a_Taiga/iStock via Getty Images

Company intro

European Residential REIT (ERES REIT) is a publicly traded (ERE.UN:CA) unincorporated, open-ended real estate investment trust focused on aggregating a portfolio of high quality, multi-residential real estate assets in key European markets with strong fundamentals. ERES REIT’s initial focus is in the Netherlands.”

Source – ERES REIT – Who We Are

While ERES is headquartered in Canada, 100% of its properties are located in Europe. Currently ERES owns a portfolio of 158 multi-residential properties located in the Netherlands, one office property in Germany as well as one office property in Belgium.

Please be aware of different currencies used in relation to ERES in both the provided investor materials as well as in this article. ERES operates in Europe, therefore financial metrics are in EUR. However, they are listed in Toronto Stock Exchange so the share price is in CAD.

Company strengths

Location, location, location

The Netherlands is an interesting location for real estate investments due to its demographics. Housing demand is high as the population density is one of the highest in Europe, and the population is still growing. The United Nations estimates that population growth in the Netherlands will continue until the late 2030s, so investors can expect the housing demand to remain robust in the foreseeable future. Additionally, many investors who are focused on the North American markets may find geographic diversification beneficial.

Focus on a growing portfolio of multi-residential properties

While ERES has owned two commercial properties since its inception in 2019, their effects on the total business operations of ERES are minuscule. As the name implies, ERES is very much focused on residential real estate. All of the new investments made by ERES since its inception have been in residential real estate in the Netherlands.

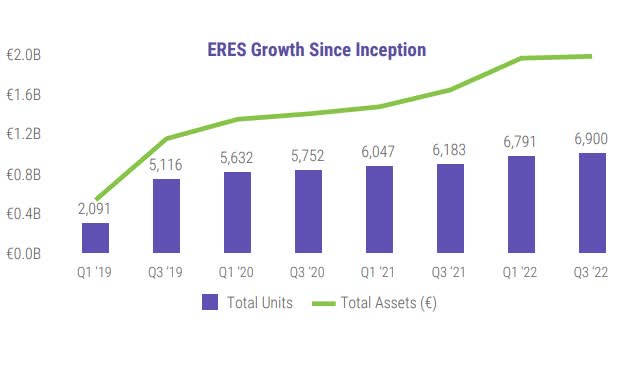

ERES Conference Call 2022 Q3 materials, page 4

As we can see from the chart above, ERES is constantly growing its presence through the acquisition of additional multi-residential properties in the Netherlands.

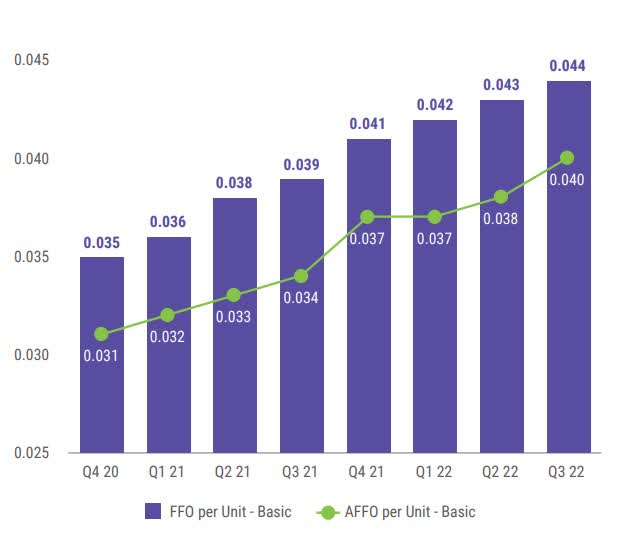

ERES Conference Call 2022 Q3 materials, page 12

New acquisitions and steady growth of rental prices have led to steady gains in both Funds From Operations (FFO) per unit as well as Adjusted Funds From Operations (AFFO) per unit. Steady growth in both of these metrics, especially during the relatively choppy market conditions in recent years, is a very strong indicator that ERES has excelled at growing profitably. The steadiness seen in the chart above is also a good indicator that this is not a short-term fluke but rather the result of good business practices.

Additionally, income investors will appreciate the fact that ERES pays a monthly distribution and has a proven history of increasing that distribution annually. The recent increases have been 5% in 2021 and 9% in 2022. These increases in both of the previous years have gone into effect in March, so we can assume another modest distribution increase to be announced within a month.

To sum it up: ERES is exactly the type of investment that should draw the interest of long-term investors, especially those who are looking for a growing stream of income from their investments.

Valuation

Seeking Alpha

After recovering from the COVID-19 related market crash in early 2020, ERES has mostly traded between CAD $4 and CAD $4.50. For the past 7 months the stock price has remained below CAD $4, even dipping below CAD $3 for a short duration in the fall of 2022. As we discussed above, the financial performance of ERES has been very good in recent years and recent months, and historically speaking the units are now trading at a very cheap valuation while the underlying business of ERES is performing better than ever. On top of that, ERES is currently offering investors a distribution yield of 4.71%, with a distribution increase likely happening soon.

There is a reason for this, and we will discuss it in the next paragraph.

The problem: Debt maturities in a rising rate environment

In my view, the main reason for the current low valuation is that ERES has a debt problem. It’s not a very traditional one either: the problem is not that they have too much debt. The problem is that ERES is very poorly positioned in case of rising interest rates due to the short maturity profile of its outstanding mortgages.

While interest rates in Europe are still much lower than in the USA, the European Central Bank has also started aggressive rate hikes in the second half of 2022. The current deposit facility interest rate is 2.00%, a stark increase from the -0.50% from the same time last year.

European Central Bank

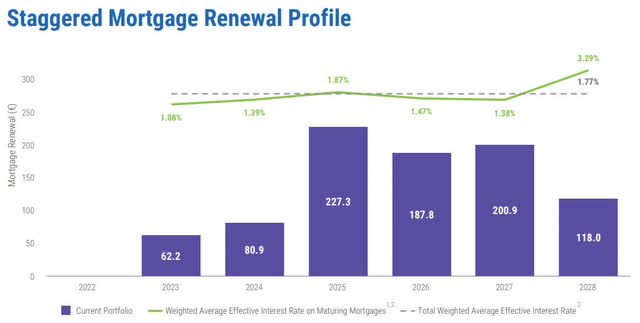

When examining ERES’ debt maturity profile, we can see that large parts of their mortgages will mature in 2025, 2026 and 2027. Unless a dramatic shift happens in central bank policy, it will not be possible to renew these mortgages anywhere near their current effective interest rates.

ERES Conference Call 2022 Q3 materials, page 14

The current average effective interest rate stands at 1.77%. There is no need to panic just yet, with only a small number of mortgages maturing in 2023 and 2024. The real problem lies in the years 2025, 2026 and 2027, when collectively 70% of ERES’ mortgages will mature. I will refrain from trying to predict interest rates that far in advance, however ERES is in a position where it could see dramatically increased interest expenses for the majority of its mortgage portfolio.

Summary

Overall, ERES is a REIT with a solid history of increasing both the scale and profitability of its business, even during the relatively choppy market conditions that we have experienced in the past few years. The current valuation does not reflect the success they have had in the past, however we cannot disregard this dangerous risk of debt maturities which could materialize in the next two to five years. I urge investors to be cautious with ERES until this risk has been properly managed.