Fannie Mae CEO, who’s responsible for 1 in 4 U.S. mortgages, says she learned to be a ‘risk manager’ from Jamie Dimon

Good morning, Broadsheet readers! Buzzy beauty brands explore sales, MacKenzie Scott rolls out $640 million in donations to nonprofits, and Fannie Mae’s CEO always knew she’d be a leader. Have a wonderful Wednesday.

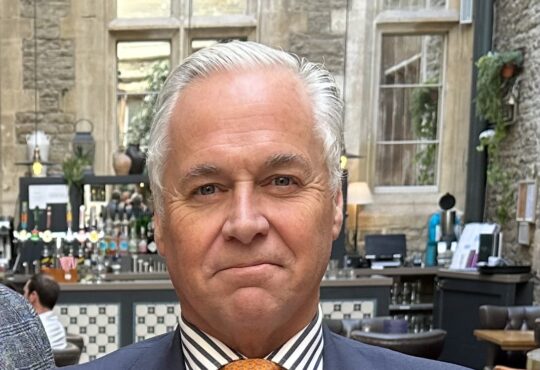

– Leadership track. When Priscilla Almodovar was 6 years old, she carried an attaché case to school alongside her backpack. “I always, even from a young age, thought I would be leading something,” she says.

Today Almodovar is the CEO of Fannie Mae, the government-chartered mortgage-financing business ranked No. 28 on the Fortune 500. The position makes her one of only five female CEOs to run a business in the Fortune 500’s top 30—and the only Latina CEO of a Fortune 500 business. Her parents moved to Brooklyn from Puerto Rico in the 1950s and bought their first house when Almodovar was 5, she recalls. “I still remember the first night I slept in my room,” she says.

Almodovar shared these reflections on the latest episode of Fortune‘s podcast Leadership Next with Alan Murray and Michal Lev-Ram. Her experience informs how she thinks about making housing accessible to Americans today.

Started during the Great Depression, Fannie Mae today buys mortgages from lenders, securitizes them, and sells them to investors. The company with $4.3 trillion in assets—equal to one in four U.S. mortgages—aims to bring liquidity to the housing market and lower interest rates for homeowners. “Our business model is: We manage a lot of risk,” Almodovar explains. A JPMorgan alum, Almodovar says she learned how to be a “risk manager” from JPMorgan Chase CEO Jamie Dimon.

While homeowners’ needs are evolving, Almodovar says that people still associate homeownership with a “good life.” “The American dream is still very much alive,” she says.

However, Fannie Mae has taken steps to support renters, too. It’s gotten 500,000 rental units to report rent payments so that those renters can rely on their rent payment history—rather than only a credit score—as proof of their qualifications to buy. “A housing payment is a housing payment, whether it’s a rental payment or principal and interest payment,” the CEO says.

To learn more about Almodovar and the housing market, listen to the full Leadership Next episode on Apple Podcasts or Spotify.

Emma Hinchliffe

[email protected]

The Broadsheet is Fortune’s newsletter for and about the world’s most powerful women. Today’s edition was curated by Joseph Abrams. Subscribe here.

This story was originally featured on Fortune.com