The past year has not been the financial one that most people will have hoped for.

We entered 2022 looking forward to a better 12 months ahead, as the Covid pandemic slipped into the rear-view mirror, but instead we got one of the toughest financial years in memory.

Double-digit inflation driven by the price of essentials rising rapidly meant that the defining financial phrase of 2022 will be ‘cost of living crisis’.

Wealth check: Some simple steps can help you make a plan to get richer in the year ahead

As I’ve written here before that’s a phrase that sits awkwardly, as it is often used interchangeably between those who can’t make ends meet however much cutting back they do, and those for whom inflation is an annoyance that means they must ease back on spending.

Nonetheless, it’s fair to say that when you have so many people across income and wealth brackets worried over the price of their weekly shop and fretting about putting the heating on, something has gone wrong.

I’m hoping that 2023 again proves different to expectations, but this time in the opposite direction, as a year that is more prosperous than hoped for – and I think that there is every chance that may happen.

But it’s important not to just leave your financial year ahead to luck – a bit of preparation and graft will pay off as well.

So, if you are in the fortunate position of being able to take control of your finances, here are my tips to get them sorted – and don’t wait for 2023 to put them into action, perhaps use some of the quieter time that often falls between Christmas and New Year to get started.

Meanwhile, if you are really struggling, share your problems with someone you trust and can talk to, and seek help from some of the excellent organisations out there that offer free assistance, such as Citizens Advice, Age UK, Stepchange or National Debtline.

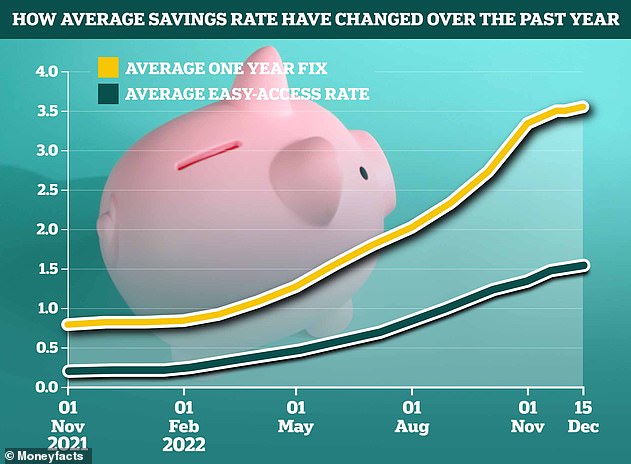

Average savings rates have shot up over the past year – but don’t settle for average, get the top deals that pay much more. You can find the details in This is Money’s savings tables

Move your savings

Savings rates have dramatically improved over the past year, with much of the gains coming since summer.

Average rates have rocketed on easy access from about 0.25 per cent to 1.5 per cent, but you shouldn’t just settle for average because the top deals pay much more.

A year ago, the top easy access deals paid about 0.75 per cent, now they pay almost 3 per cent. Meanwhile, fixed rates have rebounded to territory unseen in years: a two-year fix is available at 4.6 per cent, for example.

Sadly, banks and building societies are still paying poor rates on legacy accounts though. So, if you want these better deals you will have to seek them out and move. Check the top rates in our savings tables and sign up to our Savings Alert emails to get details of the best new rates sent straight to your inbox as they land.

Check your mortgage

Mortgage rates have also risen substantially this year and that’s bad news for homeowners at risk of being caught out by much higher costs than they expected.

Those on fixed rates are protected, but people coming to the end of deals face a big jump in costs. Meanwhile, even for those with a year or more left on a fix, it pays to check how much payments could go up by and to be prepared.

A homeowner who bought early in the pandemic property boom could have fixed their mortgage for five years in summer 2020 at 1.5 per cent, they are now two-and-half years into that fix and if they had to remortgage now they would be looking at a rate of about 5 per cent.

The difference in monthly payments on a £200,000 repayment mortgage with 25 years left to run is £369 – between £800 on their current fix and £1,169 if they needed to remortgage now.

Of course, by the time this homeowner’s fix ends, interest rates may have come down, but it is important to be prepared.

This is especially true if you have a mortgage with a fixed deal ending at any point in the next year. Most of us would struggle to find hundreds of pounds a month more, so plan ahead.

Check how much a new mortgage would cost you based on loan size and house value with our best mortgage rates calculator.

Are you paying too much on debt?

If you have outstanding credit card debt that you are paying off, personal loans or even car finance, it is worth checking if you can switch and clear it at a lower rate.

Meanwhile, even if you don’t have outstanding debts, consider how you use credit cards and whether you are making the most of them or needlessly costing yourself money.

For example, have you got a reward or points credit card that you often only pay the minimum on and forget to clear the full balance? This will cost you far more than the rewards you get.

If you do want a reward credit card – and the best deals can pay off and rack up points for some – make sure you manage it carefully and pick the best one for you, for example, would one of the top Avios deals be best, or one tied to a particular retailer, like John Lewis.

Read our guide to moving debt and our pick of the best credit cards round-up.

Sort out your investments

Diversification is essential for investors, so they don’t put all their eggs in one basket.

A classic mistake is not investing broadly enough and backing just a small selection of stocks or funds or being too focussed on one area. Ideally, instead you would start with a broad global stock market fund as a portfolio’s core and then add smaller satellite elements invested in things you think will outperform.

On the flipside, those of us who have been investing for some time often suffer from so-called ‘diworsification’, with a ragtag list of investments as long as your arm.

These could be nullifying performance, giving a portfolio a different focus to the one you think, or be so small as to make little difference other than the opportunity cost of investing in something better. Read our guide to diversification and avoiding diworsification.

Spend a bit of time looking at your portfolio, check if it is right for your risk level, and consider clearing out some low-conviction clutter.

Also, think whether you could be using a better DIY investment account for you – read our guide to the best and cheapest investing platforms.

Make a financial plan for the year ahead

Human behaviour is such that we tend to deal with things piecemeal, compartmentalise and don’t about the bigger picture. We spend our time worrying about what’s on the route rather than considering the destination.

That’s something that many of us do with our finances, rarely stepping back and asking what our goals are and how we plan to achieve them.

If you recognise you do that, why not try to make 2023 different? You don’t need a detailed roadmap if you don’t want one, just a loose financial plan for the year ahead.

What do you want to achieve and how could you do that?

As a helping hand, these three guides can start you off.

> How to start budgeting and some tips for success

> Ten money rules and tips to live a richer life

> How to create an investment plan that can help you get richer

Some links in this article may be affiliate links. If you click on them we may earn a small commission. That helps us fund This Is Money, and keep it free to use. We do not write articles to promote products. We do not allow any commercial relationship to affect our editorial independence.