foreclosure is below one percent.