Experts have warned of the “serious risks” of taking out a 1% deposit mortgage, as a new product allowing for as little as a £5,000 deposit on a £500,000 home comes onto the market.

The fee-free mortgage for first-time buyers from Yorkshire Building Society aims to create a “level playing field for those who don’t have financial support from their families to fall back on”, said the building society’s director of mortgages, Ben Merritt.

But those considering such a deal should be aware that they could end up plunged into negative equity and tackling a high level of interest over time, warned Karen Noye, a mortgage expert at Quilter.

“Though a 1% mortgage may appeal to those with little savings to put towards a deposit on their first home, there are some serious risks,” she told Yahoo News.

“Naturally, anything that helps generation rent get on the housing ladder should be applauded but there is a very real concern that if the 99% mortgage scheme were to be put in place, having such a high loan-to-value mortgage would expose buyers to the risks of negative equity.

“If house prices drop, then only having 1% equity in a property leaves the buyer with a minuscule amount of equity to play with. Given lenders such as Halifax have predicted a 2-4% fall in house prices this year, borrowers taking out such a mortgage could be in negative equity before the year’s end.”

Negative equity is when your mortgage is more than your home is worth, and can leave homeowners unable to sell their properties without making a loss.

“Homeowners who find themselves with negative equity will have an uphill struggle if they want to sell their homes. If house prices drop, then a homeowner wanting to sell will not be able to cover the repayment of the outstanding mortgage and moving costs from the proceeds of the sale and would need to then find the difference from their own funds,” Noye said.

Another potential problem for homeowners who have taken on a 99% mortgage at the advertised rate of 5.99% are the mortgage repayments will be significantly higher than for those people who have paid a larger deposit.

As well as the rate itself being higher than many deals on the market (the current average rate for a five-year fixed-rate mortgage is 4.84%, according to Right Move, while the lowest offer currently on the market stands at 4.13% for a five-year fixed-rate mortgage), the amount of interest customers will pay is also higher the more they borrow.

Kellie Steed, a mortgage expert at Uswitch, told Yahoo News: “There are potential pitfalls that the mortgage borrower would need to consider before pursuing a 1% mortgage.

“Borrowers securing a 1% mortgage could find themselves burdened with higher mortgage payments due to both the larger loan size and higher interest rates. Mortgage lenders typically view 99% loan-to-value (LTV) mortgages as particularly high-risk lending, so the rates available are considerably higher than they would be for lower LTV borrowing.”

Additionally, anyone borrowing money in this way is subject to compound interest – meaning you pay interest on the interest you accrue, which costs you more in the long term.

Beyond the risks for individuals, Claire Flynn, a spokesperson for Mojo Mortgages, said the potential increase in demand for mortgages at 99% could also affect the wider housing market as more buyers attempt to get on the property ladder.

“The introduction of 1% mortgages might initially seem like a positive move, offering a pathway for more first-time buyers to step onto the property ladder with a smaller deposit,” she said. “However, while the mortgages may indeed assist first-time buyers in joining the property ladder due to a much smaller deposit requirement, it’s predicted that this sudden surge in demand could drive up house prices overall.

“Historically, government initiatives such as Help to Buy and Stamp Duty Holidays were created to support buyers, however, they inadvertently fuelled a staggering rise in house prices. 10 years ago, the average house price sat at £188,265, however, today, it’s around £281,913, a substantial increase of £93,648. Therefore, another potential spike in house prices raises concerns.”

What is a 1% mortgage?

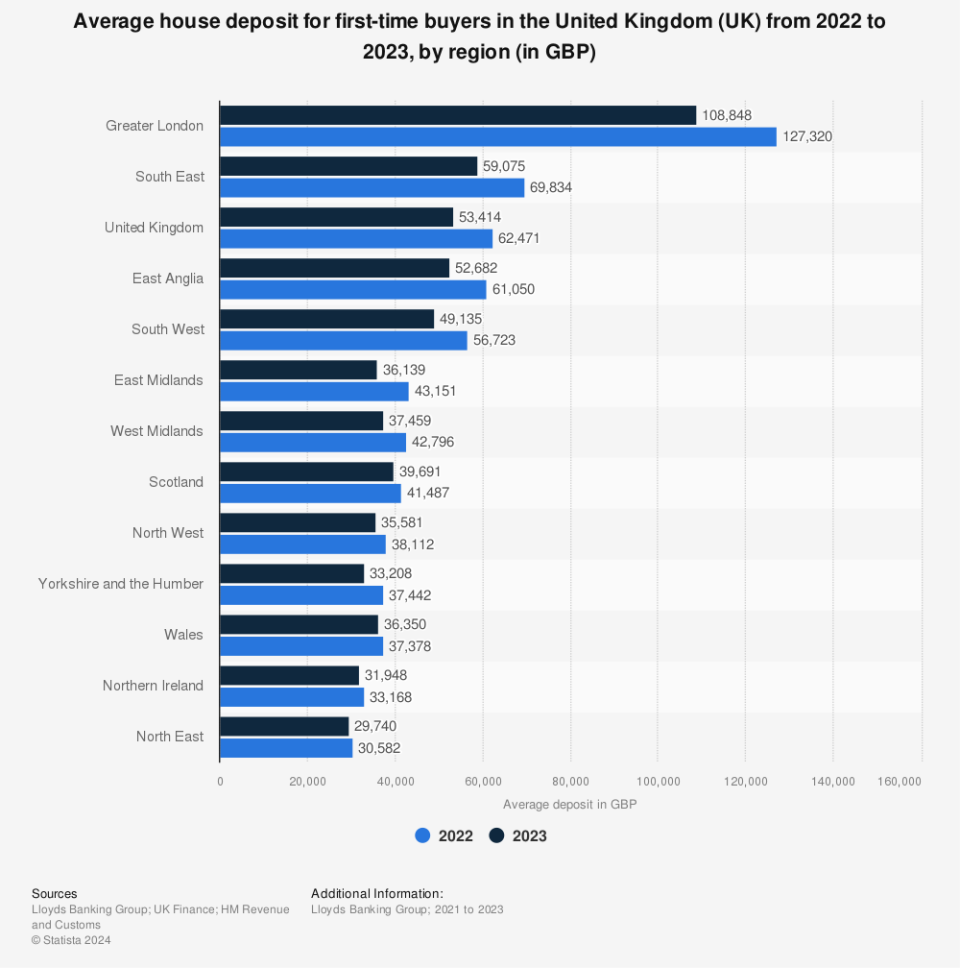

A 1% mortgage (also, confusingly referred to as a 99% mortgage) is when the buyer puts down a deposit for just 1% of the property’s value – borrowing 99% of that cost from the bank. Typically, buyers put down around between 5-20% of the value of a property, with This is Money estimating in January that buyers were averaging a 19% deposit in 2023.

The idea behind the 1% mortgage is that it removes one of the main barriers to first-time buyers purchasing a home – that is, saving enough of a deposit.

What is compound interest?

“Compound interest is the eighth wonder of the world. He who understands it, earns it … he who doesn’t, pays it,” Einstein reportedly said.

In short, compound interest is interest on your interest. If you have invested £10, and make £1 in interest, you will now earn interest on £11 (meaning more money in your pocket). If you have a £10 debit, and are charged £1 interest, you now have an £11 debt and will pay interest on that extra £1 (meaning less money in your pocket).

In terms of mortgages, there is no way to avoid compound interest, but you can take steps to minimise the amount of interest you pay eg. overpaying your mortgage if you can afford to, or starting off with a larger deposit and borrowing less.

Read more: